Oil Sinks as Dour IMF Forecast Sparks Global Growth Concerns

This article from Bloomberg may be of interest to subscribers. Here is a section:

Oil extended losses after the International Monetary Fund downgraded its global growth forecast, intensifying market concerns of an economic slowdown in the wake of hawkish comments from U.S. Federal Reserve officials.

West Texas Intermediate fell more than $5 on Tuesday to trade below $103 a barrel, the sharpest drop in more than a week. The IMF slashed its world growth forecast by the most since the early months of the Covid-19 pandemic and projected even faster inflation. The market opened on a downbeat after Fed Reserve Bank President James Bullard said late Monday the central bank needs to move quickly to raise interest rates to quell inflation.

Global growth is slowing amid tighter monetary and fiscal policy, the war in Ukraine and China’s determination to persist in its zero-Covid policy. At the same time major oil companies are flush with cash. Development and exploration budgets have been slashed over the last few years because politicians have been so eager to appease the green movement. That means the windfall from higher prices will result in large companies booking record profits.

Big piles of cash attract taxation. To minimize that risk drilling budgets will have to increase and some measurable efforts to increase supply will inevitably be forthcoming.

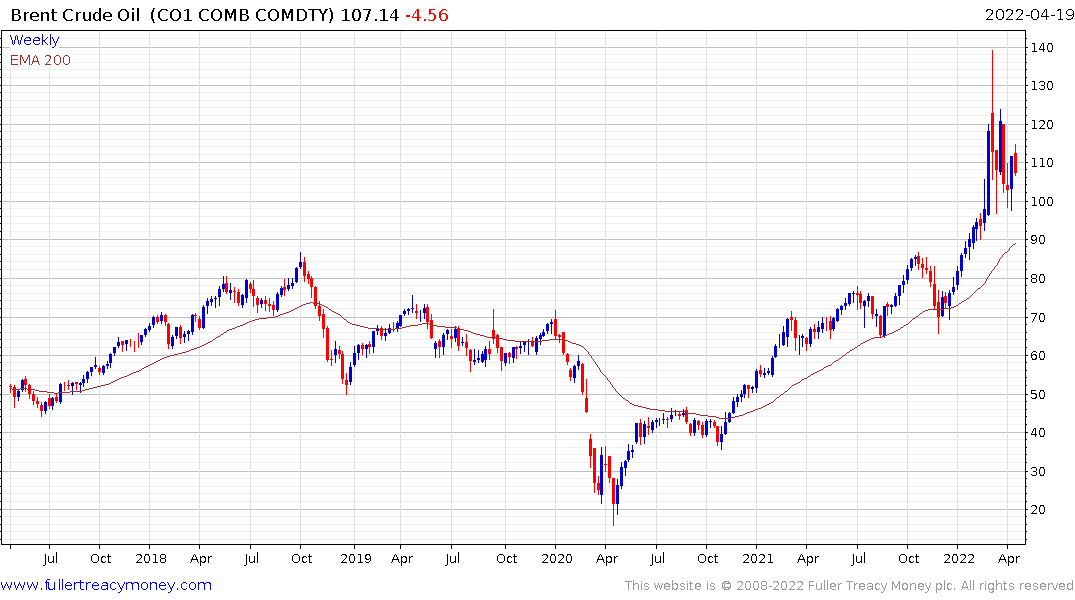

Brent crude oil pulled back today to post a second lower rally high. The $100 area will need to continue to offer support to avoid top formation completion characteristics.

Natural gas posted a large downward dynamic today to signal a peak of at least near-term significance and the beginning of a least some consolidation following a steep advance over the last month.

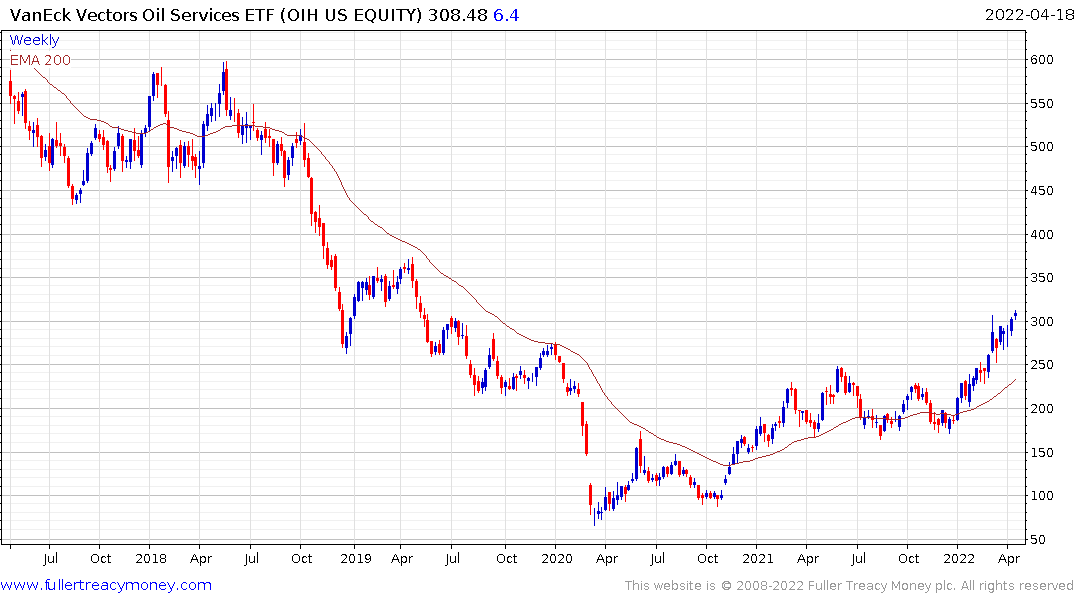

The oil services sector broke out to new recovery highs yesterday and held the move today. Nevertheless, the energy sector is unlikely to be capable to sustained resilience if the pullback in energy prices results in a break lower.

The oil services sector broke out to new recovery highs yesterday and held the move today. Nevertheless, the energy sector is unlikely to be capable to sustained resilience if the pullback in energy prices results in a break lower.