Mexico Battles Bad Timing in 1st Sale of Oil Fields Since 1930s

This article by Adam Williams and Juan Pablo Spinetto for Bloomberg may be of interest to subscribers. Here is a section:

Mexico waited 77 years to invite foreign oil producers back into its borders. That was one year too many.

The move to lure tens of billions of dollars from the likes of Exxon Mobil Corp. will be put to the test for the first time at an oilfield auction on Wednesday. With oil prices down by about half since last year, five of 38 potential bidders including Glencore Plc, Noble Energy Inc. and even Mexico’s state-owned oil producer have pulled out.

President Enrique Pena Nieto moved to end the state monopoly after poor drilling infrastructure and technology failed to reverse a decade-long production decline that reduced government revenue. To lure investments now, Mexico will probably get a much smaller share of profits than it would have a year ago.

“They shaped expectations at a $100-per-barrel market and we are way off that now,” Wilbur Matthews, chief executive officer of San Antonio-based Vaquero Global Investment, which oversees more than $100 million of assets including oil-producer bonds, said by phone July 10.

Favourable geology doesn’t just stop at the border between Texas and Mexico. Officials must have been looking on with envy as the shale boom took off in the US south west. Mexico’s state owned oil company dealt with declining output. Today’s news of Iran reaching an agreement to end sanctions and increase oil exports is another reason for Mexico to ramp production. The country will not get the same price they were hoping for from producing unconventional supplies and boosting offshore but it has little choice but to develop these reserves if the hole in its budget is to be repaired.

The Mexican Peso is somewhat oversold at present in the region of the 2008 low but a break in the Dollar’s progression of higher reaction lows would be required to signal more than temporary Peso strength.

In nominal terms the Mexican Index has been ranging mostly below 46,000 since 2013 and a sustained move below the 200-day MA, currently near 44,000 would be required to question medium-term potential for additional upside.

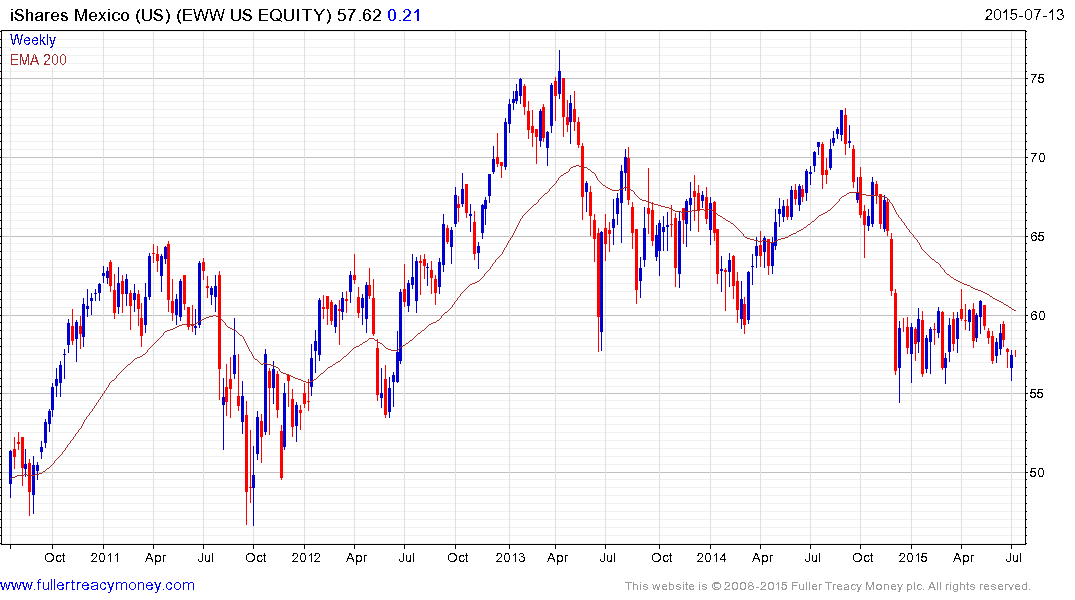

The IShares Mexico ETF highlights how much of an impact on performance the Peso has had from the perspective of a foreign investor. The Fund has been ranging mostly above $55 since December and is currently rally from the lower side. A sustained move above $60 would suggest a return to demand dominance beyond the short term.