OPEC Rift Deepens Amid Falling Oil Prices

This article by Benoit Faucon, Summer Said and Sarah Kent Connect for the Wall Street Journal may be of interest to subscribers. Here is a section:

But even modest cooperation between many members has broken down, and Saudi Arabia, in particular, has moved to act on its own. While it cut output earlier this summer, other members didn’t go along. Since then, it has dropped its prices.

Each member has a different tolerance for lower prices. Kuwait, the United Arab Emirates and Saudi Arabia generally don’t need prices quite as high as Iran and Venezuela to keep their budgets in the black.

Late Friday, Venezuelan Foreign Minister Rafael Ramirez, who represents Caracas in the group, called for an urgent meeting to tackle falling prices. The group’s next regular meeting is set for late next month.

But on Sunday, Ali al-Omair, Kuwait’s oil minister, said there had been no invitation for such a meeting, suggesting the group would need to stomach lower prices. He said there was a natural floor to how low prices could fall at about $76 to $77 per barrel—near what he said was the average production costs per barrel in Russia and the U.S.

Asia represents OPEC’s largest growth market and has become increasingly important as the USA ramps up production and European demand wanes on economic stagnation. The discounts offered in the last week to secure market share in both Europe and Asia suggest large OPEC members are willing to sacrifice short-term considerations for the longer-term goal of diversifying their client base and to ensure they preserve their competitive advantage relative to less influential producers.

This market condition won’t last forever but in the short-term major producers, such as Saudi Arabia, are likely to persist until other members are willing to the toe the line on production, pricing and competition.

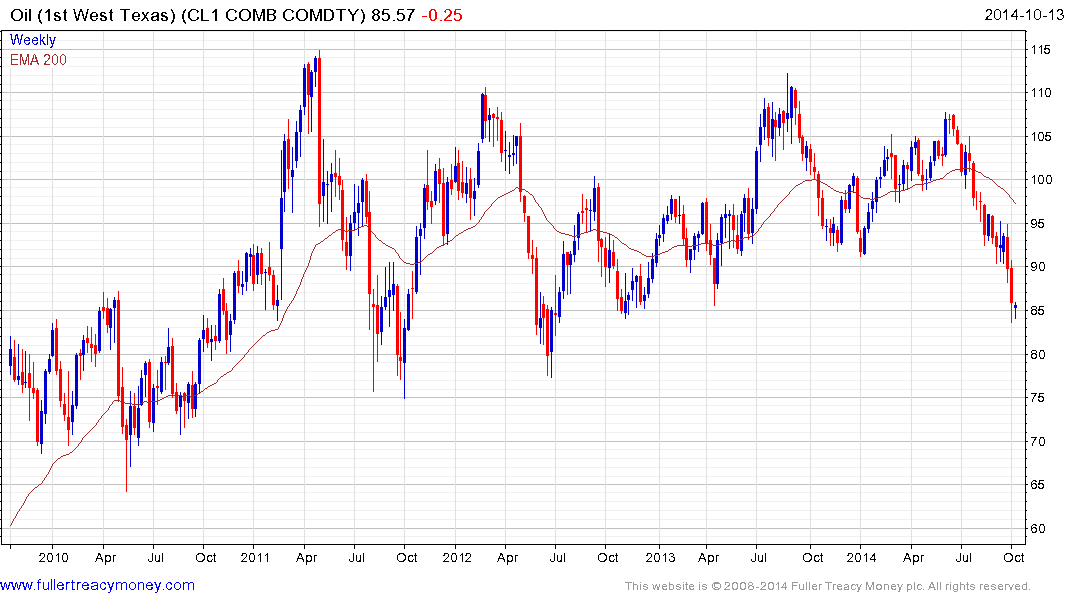

Brent crude broke downwards from a three-year range last week and extended the decline today. It is accelerating lower following this breakdown and a clear upward dynamic, sustained for more than a few sessions, will be required to check momentum and signal short covering.

West Texas Intermediate paused today in the region of $85 but shares the same accelerating breakdown and more than a $5 rally will be required to check the consistency of the three-month decline.