Oil Market Report

Thanks to a subscriber for this report from DNB which may be of interest. Here is a section:

Things have changed to the worse after the OPEC meeting

We had assumed a small OPEC quota cut and some deliverance from Saudi/UAE/Kuwait, but the market would still be over supplied

After the OPEC meeting it looks as the market will be left to itself until the next OPEC meeting scheduled for June

Prices will have to be low in order to achieve a new equilibrium between supply and demand but the price effect on fundamentals will be somewhat lagged

How far down prices need to decrease is impossible to calculate as the market could easily overshoot to the downside during the adjustment process

Our base case is that we are close to the bottom of this price cycle now but since the effects of lower prices is lagged the market could overshoot to the downside

We could see the 50’s short term before the market turns

Here is a link to the full report.

At The Chart Seminar we define a range as an explosion waiting to happen. Prices are either trending or ranging so by definition every range is eventually resolved by a breakout which generally goes farther and for longer than many expect. This is as true of upside as downside breakouts. When applied to the oil market, the tightening of the trading band in the 3-year range suggested that when the breakout came it was going to be emphatic. So what next?

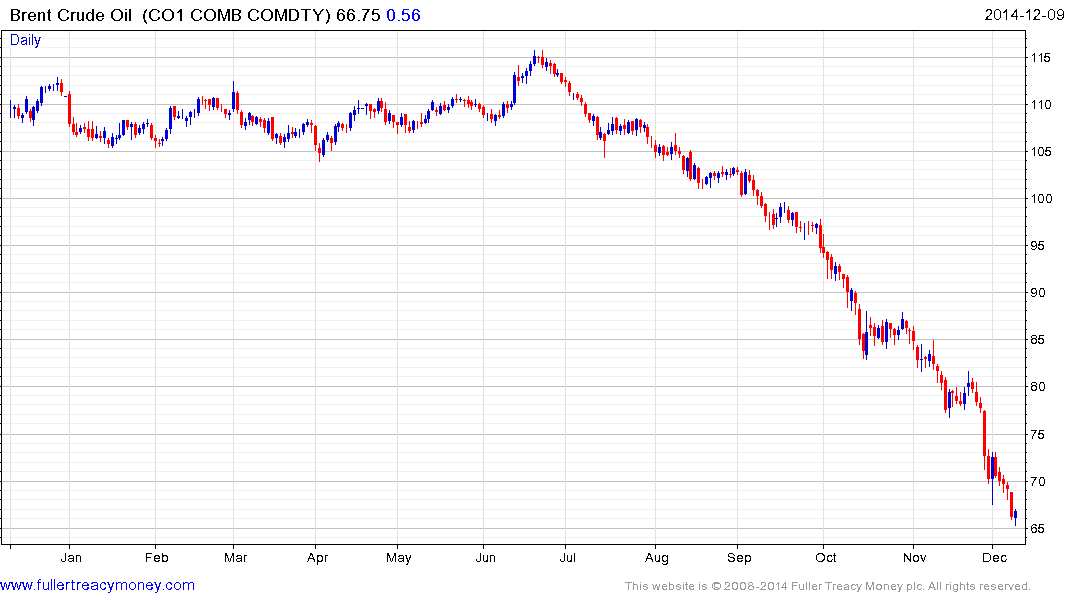

Brent crude oil has been trending consistently lower since late June with a succession of short-term ranges one below another. No rally during this time has been greater than $5 before the downtrend has been reasserted. The trend has accelerated of late and a deep short-term oversold condition is evident. However, a clear upward dynamic will be required to check the decline and this will need to be greater than $5 to pressure short positions. Prices will then need to find support above the previous low to confirm demand is beginning to return to dominance.

Taking a medium-term perspective, such has been the depth of the decline that there is potential for a short covering rally. However the powerful disinflationary forces unleashed by technological advances in the sector are likely to restrain sustained moves back to elevated pricing. While oil is more of a globally traded commodity than natural gas and is unlikely to fall to the same extent, gas’ subsequent volatile ranging may offer a clue to what we might expect from oil.

Back to top