Oil Market Outlook

Thanks to a subscriber for this report from DNB which may be of interest to subscribers. Here is a section:

We have been tracking IEA´s monthly oil reports for the past 38 months to see how they have forecasted the growth in US oil production. The graph above to the left represents 38 monthly oil market reports from the IEA. When these lines are rising it means upward revisions to production growth. During the past 38 months we have seen 35 upwards revisions. This means that in almost every monthly oil market report issued by the IEA during the past three years the agency has revised its estimated growth in US oil production higher. That is quite remarkable. Something like that has probably never happened before. The forecasted growth for 2014, which was issued last summer (in other words several years into the shale revolution) started at 700 kbd. Now the last IEA estimate is that US oil production will grow 1.4 million b/d in 2014. This is in other words a forecasting error of 100% and at the time of the initial forecast, the agency had already witnessed growth of oil production of about 1 million b/d for both 2012 and 2013. This is not to criticise the IEA. They have not been alone in being too conservative to the US shale oil industry.

The large growth in US oil production has meant that non-OPEC production has been growing faster than 1.5 million b/d for more than a year now. The key growth is as mentioned coming from the US, but also Canada and Brazil are growing their output quickly. In Canada the growth is coming from oil sands production, mainly in-situ projects, but we also see growth in shale oil output from Canada. According to PIRA Energy, Canadian shale oil production has reached about 0.5 million b/d. We expect continued start-up of new projects in Canada in 2015. These will be projects that are not sensitive to today’s oil prices, as the investments have been taken several years ago. Going forward however, the investments in Canadian oil sands are set to suffer on a lower oil price but that will only lead to lower production growth as we approach 2020. Also in Brazil there will be no negative impact on production in the next couple of years due to lower prices. The country continues to ramp up its production from the pre-salt fields in the Santos and Campos basin. Pre-salt production reached a record 532 kbd in September which is 62% higher than the year before. We do however expect larger production growth from Brazil in 2016 than in 2015 as 900 kbd of platform capacity is then set to come on line. This could of course slip into 2017 but it will be coming to the market no matter what happens to oil prices in the coming two years.

Here is a link to the full report.

Veteran subscribers will be familiar with our view that oil prices are likely to trend lower in real terms over the next decade. The DNB team have been among a small number of analysts to share this view. Unconventional oil and gas remain game changers for the energy sector and this is likely to remain a significant factor for the foreseeable future.

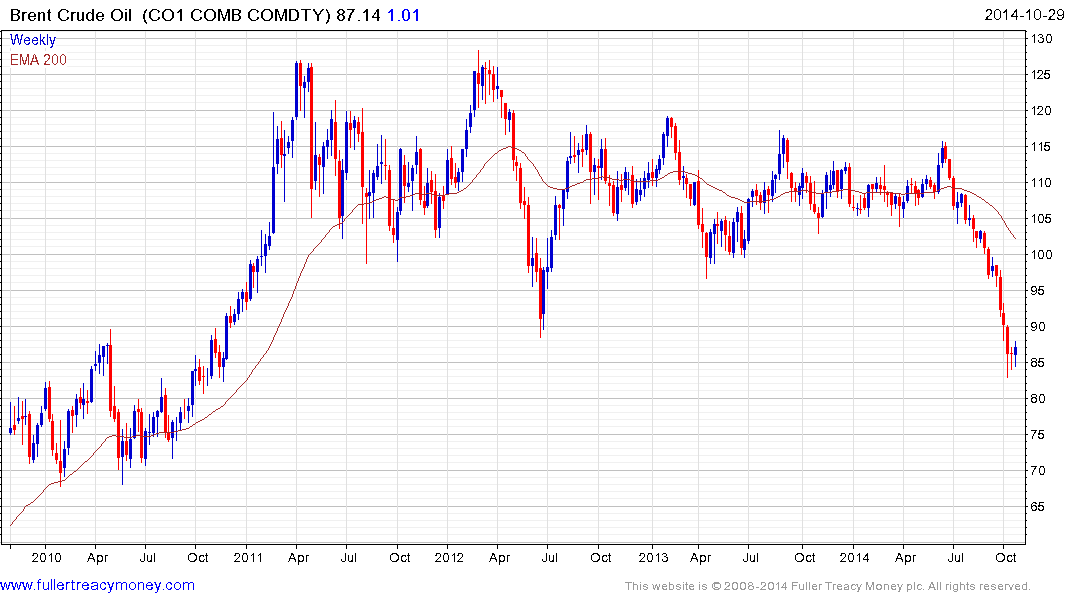

In the short-term, Brent crude’s steep decline of the last three months has lost momentum as prices stabilise above $80. Even if one holds a medium-term bearish view, potential for a reversionary rally, back up towards the now declining 200-day MA, has increased.

