Mini-Budget Torched, Now Hunt Must Balance the Books

This article from Bloomberg may be of interest to subscribers. Here is a section:

Our latest assessment, taking on board the change in borrowing costs since Hunt’s announcement and the policies in the statement, is that a further £13 billion will still need to be found to just get debt falling relative to GDP. It would take more like £36 billion of consolidation to put it on the same trajectory as we projected before the mini-budget was published in September.

Debt Still On Explosive Path

Finding a package of spending cuts that are politically viable and deliverable will be extremely challenging -- much of the low-hanging fruit has already been picked. Hunt faces an uphill struggle to win the faith of markets as he formulates a budget, to be delivered on Oct. 31.Hunt also said that the universal household energy price cap will be replaced from April 2023 with more targeted measures. It’s not clear what those measures will be but removing the government cap altogether and reverting to Ofgem’s methodology from April would imply a 75% rise in energy bills for households. Inflation would jump to 11.6% in April, against 6.4% under the cap.

The combination of austerity and less support for households next year means the risks to our forecast for a 0.4% drop in GDP in 2023 have shifted to the downside.

Jeremy Hunt introduced a reset over the weekend which puts the UK government’s finances back to where they were two weeks ago. As a result the Pound is back to where it was on September 20th. Deficits are wide but the assumption is the universal energy price cap is assumed to be temporary. The reality is price controls are difficult to remove once installed and are always expensive to maintain.

Centrica was given the green light to reopen the Rough gas storage platform 10 days ago. That could double the UK’s natural gas storage capacity. However, it was shut because the cost of renovations was considered too high and the question of funding has probably been amplified over the intervening few years. https://www.thechemicalengineer.com/news/uk-gas-storage-capacity-set-to-double-amid-concerns-that-supply-shortages-could-force-industry-closures/

Centrica was given the green light to reopen the Rough gas storage platform 10 days ago. That could double the UK’s natural gas storage capacity. However, it was shut because the cost of renovations was considered too high and the question of funding has probably been amplified over the intervening few years. https://www.thechemicalengineer.com/news/uk-gas-storage-capacity-set-to-double-amid-concerns-that-supply-shortages-could-force-industry-closures/

Prices for European gas are predictably falling because of the physical limitations of storage capacity. When inventories begin to be drawn down over the coming months, demand will return. Assuming Russian exports are still unavailable next summer a scramble will ensue to source inventories. That suggests ample scope for further volatility next year so deep oversold conditions are unlikely to last long.

Prices for European gas are predictably falling because of the physical limitations of storage capacity. When inventories begin to be drawn down over the coming months, demand will return. Assuming Russian exports are still unavailable next summer a scramble will ensue to source inventories. That suggests ample scope for further volatility next year so deep oversold conditions are unlikely to last long.

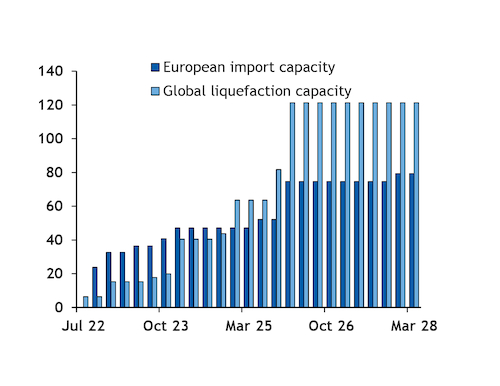

This graphic from Argus suggests it will be 2025 between global liquefication capacity approaches European’s increased import capacity.

This graphic from Argus suggests it will be 2025 between global liquefication capacity approaches European’s increased import capacity.

Mexico is proactively seeking opportunities in the LNG export sector. It just signed a deal with TC energy to build an LNG export facility to supply a 20-year contract agreed with Germany.

Pemex’s 2047 6.75% bond yields 11.86% and the chart has hit a peak of at least near-term significance.

Pemex’s 2047 6.75% bond yields 11.86% and the chart has hit a peak of at least near-term significance.

Mexico has also nationalized its lithium sector with the express aim of being a major battery producer for its export-driven auto manufacturing sector. The Peso has been effectively pegged to the Dollar since Obrador became president.

Meanwhile China banned re-export of LNG today, suggesting another avenue for European imports has been closed down.

Back to top