Musings from the Oil Patch June 30th 2015

Thanks to a subscriber for this edition of Allen Brooks’ ever interesting report for PPHB. Here is a section on Canadian oil supply:

The significance of the oil sands on global oil supply cannot be ignored. Over the past five years, oil sands output has grown by 1.1 mmb/d, fully one-fifth of the total oil production growth for North America. The impact of lower oil prices on the oil sands cannot be missed. Early in 2014, Western Canada Select, a heavy oil price market, was selling at $86 a barrel. By the end of March, that marker was trading below $30 a barrel. This is when, according to oil industry consultant Rystad Energy, new oil sands projects require a price of $100 a barrel in order to breakeven. What’s been the impact of the price decline on the Canadian oil industry?

In February, Royal Dutch Shell (RDS.A-NYSE) withdrew its application to build a new 200,000 barrels per day (b/d) mine at Pierre River, north of Fort McMurray. In May, the company announced it would delay for several years a new 80,000 b/d in situ oil sands project at Carmon Creek near Peace River. The significance of these projects is highlighted when one realizes that Shell currently operates 225,000 b/d of oil sands production. Other projects are being delayed as companies plan to bring much smaller in situ projects into production at a delayed pace in order to manage their cash flow and capital investment requirements.

A June 16th report from Ernst & Young LLP projects a 30% decline in Canadian oil sands spending, bringing this year’s investment to $23 billion, down from an expected $33 billion. The result of this spending decline and the announcements by several producers to stop or delay new oil sands mines and in situ projects means total oil production will be 17% lower by 2030 compared to the target output in the 2014 forecast provided by the Canadian Association of Petroleum Producers (CAPP).

In addition to cutting new investment, oil sands producers are looking at ways to cut their operating costs to help improve their breakeven prices. Suncor Energy (SU-NYSE), a significant oil sands producer, has said it plans to replace 800 dump truck drivers with automated trucks at its oil sands mines. That move, which is a huge boost for autonomous vehicle technology, is projected to save the company C$200,000 per driver.

Here is a link to the full report.

Decisions to postpone or cancel spending on new projects has long-term consequences for oil supply growth forecasts not least when this situation is not limited to Alberta. Oil and gas companies are cutting expenditure wherever they can in order to remain profitable in what could be a persistently low price environment, at least relative to the levels that prevailed until a year ago.

Western Canada Select is not nearly as liquid as futures traded contracts (pardon the pun) but shares a reasonably high degree of commonality. It unwound the oversold condition relative to the trend mean by April and has spent much of the last couple of months ranging. It broke lower yesterday and a sustained move back above $60 would be required to question potential for a further test of underlying trading.

West Texas Intermediate remains within its range and bounced from the lower side today. A widening spread in favour of Western Canada Select should be good news for Albertan producers.

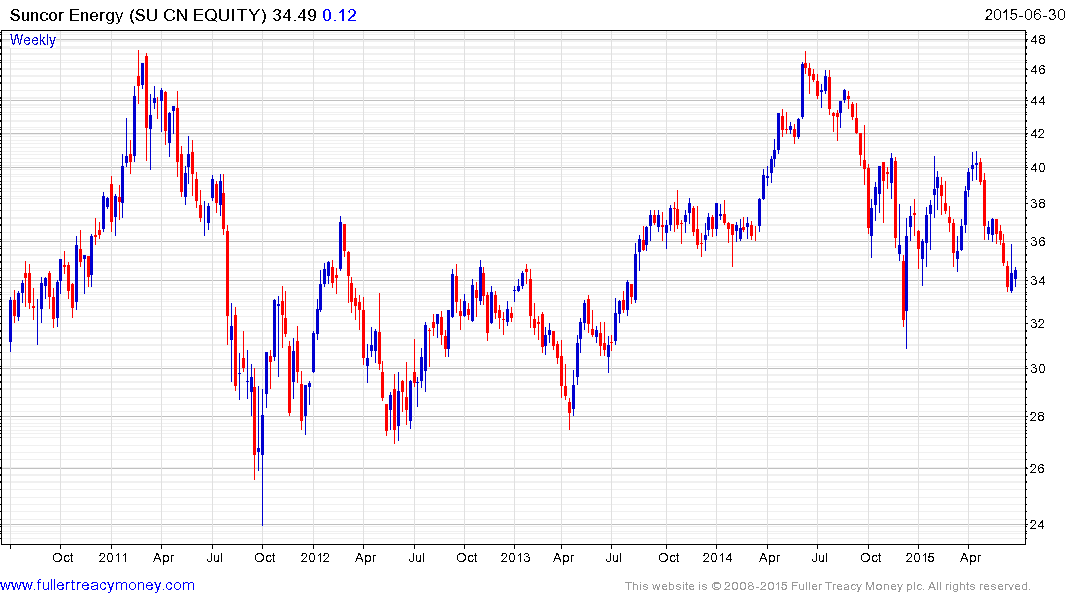

Related Canadian shares such as Suncor Energy and Canadian Oil Sands Trust continues to range above their respective recent lows.

Back to top