Lula Losing Brazil' Biggest State Forces Urgent Campaign Rejig

This article from Bloomberg may be of interest to subscribers. Here is a section:

Inside Lula’s campaign, the result in Brazil’s most populous state — the birthplace of his political career, and containing about 25% of the entire electorate — was compared to a plane crash, where a confluence of small factors leads to catastrophe. At his team’s first post-election meeting, the talk was of frustration and failure.

Edinho Silva, the former president’s campaign coordinator, may have had an inkling of what was to come, saying in an interview on the eve of polling that Sao Paulo had become a center of hard-core support for Bolsonaro’s brand of right-wing identity politics.

“We have a percentage of Brazilian society that, unfortunately, is racist, homophobic, sexist, xenophobic, and doesn’t accept the social ascent of the lower classes,” he said. “And a significant part of Brazil that thinks in this way lives in Sao Paulo.”

Here is a novel idea. Perhaps Brazilian voters are not prepared to install a man who squandered the bounty from the last commodity boom on vanity projects. As if that were not enough, he led an administration that was the most corrupt in the country’s history, and that is saying something. Lula was jailed for corruption and was only allowed to run because he was offered a politically motivated dispensation.

Did it ever occur to the Worker’s Party that perhaps he is a flawed character to put up for re-election? Perhaps they calculated support for Jair Bolsonaro is not nearly as strong as it seems on the surface and a familiar face would be enough to turn the tide.

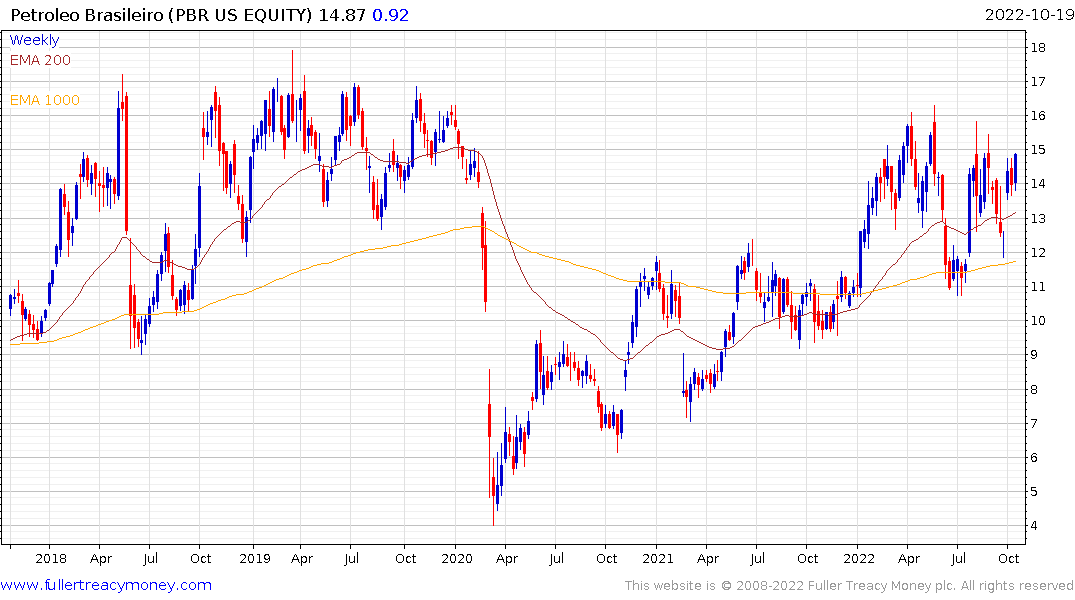

Petrobras’ world beating dividend is likely to be secure if Bolsonaro wins the election. The share is rebounding to retest the upper side of the six-month range at present. Whoever wins the election will inherit an economy on the cusp of recovery where inflation has demonstrably already peaked.

Petrobras’ world beating dividend is likely to be secure if Bolsonaro wins the election. The share is rebounding to retest the upper side of the six-month range at present. Whoever wins the election will inherit an economy on the cusp of recovery where inflation has demonstrably already peaked.

The Real continues to hold is sequence of higher reaction lows versus the Dollar.

The iBovespa Index is firming within a two-year range.

The iBovespa Index is firming within a two-year range.