Made-in-China Cars Are Primed to Conquer the Global Market

This article by may be of interest to subscribers. Here is a section:

“To fight the Chinese, we will have to have comparable cost structures,” Stellantis NV CEO Carlos Tavares said on Dec. 19, speaking to reporters at a powertrain plant in Tremery in northern France. “Alternatively, Europe will have to decide to close its borders at least partially to Chinese rivals. If Europe doesn’t want to put itself in this position, we need to work harder on the competitiveness of what we do.”

And

The growth in the supply chain in China has also kept pace with car manufacturing. Domestic companies now make almost all parts, including those they used to import until about a decade ago, such as high-strength steel and reinforced fiberglass. As a result, China ran a trade surplus in vehicles and vehicle parts for the first time in 2021. The assembly lines still depend on advanced machines from Japan and Germany, though.

“There seems to have been a step change,” Dyer says. “The long-term trend is for increasing sales of Chinese brands around the world.”

A decade ago it was obvious China was moving up the value chain in manufacturing. It might have not have reached heights of 3nm chip production but planes and automobile parity is now a reality. That’s as much of challenge for Airbus and Boeing as it is for Toyota, Hyundai, Volkswagen and GM.

Anyone who is still under the illusion that the EU’s extraterritorial carbon emissions push is about anything other than protectionism needs to consider how dire the need is to improve European competitiveness.

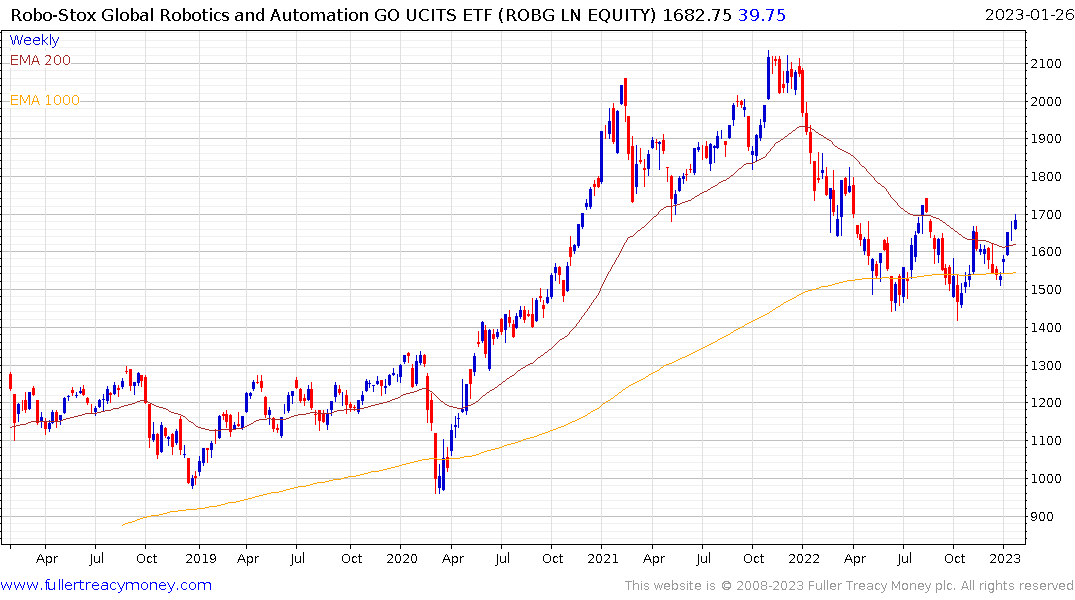

If Chinese companies have a higher robot to worker ratio than European manufacturers, then competitiveness needs to be achieved on the technological front, more worker hours will be ineffective. Inventing ways to tax imports is infinitely preferable to firing tens, or even hundreds, of thousands of well paid manufacturing workers who are union members and vote accordingly.

