Musings from the Oil Patch April 16th 2018

Thanks to a subscriber for this edition of Allen Brooks’ ever interesting report for PPHB. Here is a section on Shell:

Here is a link to the full report.

Here is a section from it:

As Shell further offers, some parts of the energy system are “stubborn.” In particular, there are few apparent low-carbon solutions for aviation, shipping, cement manufacture, some chemical processes, smelting and glass manufacture. This means significant sectors of modern industrial economies won’t be able to transition rapidly to a zero emissions world. To some degree, this challenge is tied to the issue of various technologies being “stalled.” Shell cites hydrogen for the transportation system as a technology that has been supplanted by developments in battery technology. Biofuel development has also stalled as a technology that could provide high-energy density, low-carbon footprint fuels for certain transportation markets.

Potentially, one of the most difficult challenges is that energy system transformations are unpredictable and take time, which runs into Shell’s final challenge that “given the time frame of 2070, there can be no slippage.” Therein lies the greatest challenge for the Sky scenario – it requires a significant revamping of energy systems, which will need social and political support to enact, yet there is little time to make the necessary adjustments. Absent from Shell’s Sky scenario is any commentary on the cost necessary to make the transition, let alone the economic damage that would be inflicted on society if new energy technologies do not follow the projected downward cost curves and timelines assumed.

Understanding the Sky scenario requires seeing how it would facilitate meeting the Paris Agreement global temperature goal in contrast with Shell’s Mountains and Oceans scenarios. The difference is captured in Exhibit 2.

Two charts summarize Sky’s conclusions. One shows how in a net zero emissions world in 2070, renewables dominate the fuel supply, although oil remains the largest fossil fuel source. The second chart shows how energy use by economic sector changes over time. Industrial energy use, as well as passenger road transportation, decline, while freight, air transport and non-energy use increase

Major companies, like Exxon Mobil and Royal Dutch Shell, transitioned from being majority oil producers’ years ago. While they still report in energy equivalent barrels the reality is that the majority of their production is natural gas. As a comparatively clean fuel, which tends to see demand increase as living standards improve, the long-term outlook for gas demand appears to be relatively secure.

Shell has taken some of the boldest steps in becoming a natural gas focused business over the last decade and is now reaping the rewards, particularly as demand in Asia trends higher. Its burgeoning supply growth in Western and Northern Australia represents a potent asset for the company although there are rumblings in the media about the highly accommodative deal it received from the Australian government to develop the assets. More than any other factor I suspect government rent seeking is the biggest challenge for energy companies performing the global market.

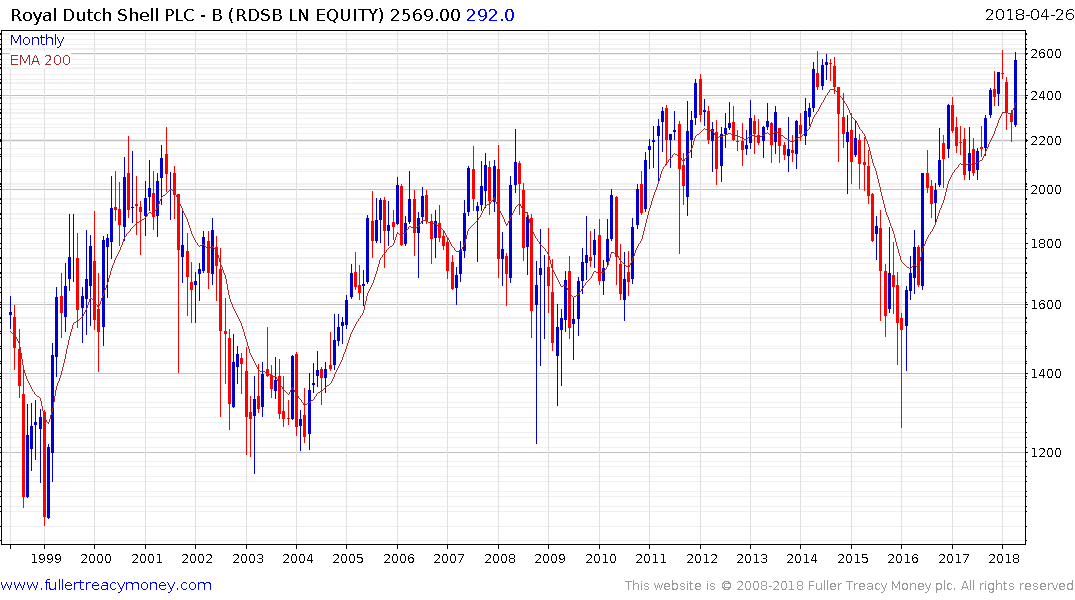

The share is now testing its all-time peak and a short-term overbought condition is evident. Some consolidation is possible but a sustained move below the trend mean would be required to question medium-term scope for continued upside.

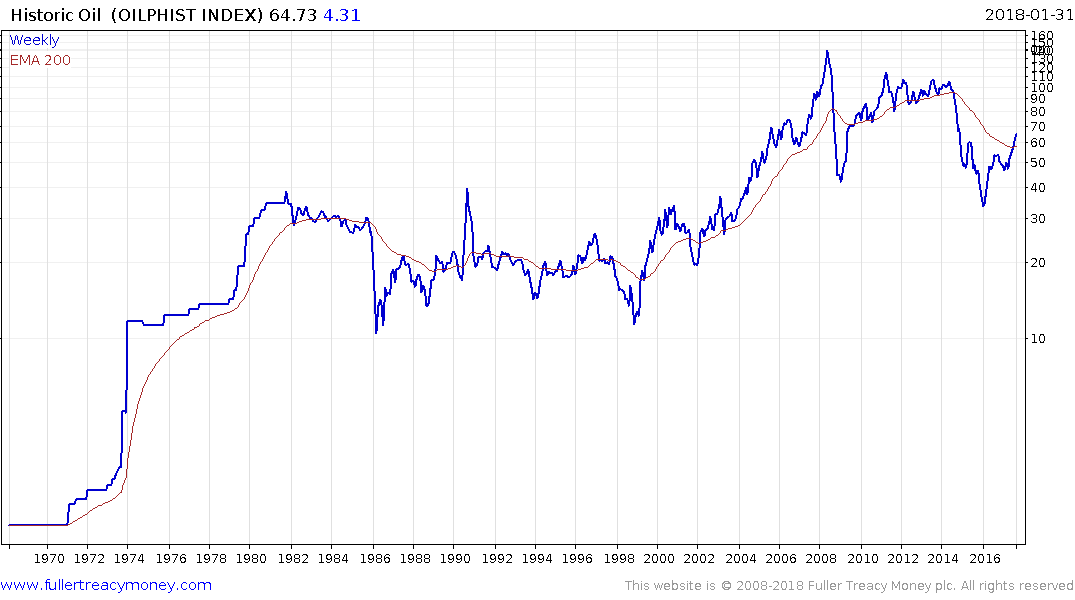

An additional consideration is that long-term market forecasts by energy companies have historically tended to be wide of the mark. Historically oil has moved in long-term cycles which have been characterized by generational long ranges followed by multi-year uptrends. The last range between $10 and $40 prevailed between 1981 and 2004. It was followed by a massive bull market that resulted in new sources of supply being brought to market in conjunction with a step-up in the marginal cost of production.

If history is any guide the current ranging environment, mostly between $30 and $100 could persist for decades. The price right now is about half way up the range and sustained move below the trend mean would be required to question current scope for continued upside.