Musings from the Oil Patch November 1st 2016

Thanks to a subscriber for this edition of Allen Brooks' ever interesting report for PPHB which may be of interest. Here is a section:

It appears to us that everyone in the energy industry is fixated on whether the OPEC oil ministers meeting in Vienna, Austria on November 30th will produce an agreement to limit the group’s output, and how that production volume will be shared among the group’s 12 members. Also, it will be important to see who among the 12 OPEC members will be exempted from a monthly production quota and what those countries near-term output goals are. Lastly, we need to see some support from Russia for OPEC’s production cap to have much strength. While all these details are important to the outcome of the OPEC meeting and how the energy world reacts to whatever is agreed to, the lack of executive thinking about what happens to energy demand if the U.S. enters a recession could be the pothole everyone steps in. The duration and depth on any recession will determine how much oil demand might be lost due to weaker economic activity. We suggest you should pay attention to this hidden elephant in the OPEC meeting room.

Here is a link to the full report.

While Allen Brooks is not predicting a recession more than a few analysts have floated the idea. It’s an important consideration that would of course have a significant impact on the energy markets but also on just about every other asset class. Perhaps it would be timely to review some of the leading indicators for recessions to see where we are in the cycle.

Generally speaking when oil prices spike higher they represent a causal factor in economic contractions. Brent Crude Oil staged an impressive rally between January and June but from very depressed levels and has been rangebound since. If anything the current level of oil prices represents a tailwind for consumers of the commodity.

With prices failing to hold the move above $50, the question now is at what level support can be demonstrated. The primary obstacle to substantially higher prices is that there is a significant quantity of unconventional supply that can be brought on line, with a relatively short lead time, that is totally independent of OPEC.

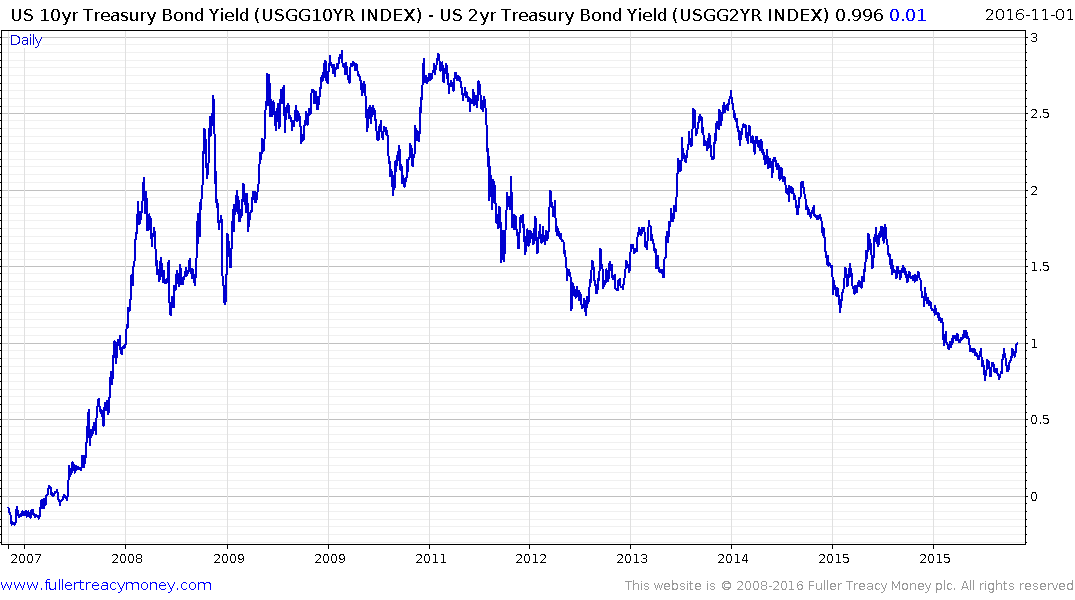

There has been some debate about whether the yield curve spread (10-year – 2-year Treasury

yields) will be as reliable a lead indicator of recessions following almost a decade of extraordinary monetary policy. However at present the spread is widening, rather than contracting, suggesting less pressure on the banking sector.

