LNG Market Supply to Remain Tight for Years, Top Producers Say

This article from Bloomberg may be of interest to subscribers. Here is a section:

Liquefied natural gas will be in short supply in the coming years as production lags behind surging demand from Europe, according to the world’s top producers of the fuel.

Global LNG demand is unlikely to peak for another 20 to 30 years, Qatar Energy Minister Saad Al-Kaabi said at the Energy Intelligence forum in London. Meanwhile, supply will remain “structurally short” until there’s significant new production capacity, which will be 2026 at earliest, Meg O’Neill, chief executive officer of Australia’s Woodside Energy Group Ltd., said at the event.

Their comments add to a growing chorus warning that Europe’s worst energy crisis in decades is unlikely to end soon. While the continent looks set to cope this winter, it’s next winter when the supply shortage will really bite as Europe tries to replenish its stockpiles without Russian imports.

“Next winter is going to be the problem,” Al-Kaabi said. “It doesn’t look like it’s getting better.”

The opinion that Europe will cope this season is implied in prevailing prices of natural gas. It is not reflected in media coverage which continues to paint a dire picture of what this winter will feel like for many consumers.

I also continue to see sensationalist coverage that if we don’t freeze, we will starve this winter because of an impending oil price spike. I remain of the view demand is much more important that supply when the global economy is slowing down.

The bigger point is many European buyers will be eager to secure cargoes for the winter of 2023/24 because they will no longer be able to rely on Russia supply. That’s a bonus for LNG exporters in the USA, Qatar and Australia.

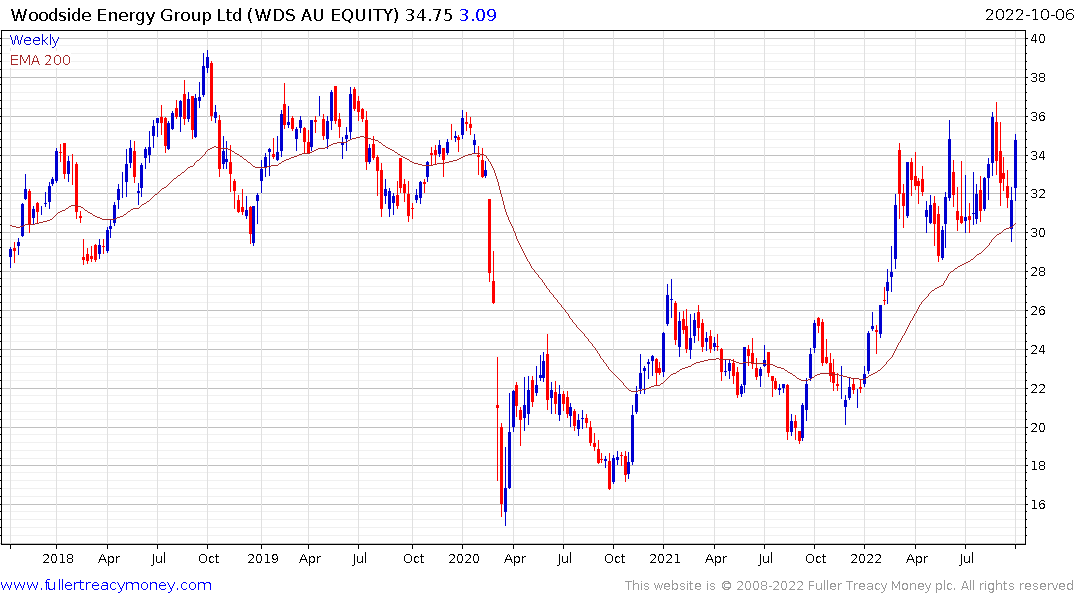

Woodside acquired BHP’s energy assets four months ago and currently yields 12% gross. The share is firming from the region of the 200-day MA.

Woodside acquired BHP’s energy assets four months ago and currently yields 12% gross. The share is firming from the region of the 200-day MA.

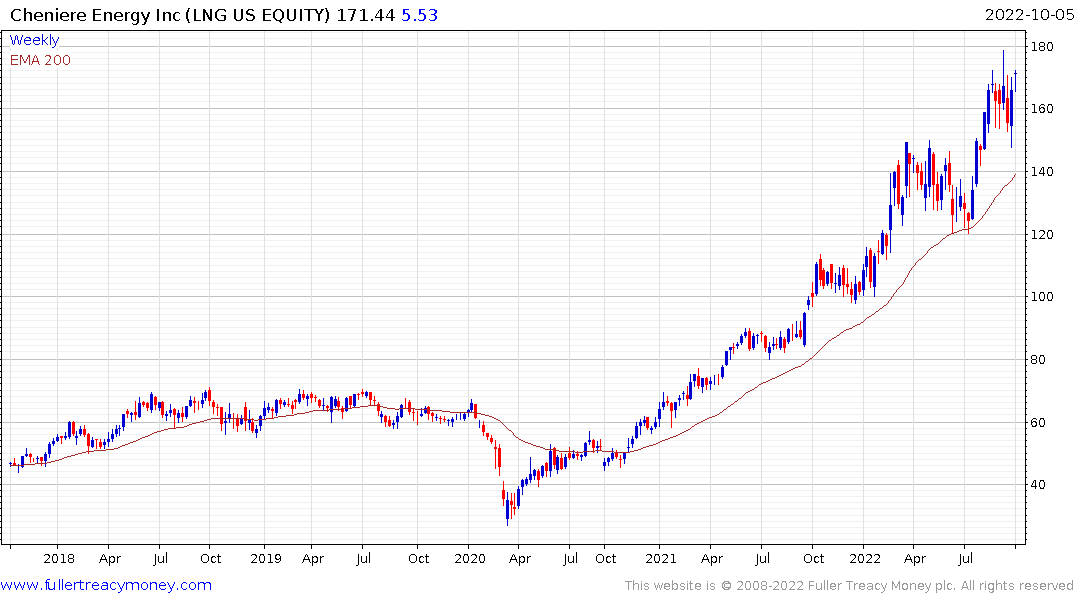

Cheniere LNG remains in a steep but consistent medium-term uptrend.

Cheniere LNG remains in a steep but consistent medium-term uptrend.

EOG and Devon Energy continue to firm as exports from the Freeport terminal are expected to restart in November.