Jamie Dimon's Rate-Spike Nightmare

This article by Lisa Abramowicz and Rani Molla for Bloomberg may be of interest to subscribers. Here is a section:

3) Investors are piling into medium and longer-term U.S. bonds with increasing conviction that borrowing costs will stay low forever. The biggest exchange-traded funds that focus on such notes have experienced a surge of new money this year, with the volume of short interest on the ETFs' shares falling. This has helped fuel a 4.9 percent surge in Treasuries maturing in seven to 10 years so far this year, according to Bank of America Merrill Lynch index data.

4) The demand hasn't only come from ETFs and mutual funds. Big institutions and hedge funds have also bought more U.S. government bonds, particularly those maturing in the next decade, as they seek safe spots to park cash in the face of global economic uncertainty.

How the Fed measures inflation does not appear to bear a great deal of resemblance to what we experience in our day to day lives. The cost of services such as insurance, education and healthcare have all trended higher and housing prices have recovered in many major cities but inflation measures have not responded. When I look at what I spend on a monthly basis that doesn’t make sense but the other side of the balance sheet also needs to be addressed.

Wages have been static for a long time and that means people have had to pay more for services but have cut back elsewhere to make ends meet. That is probably closer to how the Fed views inflation than any other explanation but it means wages are vital in how they decide to act.

This article from Bloomberg discussing the merits or otherwise of the national drive to raise the minimum wage to $15 is noteworthy. However I think it misses the point in focusing its discussion on the outlook for minimum wage workers.

According to the Bureau of Labor Statistics about 77.2 million people in the USA were paid an hourly wage and of those 3 million were paid the minimum wage of $7.25 or less. Of that 3 million half are under the age of 25.

My question is what about the person making $15-18 an hour today? What are their wage demands likely to be when a teenager, in an after school job, flipping burgers is getting paid the same as they are? They are going to want to get more money for the work they do and the fact that it has been a few years since they got a significant pay rise will be used as a bargaining chip.

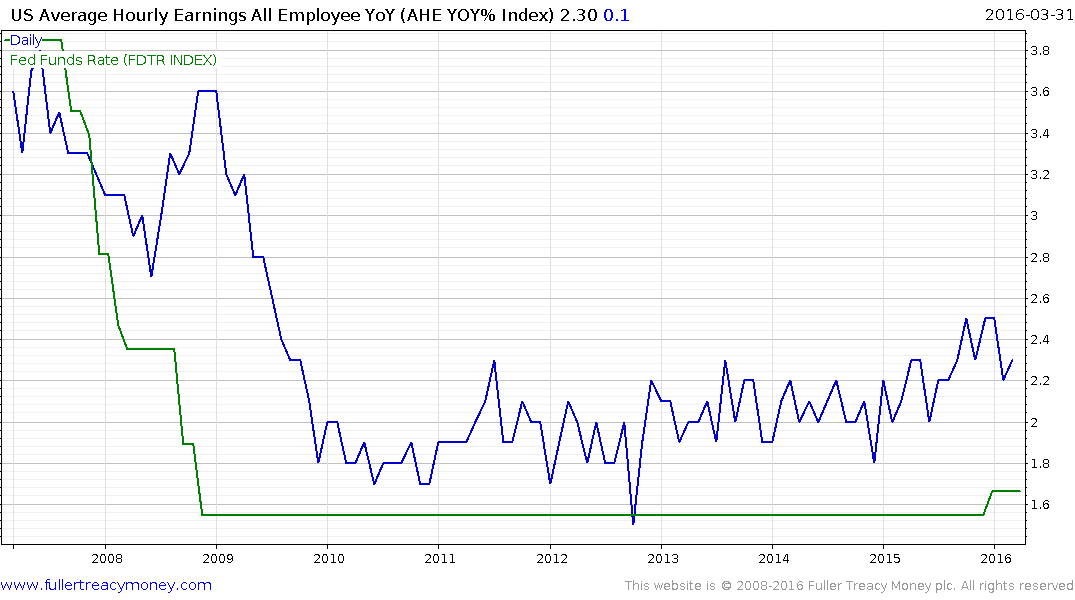

US Average Hourly Earnings Growth broke out in September and has held the move. It is hardly a coincidence the Fed raised rates shortly afterwards. With just about everything else in how they measure inflation sanitised by hedonic measures, wage growth plays an important role in how they manage expectations. There is an increasingly vocal drive to raise the Federal minimum wage in stages and a number of large cities have already announced plans to raise their levels to around $15 in the next few years.

That suggests wage growth is likely to be much more of an issue for policy makers in the next few years than it has been in almost a decade. That means higher rates. This is all likely to unfold reasonably gradually but it would be rash to expect the bull market in bonds to persist if this scenario unfolds without a recession to support demand and cap wage demands.

In addition to these considerations oil prices have probably bottomed and have already staged an impressive rebound in percentage terms. We can expect volatility but energy and commodity prices are unlikely to exert the same deflationary forces and may even contribute to inflation going forward.

US 10 year yields have base formation characteristics and retested the 2012 lows in February. However, a sustained move above 2% will be required to signal a return to supply dominance.