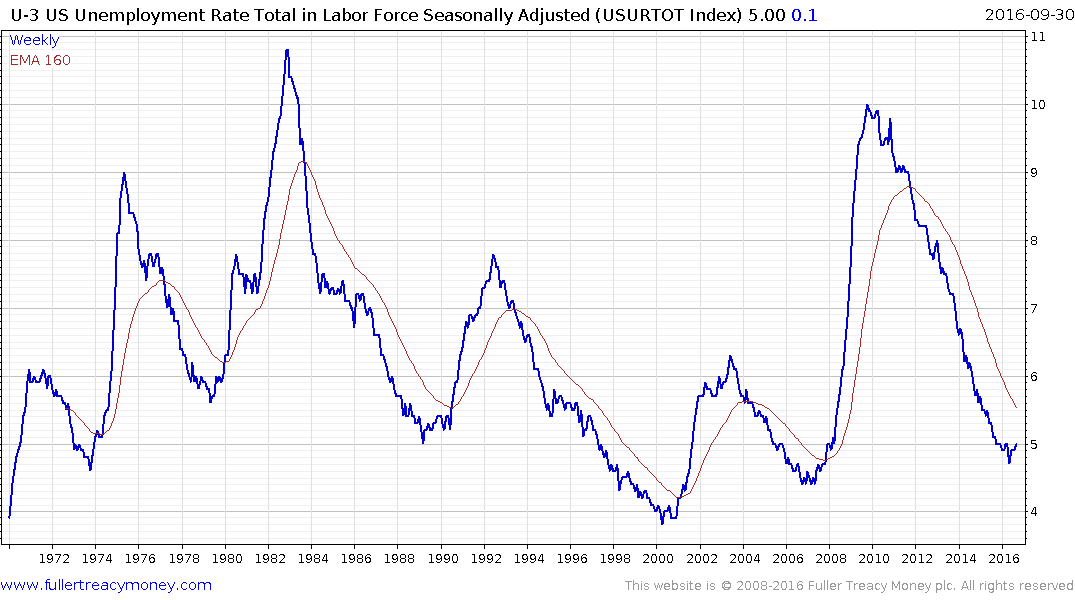

The US Unemployment Rate is at least a coincident indicator of recessions and while there is some evidence the rate has stabilised near 5% it is still not trading above the 200-day MA.

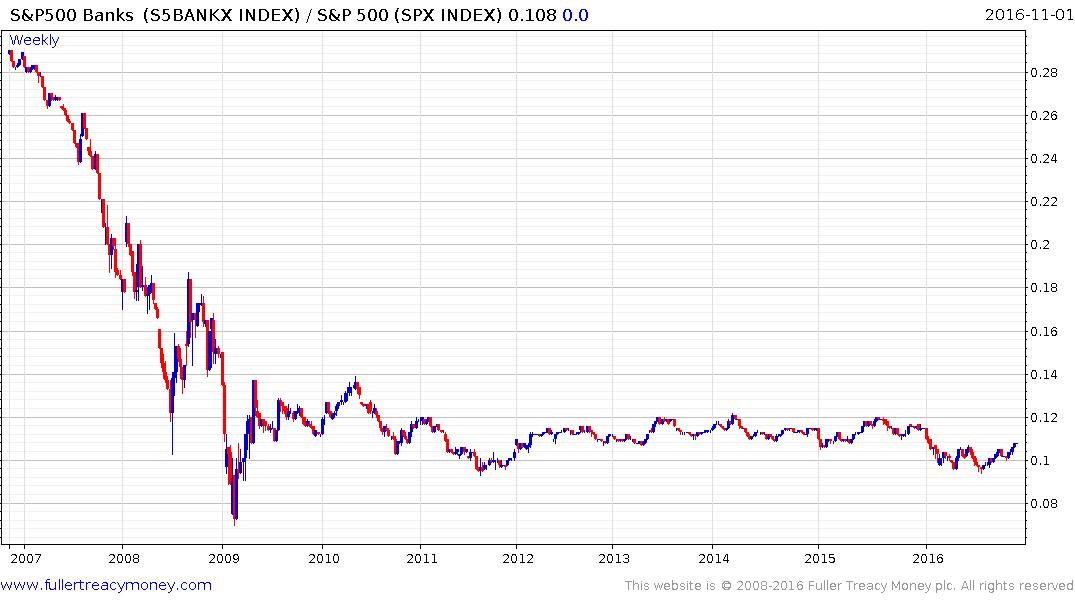

The S&P500 Banks / S&P500 Index ratio has been rangebound for seven years. However the prospect of higher interest rates is bullish for the banking sector and it broke out to a new relative high for the year this week.

The recovery of the Continuous Commodity Index (Old CRB) from very depressed levels is something we associate with the later stages of a bull market. Supply has been cut back because prices were low and marginal operations have closed. Meanwhile economic activity is finally beginning to pick up which has central banks talking about raising interest rates. Assuming the Index continues to firm from the trend mean, and can reassert the medium-term uptrend by breaking to a new recovery high we can conclude the recovery is still in place and that we are in fact in the latter stages of a lengthy economic expansion but that it is not over.