Musings from the Oil Patch May 3rd 2016

Thanks to a subscriber for this edition of Allen Brooks’ ever interesting report for PPHB. Here is a section:

This time around, the discussion seems to be heading in a slightly different direction. Mr. Kibsgaard believes that the downturn will result in a “medium for longer” pricing scenario in which the national oil companies of OPEC can still generate significant returns for their owners due to the low cost base of their conventional resources. With this cost advantage and a desire to play for market share in a world of minimal demand growth, cost issues for producers will become very important. In his view, the procurement-driven contracting model is the main obstacle to creating the performance improvement desired by the customers. The problem comes from producer procurement professionals who believe the service companies don’t bring much to the engineering aspect of projects thus the only way the companies can be compared is by price, which means comparing them on the basis of their more commodity-oriented products.

In Mr. Kibsgaard’s view, the procurement-driven model leads to suboptimal technical solutions and correspondingly poor project performance from both a design and executional standpoint. That also means financial returns will be negatively impacted. In light of this outlook, Schlumberger has been undertaking a revamping of how it competes based on collaboration and commercial alignment between the operators and the largest service companies. This preparation can be seen through their acquisition strategy during the past few years as Schlumberger has filled holes in its technology suite and extended its ability to do more of what was often contracted to others, which has become more important for retaining complete control of projects.

Schlumberger is close to putting five prototype drilling rigs into the field to test its new drilling system that will capitalize on its downhole instruments to help guide and evaluate the formations being drilled and render information to the drilling equipment and the people at the surface. By automating the drilling process based on the downhole intelligence, wells can be drilled faster, cheaper, safer and with a greater productivity outcome. It is possible fewer workers will be needed on the rigs further reducing the cost of drilling wells and potentially helping both the operator and service company improve returns.

Competitors will be watching Schlumberger closely. Initial successes will pressure competitor management teams to consider broadening their product and service offerings followed by how to make them more integrated and profitable. Producers will be watching the experiment as they wrestle with how to increase their profit margins if oil prices remain in the $40-$55 per barrel range for a number of years. If producers cannot grow production because of low industry growth, they will need to strive to become more profitable in order to be rewarded by investors.

Here is a link to the full report.

Big declines in oil prices put enormous pressure on drillers to innovate. As exploration budgets are slashed customers demand more for less and new technology is the only way that can be achieved. Companies like Schlumberger have to constantly push the barrier of what is possible so they can gain market share and ensure a place for themselves when the oil majors come under cost pressure.

Schlumberger rallied to break the medium-term progression of lower rally highs between January and last week. Some consolidation of that gain now looks more likely than not. The extent to which it can hold the four-month progression of higher reaction lows will be a good indicator of whether demand has returned to dominance beyond near-term steadying.

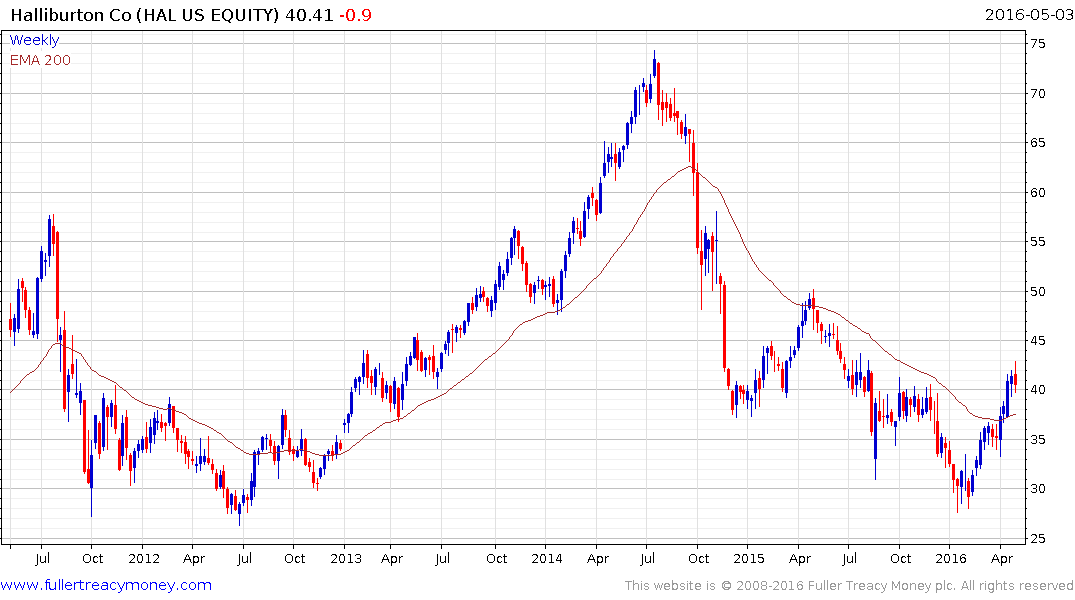

Halliburton and Baker Hughes called off their merger yesterday which has been a net positive for Halliburton, but the share also looks likely to at least consolidate its advance from the January lows.

Baker Hughes did not manage to sustain a weekly close above the trend mean and is now also susceptible to at least some consolidation of earlier gains.

Brent Crude Oil has experienced three reactions of between $5 and $6 since hitting a medium-term low in late January. So far the current pullback is a little more than $3 but from a higher level. A reaction of greater than $7 would signal more than a temporary pause and would question the consistency of the four-month advance.