Oil Tumbles as Russia Is Said to Oppose Deeper Production Curbs

This article by Meenal Vamburkar for Bloomberg may be of interest to subscribers. Here is a section:

Russia "pretty much threw cold water" on rumors of additional cuts, said Bob Yawger, director of the futures division at Mizuho Securities USA in New York. The American Petroleum Institute is due to issue weekly U.S. inventory numbers Wednesday afternoon.

Oil and gas companies’ shares were down across the board. Bloomberg Intelligence’s index of independent exploration and production companies fell as much as 4.4 percent. Baker Hughes plunged 34 percent on its first day of trading as a unit of General Electric Co.

While crude prices surged last week, futures are down 15 percent for the year amid concerns that rising global supply will offset the output cuts from the Organization of Petroleum Exporting Countries and its partners. Libya and Nigeria, which are exempt from the agreement, accounted for half of the group’s production boost last month, according to data compiled by Bloomberg.

"Now we’ll see if this rally was based on loose expectations that there could’ve been some agreement or additional cuts, or if it was a rally on short-covering," Mizuho’s Yawger said.

Oil prices have been confined to a volatile range over the last 12 months with a distinct downward bias since January. The price might have rallied for eight consecutive sessions but there has been a distinct absence of clear upward dynamics similar to those posted in August and November while the large tail on the candle that marked the May low was also a clearly bullish development.

.png)

By way of contrast each of the lower highs from early January has been marked by a large downward dynamic and today’s move is more in character with those declines. That suggests the short covering rally may have run its course and lower to lateral ranging is once more the most likely scenario.

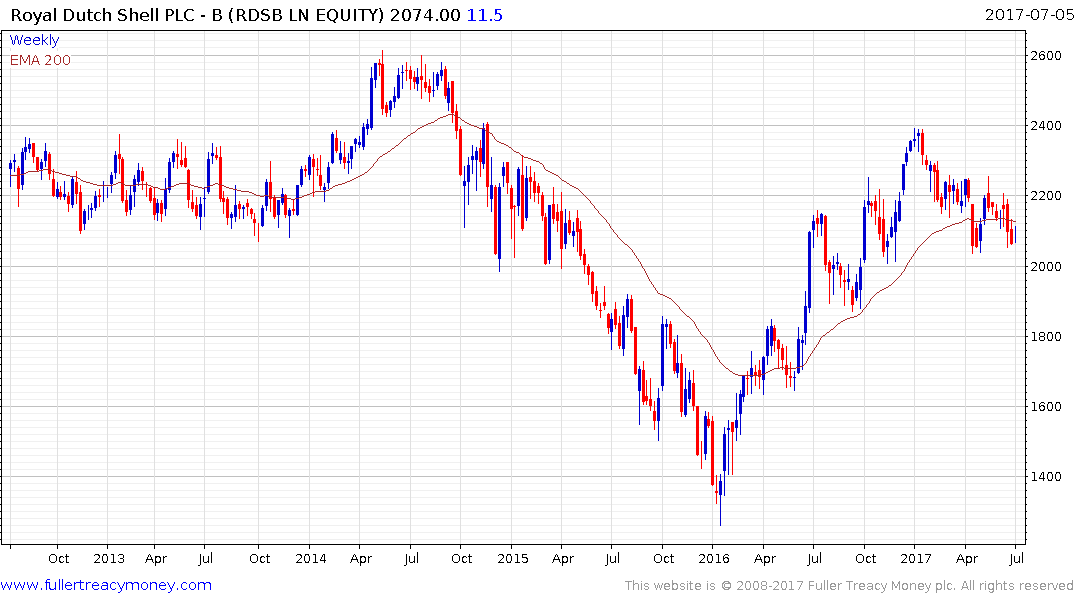

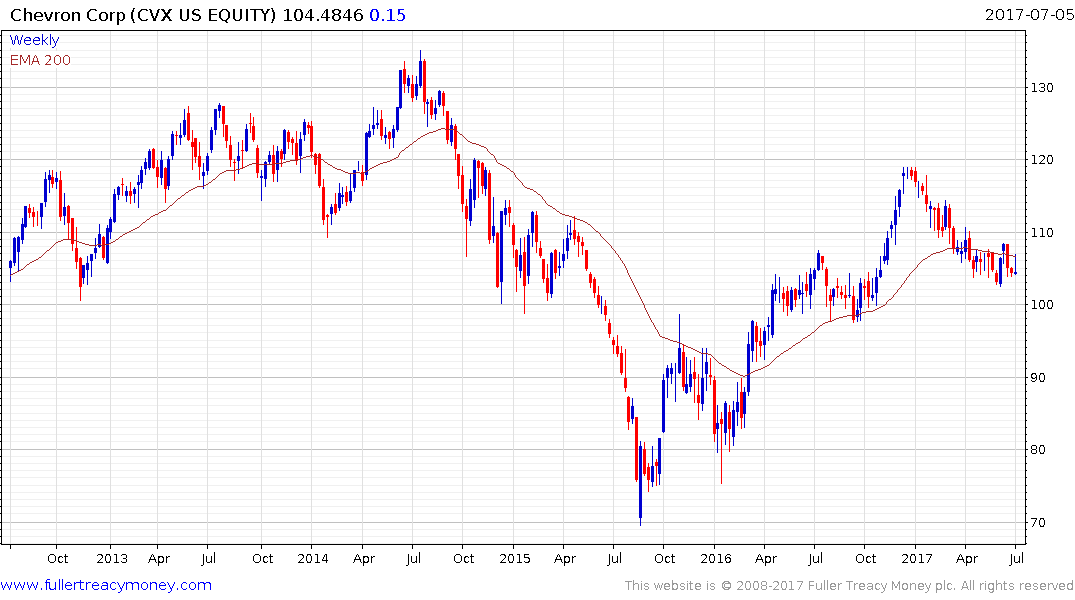

Major oil shares like Royal Dutch Shell or Chevron have held up reasonably well this year but are both now trading below their respective trend means and are questioning the integrity of medium-term advances evident since late 2015.

The big question for these kinds of companies is what the lower limit for pricing is. We know that a great deal of supply from both unconventional and offshore sources becomes economic above $55 but the question is what is the pressure point that takes a lot of supply out of the market when prices decline? In early 2016 it was sub $30 levels, whether that is still the case remains to be seen.