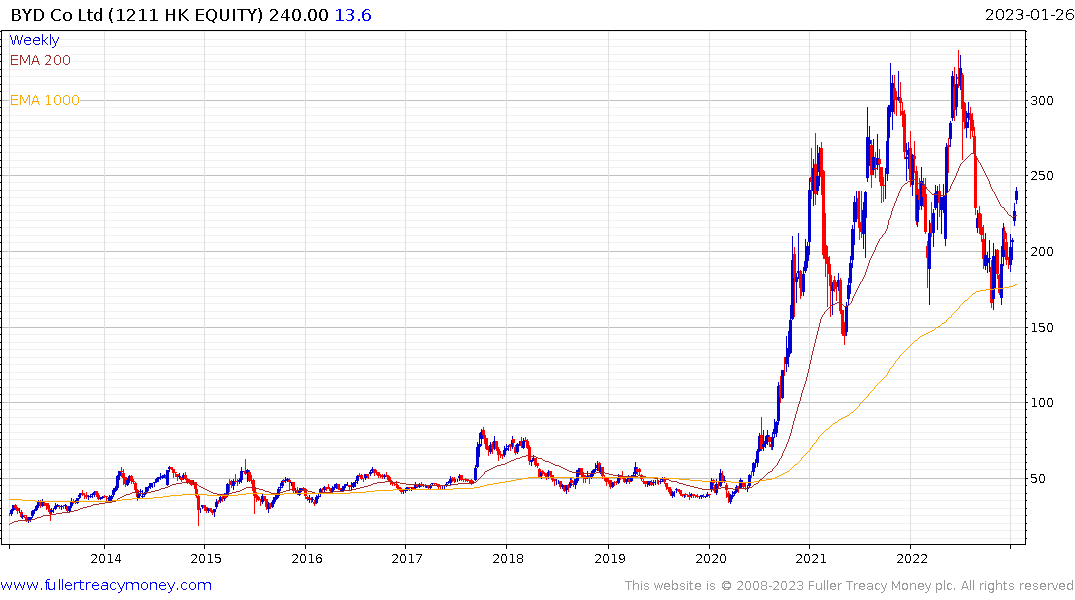

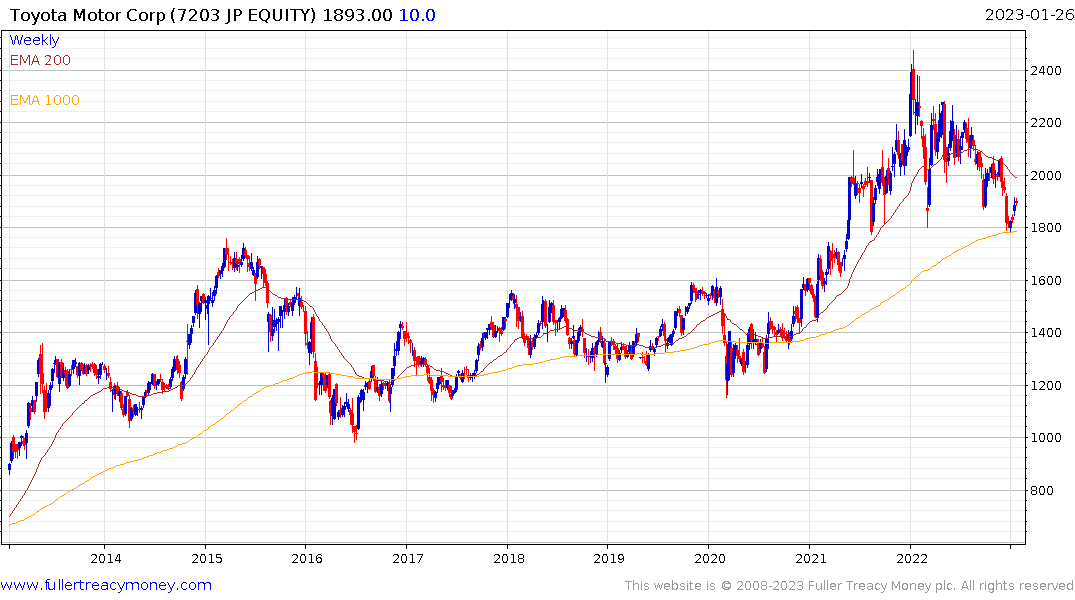

These issues appear to be adequately reflected in the valuations of the main auto companies. Volkswagen, Ford and GM are on single digit multiples while Toyota has a forward P/E of 10.05. They are badly in need of global growth recovering to sustain recovery. China’s reopening certainly helps by sopping up excess supply in the domestic market.

Meanwhile Tesla continues to unwind its deep short-term oversold condition.

The L&G ROBO Global Robotics and Automation ETF broke successfully back above the trend mean last week and has increasingly convincing inverse head and shoulders base formation characteristics.