New study rips into cobalt, lithium price bulls

This article by Frik Els for Mining.com may be of interest to subscribers. Here is a section:

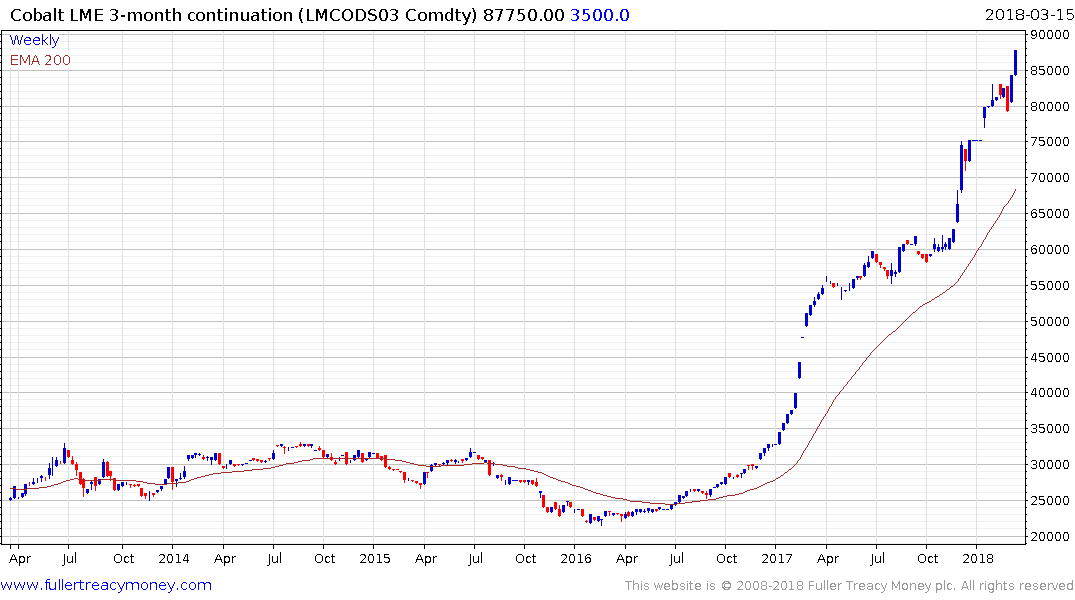

Prominent commodities research house Wood Mackenzie this week released a report on battery materials that forecasts a decline in the price of cobalt and lithium this year which would turn into a rout from 2019 onwards.

Woodmac is not lowballing demand growth for lithium and the authors expect demand to grow from 233 kilotonnes (kt) in 2017 to 330kt of lithium carbonate equivalent in 2020 and 405kt in 2022, but:

… the supply response is under way. Yet it will take some time for this new capacity to materialise as battery-grade chemicals. As such, we expect relatively high price levels to be maintained over 2018. However, for 2019 and beyond, supply will start to outpace demand more aggressively and price levels will decline in turn.

According to Woodmac data, spot lithium carbonate prices on the domestic market in China are already down 6% from December levels to around $24,500 a tonne while international market prices have remained robust rising to $16,000 at the end of February.

Lithium and cobalt represent the freshest iterations of the supply inelasticity meets rising demand condition that contributes to the cyclicality of mining ventures. Batteries are now big business and with Volkswagen saying this week that it is willing to outspend Tesla on batteries by the early 2020s the demand portion of the market is well affirmed.

The supply side, as always, is the arbiter of just how sustainable the demand dominated story is likely to persist. Lithium is seeing major investment in additional supply to meet the capacity demands of the battery sector so it stands to reason when those new operations open the price will return to some sense of normalcy.

It’s difficult to increase the supply of cobalt because it is a byproduct of copper and nickel mining. That has resulted in a slow supply response to surging prices. However, the drive towards substitution has been boosted as a result. Every effort is being made to increase the ratio of nickel in the next generation of batteries so that cobalt can be limited.

I started writing about the potential for a bull market in battery related commodities like lithium from at least 2010. That’s helps to put into perspective that this is a trend which has been evolving for some eight years already, despite the particularly optimistic period we have seen over the course of the couple of years with Tesla’s emergence.

Orocobre represents the closest I have found to a pureplay on lithium production. The share is currently testing the region of the trend mean and will need to continue to find support in this area if the medium-term uptrend is to continue to be considered reasonably consistent.

Cobalt continues to accelerate higher and Katanga Mining continues to hold a progression of higher major reaction lows.