Marine Shipping: Brighter Horizons Ahead

Thanks to a subscriber for this report from Deutsche Bank which may be of interest to subscribers. Here is a section:

1. We believe the global Shipping industry is on the cusp of entering a new era of prosperity, driven by:

Improved supply/demand dynamics

Increased fleet utilization

Abundant capital to fund vessel growth2. We forecast an almost doubling of earnings power in 2016 (vs. 2013) across our coverage universe, driven by:

Increasing spot market rates

Vessel growth3. We are most bullish on shippers of Dry Bulk, Crude Oil, and LPG/LNG

Near-term: Dry Bulk rates are starting to inflect higher, but are still 55% below 20-year historical average (i.e. more room to run).

Mid-term: Distance between where oil is harvested and refined is increasing, creating significant secular growth opportunities for shippers of crude oil.

Long-term: Demand for LPG/LNG shipping should increase significantly as infrastructure projects come online and export capacity grows.

Here is a link to the full report.

Generally speaking when shippers have high yields and attractive valuations they are about to engage in a spending spree to purchase new ships which trashes their balance sheets. However, following a period where profligate spending was widespread the supply of new ships is moderating and the credit crisis has curtailed overly ambitious expansion plans.

Nevertheless, as the sector reaches equilibrium, catalysts such as improving global trade will be required to reignite investor interest in the majority of shares.

While the fall off in the USA’s demand for imported oil means cargoes may have to go farther to find customers, the evolution of this trend is medium-term in nature. On the other hand the expansion of the natural gas transportation sector is relevant today and is likely to grow even further as more infrastructure comes online and as more countries attempt to wean themselves off a reliance on coal.

Among LNG and LPG carriers:

.png)

Dynagas (Est P/E 14.98, DY 6.3%) has held a progression of higher reaction lows since its IPO in 2013 and is currently testing the region of the 200-day MA.

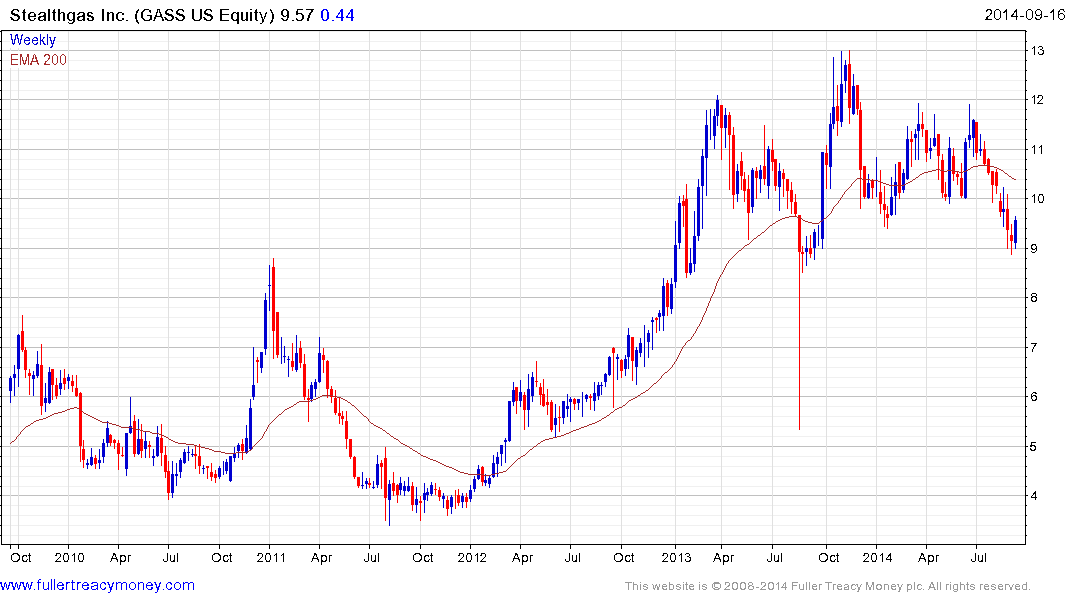

Stealthgas (Est P/E 12.84, DY N/A) has been ranging above its 2009 – 2012 base for 18 months and has returned to retest the $9 area. It will need to continue to find support in this area if the accumulation hypothesis is to be given the benefit of the doubt.

Golar LNG (Est P/E N/A , DY 2.53%) broke out of a 30-month range in June and continues to extend the advance. It is becoming increasingly overextended relative to the trend mean but a break in the progression of higher reaction lows would be required to check momentum beyond a brief pause.

