Oil Shocks and Recessions

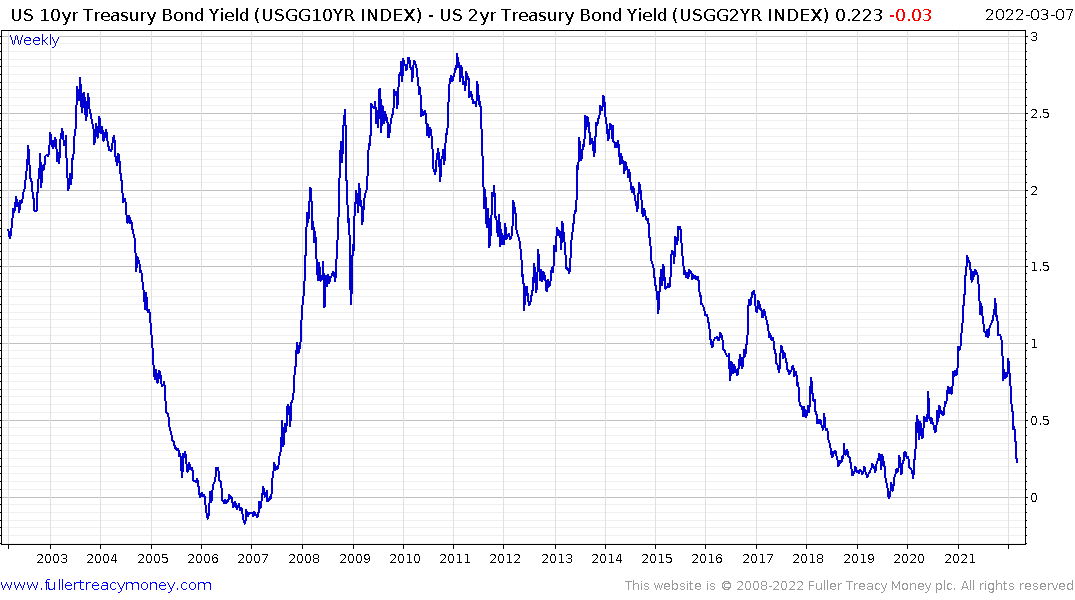

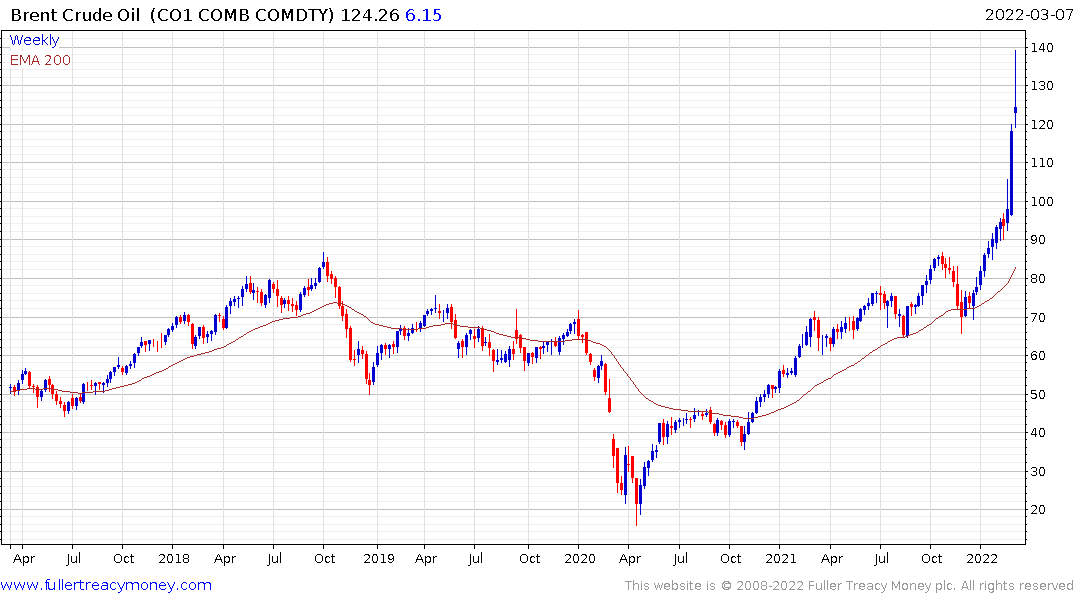

The two things anyone seeking to predict future trouble in the stock market looks at are the yield curve spread and oil prices.

The spread the 10-year and the 2-year is down to 23 basis points, from 120 in October. At the current pace of compression, it could be negative by the end of the week.

.png)

The 10-year - 3-month has generally moved ahead of the 10-2 spread but is not doing so on this occasion. That is because bond funds are focusing on short duration bonds because inflationary pressures take a bigger toll on long-dated issues.

Surging commodity prices are a tax on consumption. They spur inflationary pressures in the short term but high prices ultimately result in demand destruction. Oil is an indispensable part of the global economy. When it surges, it can contribute to deflationary forces.

Brent crude briefly testing the $140 peak 2008 from today. In nominal terms, the recent acceleration is faster than the move up from January 2007 to the peak in June 2008 and both came from almost the same prices levels.

Over the last 14 years the purchasing power of the Dollar has deteriorated. When we adjust for that, the price of oil has surged but not nearly as much as it did ahead of the credit crisis.

