Musings From the Oil Patch March 24th 2015

Thanks to a subscriber for this edition of Allen Brooks’ ever interesting report for PPHB. Here is a section:

As small U.S. oil producers struggle to remake their business models, the bankruptcies are already beginning to be announced with Quicksilver (KWKA-OTC), a Barnett gas shale producer being the most recent company to file for court protection. Continued low natural gas prices and now low oil and natural gas liquids prices are straining the finances of E&P companies, and in some cases oilfield service firms. We are seeing frequent announcements of E&P company asset sales, capital spending cuts and employee layoffs. We also see numerous announcements of companies hiring advisors signaling that more restructuring activity is on the horizon.

Indicative of the challenges facing energy companies with substantial debt loads is shown in Exhibit 14, which plots the rates for the high-yield (HY) debt market overall and for the energy sector within that market. As shown, immediately before global oil prices began to slide last year, the spread between energy HY and overall HY yields was almost non-existent. As oil prices fell at the end of 2014, the energy HY rate soared as the financial weakness of highly leveraged energy companies was highlighted.

?The most surprising phenomenon (for us) this year has been the receptivity of public equity and debt markets to offerings from energy companies. As Dealogic has reported, so far this year, energy equity offerings have accounted for 12% of total U.S. equity issuances, or roughly $8 billion. The firm also reports that the pace of energy debt issuance has remained consistent with the pace the sector experienced over the past five years, as companies have sold $5.6 billion in new bonds. It appears investors are happy to back energy companies with the expectation crude oil and natural gas prices will rise from current levels in response to global energy demand growth and prospects that supply additions will be limited or even decline, as producers cut back their drilling. How much this view is shaped by a hoped-for-cut in output this spring by OPEC, Russia and Mexico that would shoot oil prices sharply higher is unknown, but we suspect that possible scenario does play a role.

Here is a link to the full report.

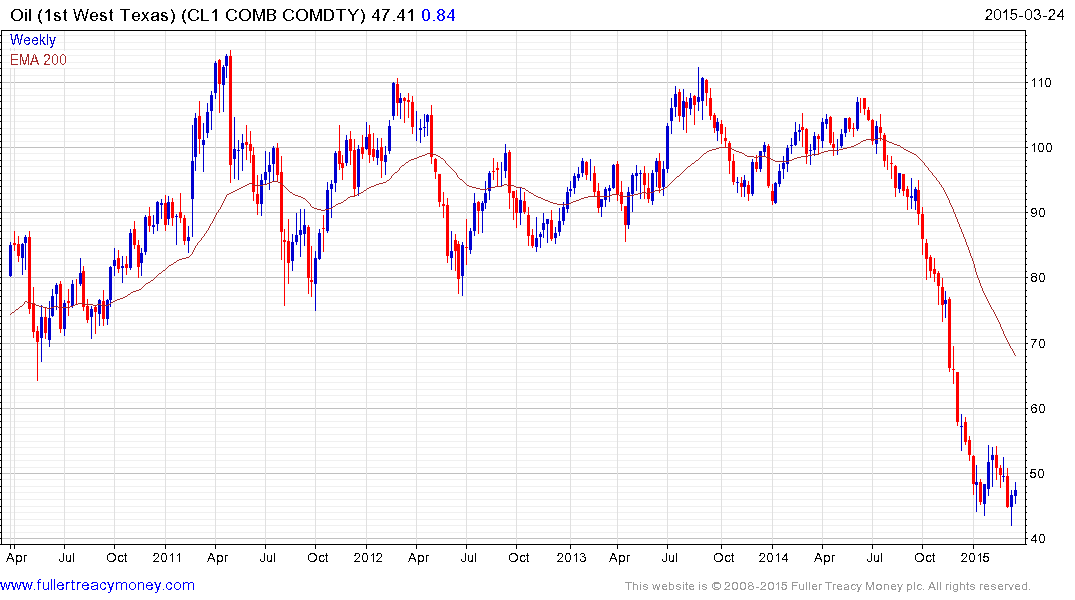

WTI crude oil prices have at least stabilised in the region of $40. However, a meaningful catalyst in the form of sharply lower output or significantly above target demand will likely be required to spur a return to demand dominance beyond the short term. The wide divergence between current pricing and where oil was expected to trade when so much money was invested in additional supply from expensive and technically difficult regions is undoubtedly causing problems for less well-capitalised companies.

There will be additional bankruptcies and private equity firms are eager to make acquisitions at distressed valuations. However an additional perspective is to conclude the only way companies have a chance of meeting their debt obligations is to increase output and that supply has to get to market.

I have recreated my Shale Rail section in the Eoin’s Favourites portion of Chart Library. The majority of rail operators that benefit from shale by rail projects have returned to test the region of their respective 200-day MAs. CSX is representative and will need to find support in the current area if its medium-term uptrend is to remain reasonably consistent.

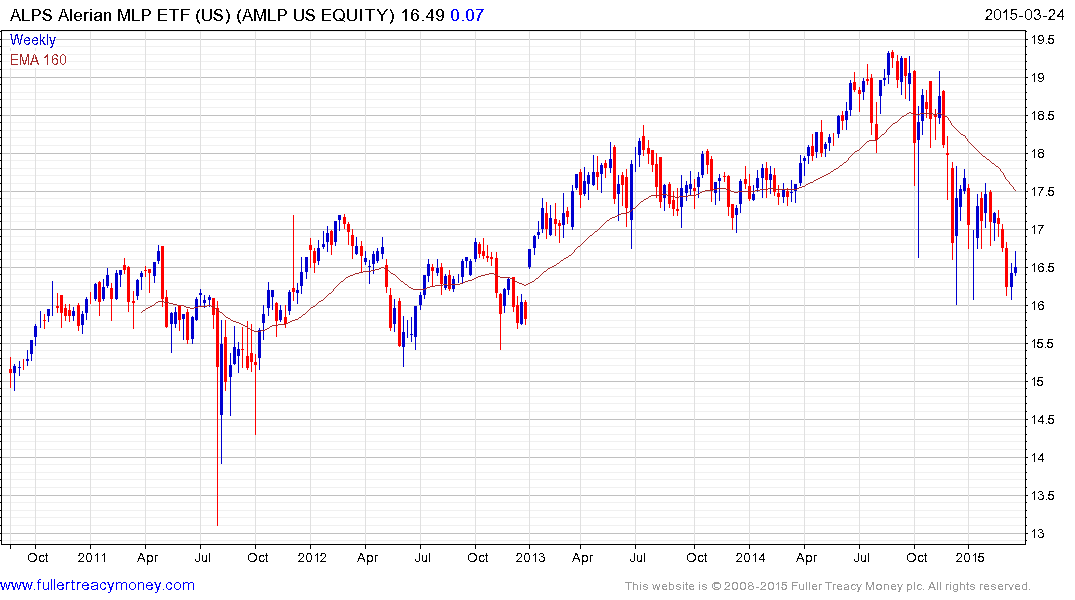

The pipeline laden Alerian MLP Index ETF has a 12-month yield of 6.94% and its parent index has a P/E of 24.42. It has bounced from the $16 region on three occasions since December and a sustained move below that level would be required to signal a return to supply dominance. In the meantime potential for an additional bounce can be given the benefit of the doubt.

Back to top