It's expensive, but you need some insurance

Thanks to a subscriber for this report from Deutsche Bank focusing on the outlook for gold not least as a hedge against fear in other asset classes. Here is a section:

As a hedge against a weakening currency, we think Chinese gold demand will continue to increase, and whilst we do not forecast a repeat of 2013, physical demand could grow in the order of 10% or 100 tonnes. Chinese demand has increased by 14% CAGR since 2005. In the recent bout of RMB weakness we have seen increased trading volumes on the Shanghai Gold exchange, suggesting a higher propensity to buy gold as a hedge against a depreciating currency. Chinese buying remains tactical with the most activity occurring on the dips. We note that since the strong rally in gold, we have seen activity drop off on the SGE.

Gold holds its own in a US recession

Although we are not as bearish on the US to suggest that the entire economy will lapse into a recession, there are certain manufacturing sectors that are in a recession. Assuming the worst case scenario where the US slips into a recession, dragging the global economy with it, the USD normally performs very well as investors search for safe havens and US investors repatriate funds onshore. Gold is normally inversely correlated to the USD, but under these conditions i.e. extreme risk aversion, gold also performs relatively well. We outline the performance of the USD in the past two global recessions.

Here is a link to the full report.

Gold rallied as negative yields made it attractive based on what is now a positive carry. That alerted people once more to its characteristics as an uncorrelated asset class which was ignored while prices trended lower.

Perhaps more importantly, the break of the medium-term downtrend has re-enlivened the argument that gold should form at least part of a balanced portfolio. That should put some support under prices and suggests the lows near $1050 are medium-term in nature.

.png)

Gold continues to consolidate its earlier advance in an orderly manner which has helped to at least unwind its overbought condition. A clear downward dynamic would be required to question potential for additional upside.

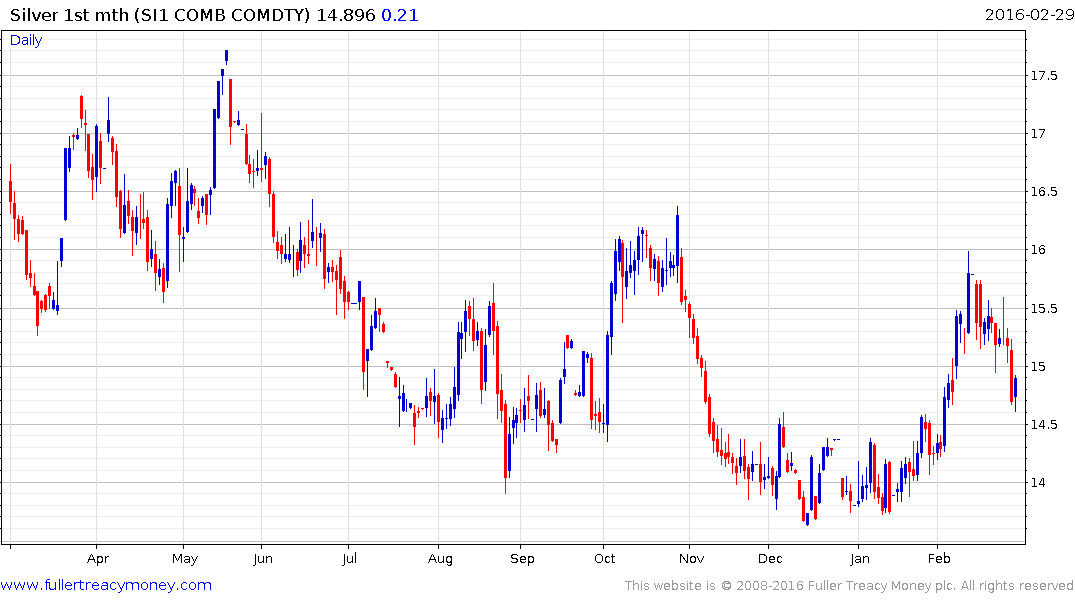

Silver has returned to test the region of upper side of the underlying trading range near $14.50 and a sustained move below that level would be required to question potential for additional upside.

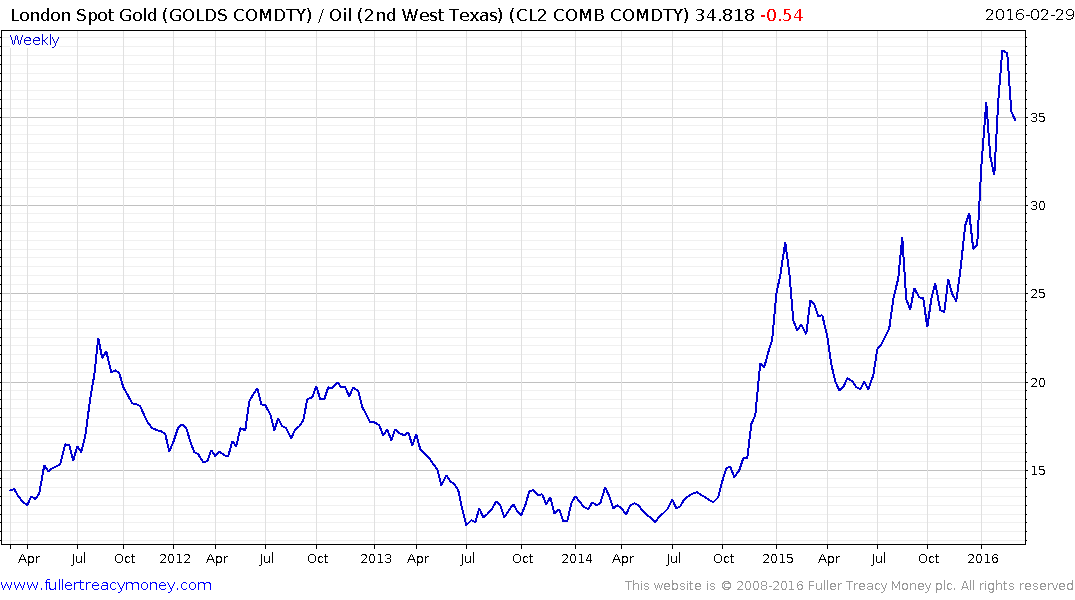

Oil is rapidly unwinding its oversold condition relative to the gold which had been at historic levels so there is still scope for it out perform even in a bullish overall environment for precious metals.