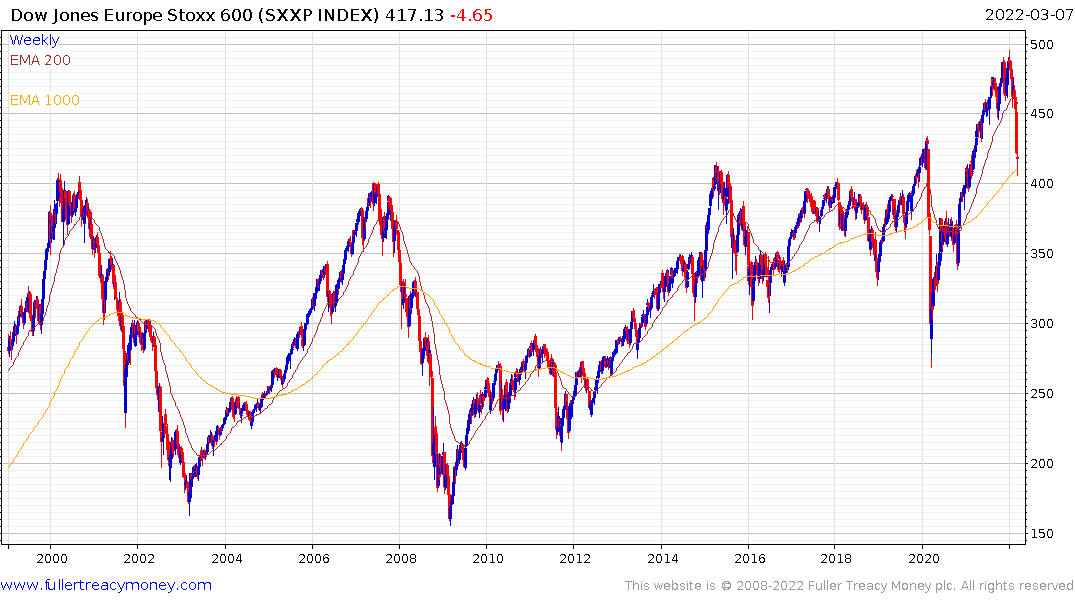

The primary challenge is in Europe where the euro is falling in value and natural gas prices are at new all-time highs…again. The war in Ukraine represents a significant drag for the European economy.

The price spike on the UK future today, with an intraday peak of £800 was fueled by fears the USA would unilaterally sanction Russia oil and refined product imports. With Germany rebelling at that idea, the price reversed course.

So did copper prices. The price briefly surpassed $5 but did not hold the move.

Some extraordinary volatility is present in energy prices at present. We can expect additional wild swings until a détente is agreed.

Europe needs to be energy independent if it is ever to stand up to threats like Russian aggression. That’s the number one lesson everyone will have learned from this episode.

The Europe STOXX 600 is now testing the region of the 1000-day MA. This level also coincides with the upper side of the underlying 21-year range. If the breakout is to be sustained the 400 area will need to hold.

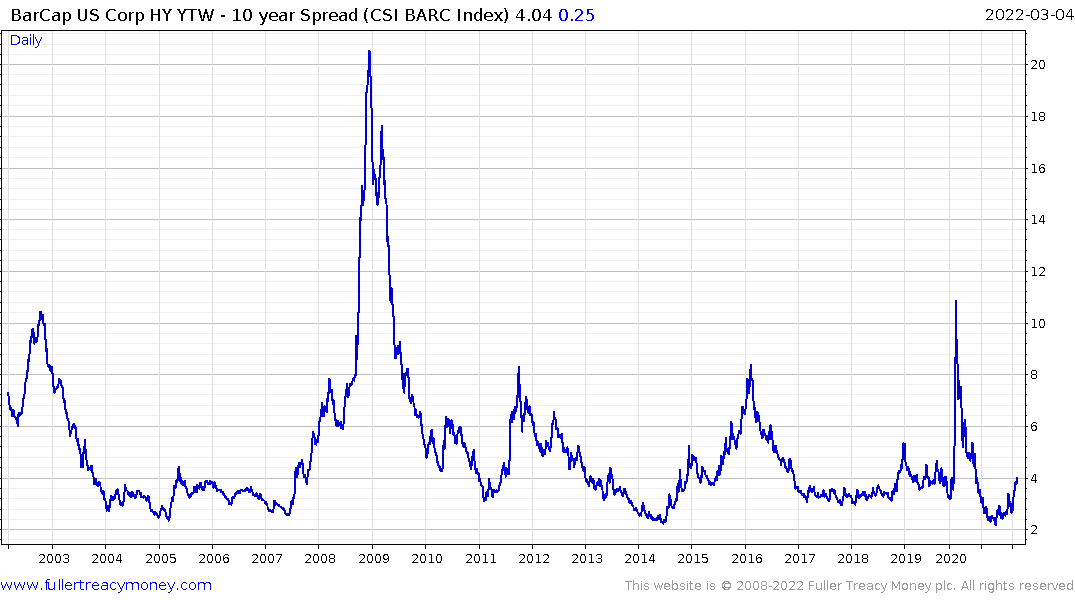

High yield spreads are flashing yellow at present as they climb above 400 basis points. Occasions when they trade above 500 basis points tend to coincide with significant stock market drawdowns. Peaks in high yield spreads coincide with significant market bottoms.

High yield spreads are flashing yellow at present as they climb above 400 basis points. Occasions when they trade above 500 basis points tend to coincide with significant stock market drawdowns. Peaks in high yield spreads coincide with significant market bottoms.

There is still time for peace to break out and calm nerves. There is not much sign yet that an agreement is close to being reached so we should expect stock prices to remain weak on aggregate.

The Nasdaq-100 continue to unwind the recent rebound and has demonstrated resistance in the region of the 200-day MA. It is still a consistent downtrend.

The Nasdaq-100 continue to unwind the recent rebound and has demonstrated resistance in the region of the 200-day MA. It is still a consistent downtrend.