Oil at $150 May Be Closer Than You Think

This article from Bloomberg may be of interest to subscribers. Here is a section:

The global oil market is so tight on the cusp of the second half that a single, powerful jolt could unleash the furies and power prices toward $150/bbl within a few swift, brutal days. This is a high-risk environment for crude, as well as for global growth, inflation, and by extension for assets from equities to bonds.

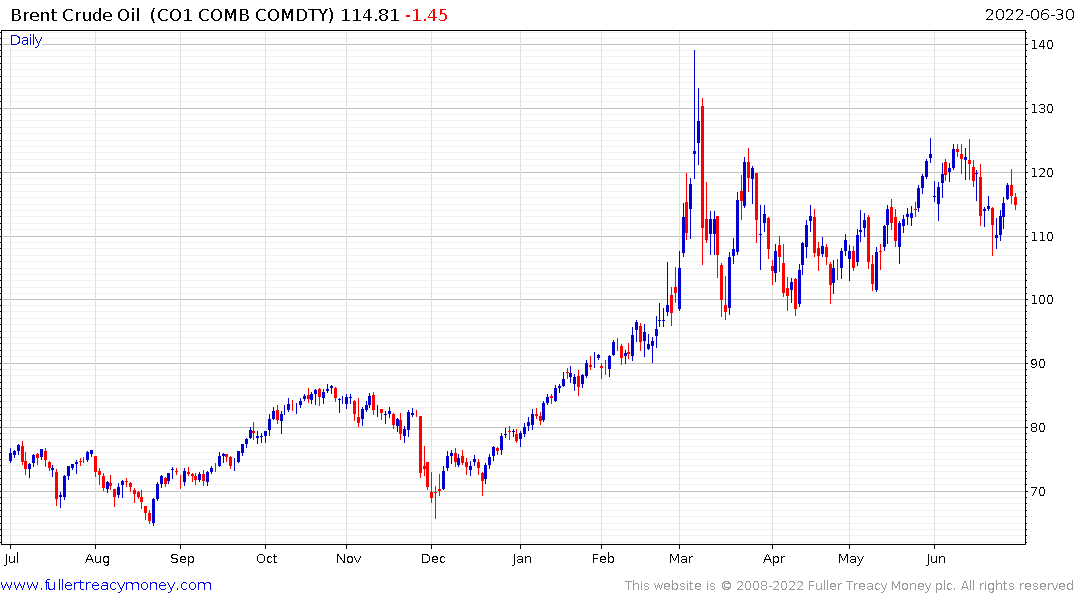

Brent eased in June as the Fed stood up, recession angst built, and one or two faint signs of demand destruction crept into the mix. But the benchmark remains well up in 2Q, and wherever you look, market signals -- both esoteric and mainstream -- testify to extraordinarily tight conditions. Also of note, US stockpiles at the Cushing hub just hit the lowest since 2014, and OPEC+ (which meets today to assess policy) has scant spare capacity.

To say that a spike toward $150/bbl is entirely possible is not to say that the milestone will come to pass. But these are strange and rare times in energy markets that are being addled by war, sanctions, monetary-policy ructions, pandemic recovery, and the legacy impact of scant industry investment. Add to that roster of drivers, elevated weather risk, as well as scope for disruptions beyond those seen this week in Libya and Ecuador.

To get a sense of how much tension the market has, look at what sober-minded folk are saying. Shell CEO Ben van Beurden swung through Singapore this week and said the world is set for a “turbulent period” as spare energy production capacity is running “very low”. Significantly, he talked of a “fear factor” as a result of an “ever-tighter market”. Buckle up for the coming quarter.

There is no doubt inventories are tight and the dearth of investment means additional new supply will be slow to come online. It is, however, worth remembering the world is not running out of oil. Offshore exploration has all but disappeared. The reason there is a supply shortage is because much of the world has decided to stop attempting to produce more.

There is growing competition to come up with the most bullish forecast. $150 is not especially ambitious but it is worth keeping an eye out for higher bids. Meanwhile, the front month price chart has a lower high and I see no one predicting significantly lower prices.

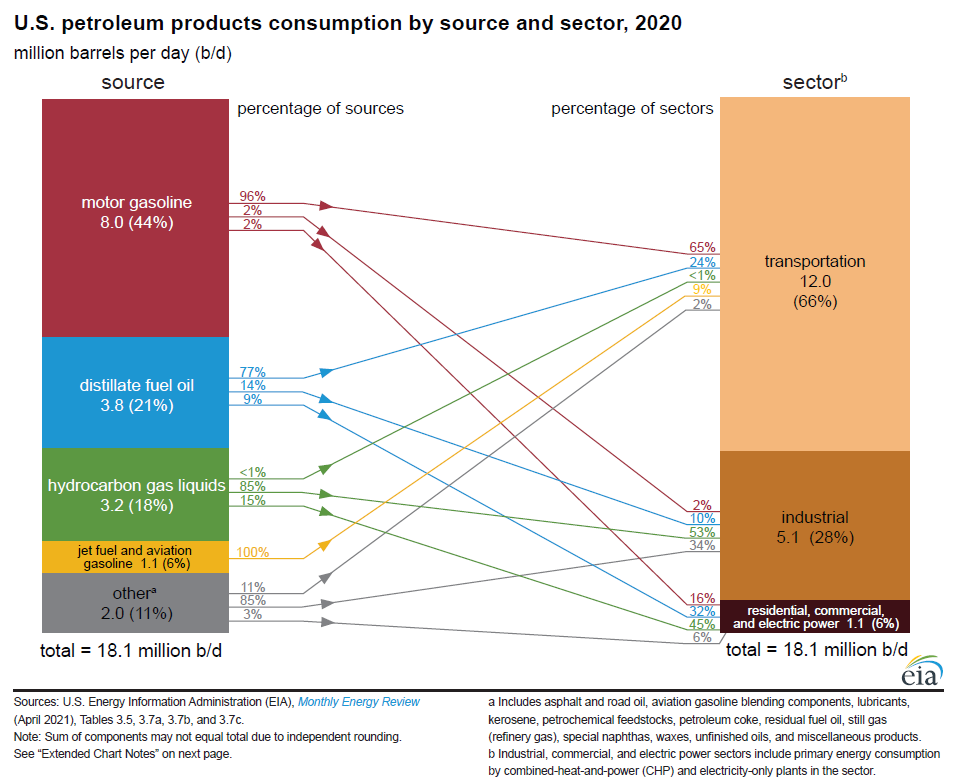

66% of oil demand is transportation like vehicles, ships and planes. 26% is industrial and the remaining 2% is used for power generation. European industrial shares are collapsing as the threat of Russia further reducing gas exports is priced in. That implies less demand so perhaps the oil market is closer to surplus than traders are willing to give credence to. The oil sector has been one of the only positive performers this year asset managers have a vested interest in hoping that remains the case. The market doesn’t always do what we want.

A sustained move above $120 will be required to question current scope for lower to later ranging on Brent.

A sustained move above $120 will be required to question current scope for lower to later ranging on Brent.