JPMorgan, Citigroup Maintaining Some Russia Ties Due To U.S. Government Instructions

This note from Dow Jones may be of interest to subscribers.

JPMorgan Chase & Co. and Citigroup Inc. are maintaining some ties with Russian companies for strategic reasons on directives behind the scenes from the U.S. State Department and Treasury Department, Bloomberg reported on Monday. The country's biggest banks are caught between Congress, which is pushing for strict sanctions against Russia for its invasion of Ukraine, and the Biden administration, which has urged banks to continue doing business with strategic Russian companies, Bloomberg reported, citing people familiar with the situation. Nnedinma Ifudu Nweke, a lawyer at Akin Gump Strauss Hauer & Feld LLP who specializes in economic sanctions, told Bloomberg that some pockets of business are still allowed with Russia, particularly in the humanitarian space as well as facets of the financial system that would pose a systemic risk. A spokesperson from the Treasury Department told Bloomberg that it has issued guidelines to banks to assure that humanitarian aid, energy and agriculture activities continue.

This would be a news grabber on its own but when it comes in tandem with the story that the USA asked Ukraine to at least act like they are open to negotiations with Russia it is potentially even more significant.

The assumption has been the USA was willing to support the war in Ukraine indefinitely. Now that a recession in evident in Europe and public support for the war is being questioned, efforts are under way to tone back some of the rhetoric.

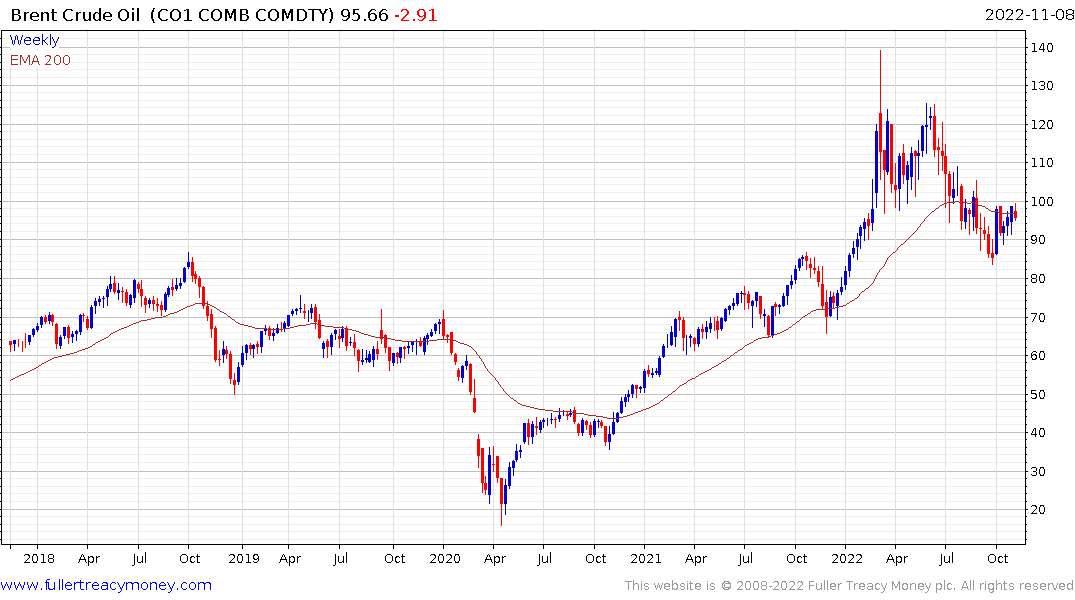

China doubling down on COVID-zero was a partial catalyst for lower oil prices today but the potential for de-escalation in Ukraine is potentially more significant. Brent crude remains in a tight $10 range and has not yet broken out.

China doubling down on COVID-zero was a partial catalyst for lower oil prices today but the potential for de-escalation in Ukraine is potentially more significant. Brent crude remains in a tight $10 range and has not yet broken out.

US natural gas reversed yesterday’s surge to confirm near-term resistance in the region of the 200-day MA. That’s attributed to speculation the Freeport LNG terminal is not quite ready to begin exports again and the restart may be delayed until December.

Back to top