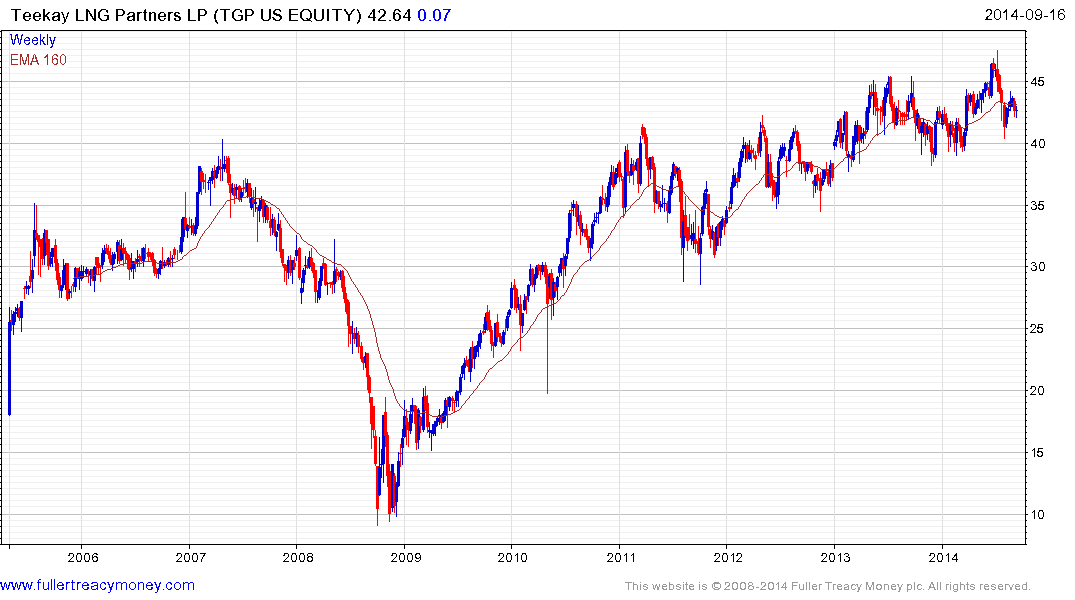

Teekay LNG Partners LP (Est P/E 17.98, DY 6.49%) lost momentum in 2011 and continues to range with a mild upward bias.

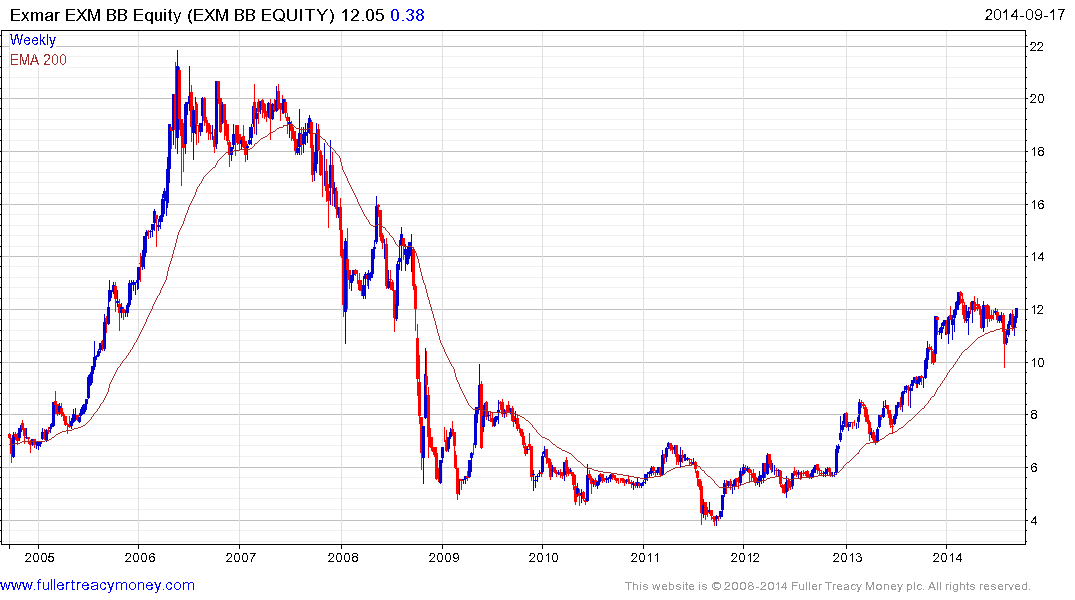

Belgium listed Exmar (Est P/E 22.31, DY 4.17%) has bounced back from a sharp reaction in August to break a progression of lower rally highs evident since January. A sustained move below €10 would now be required to question medium-term scope for continued higher to lateral ranging.

Here is an article discussing differences between LPG, LNG and CNG.

Back to top