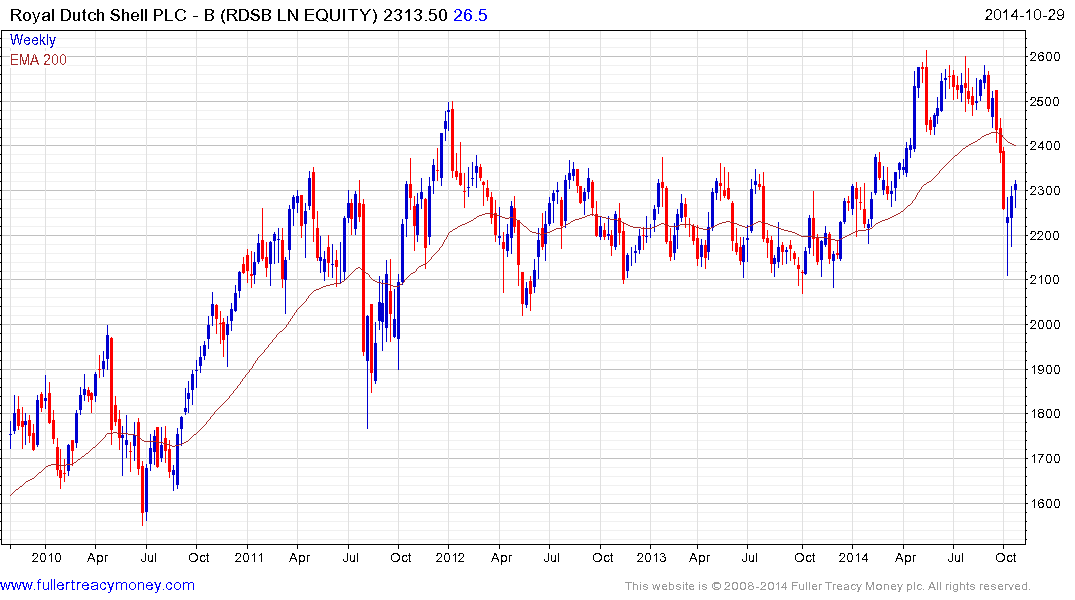

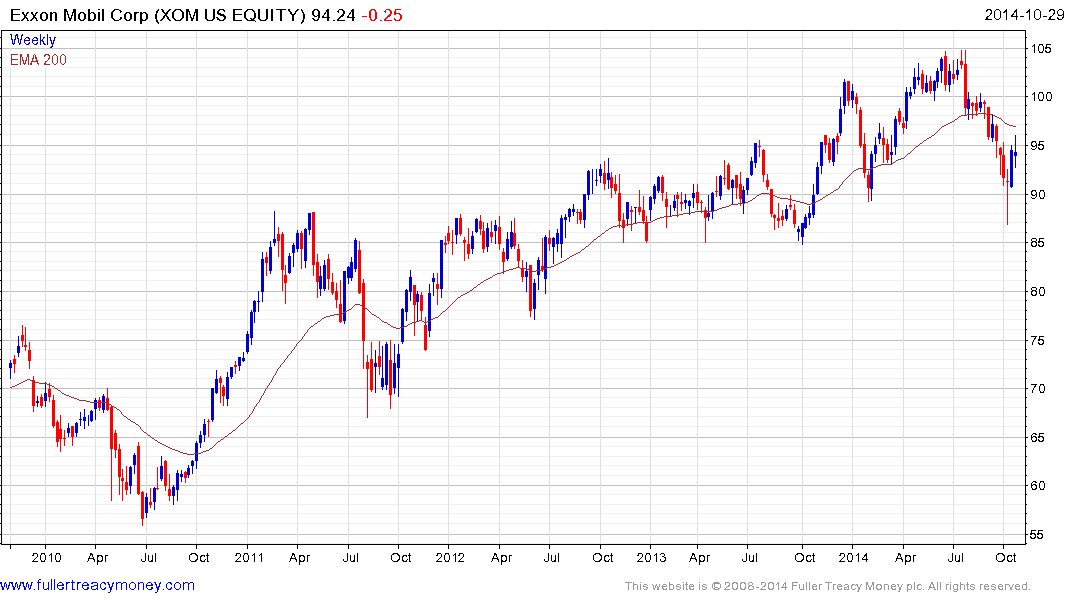

A steadier tone for oil prices has translated into at least some of the short-term oversold condition in oil shares also being unwound. Both Exxon Mobil and Royal Dutch Shell are bouncing from short-term oversold conditions.

Back to top