Iran May Drain Offshore Oil Cache If Nuclear Deal Reached

This article from Bloomberg may be of interest to subscribers. Here is a section:

About 93 million barrels of Iranian crude and condensate are currently stored on vessels in the Persian Gulf, off Singapore and near China, according to ship-tracking firm Kpler, while Vortexa Ltd. estimates the holdings at 60 to 70 million barrels. In addition, there are smaller volumes in onshore tanks.

“Iran has built up a sizable flotilla of cargoes that could hit the market fairly soon,” said John Driscoll, chief strategist at JTD Energy Services Pte. Still, it may take “a bit of time” to iron out insurance and shipping issues, as well as spot and term sales post-sanctions, he said.

And

The focus for diplomats is the revival of a multinational accord that limited Iran’s nuclear program in exchange for the lifting of related sanctions, including on oil flows. The original deal collapsed after then-President Donald Trump abandoned it. Last week, the US sent its response to the latest proposal, boosting speculation an agreement may soon be struck, although Tehran said Sunday that exchanges will now drag on into September.Iran’s offshore crude hoard compares with average daily global supply this year of about 100 million barrels a day, according to an estimate from the International Energy Agency. In the US, President Joe Biden has been releasing about 180 million barrels from the SPR over a six-month period.

And

Longer term after any deal is struck and the offshore cache is drained, Iran would seek to rebuild production and step up overseas sales. Goldman Sachs Group Inc., which is skeptical about a breakthrough in the near term, said even if a deal is reached, these wouldn’t begin until 2023, according to a note.

Bringing Iran’s oil supply onto the market is desirable for consumers faced with restricted supply from Russia. The price is re-admitting the biggest state sponsor of terrorism back into the global market. That’s obviously controversial for countries across the GCC and Israel. It’s a high price to pay for boosting supply in the near-term. Spending more on developing alternative assets should really be taking priority.

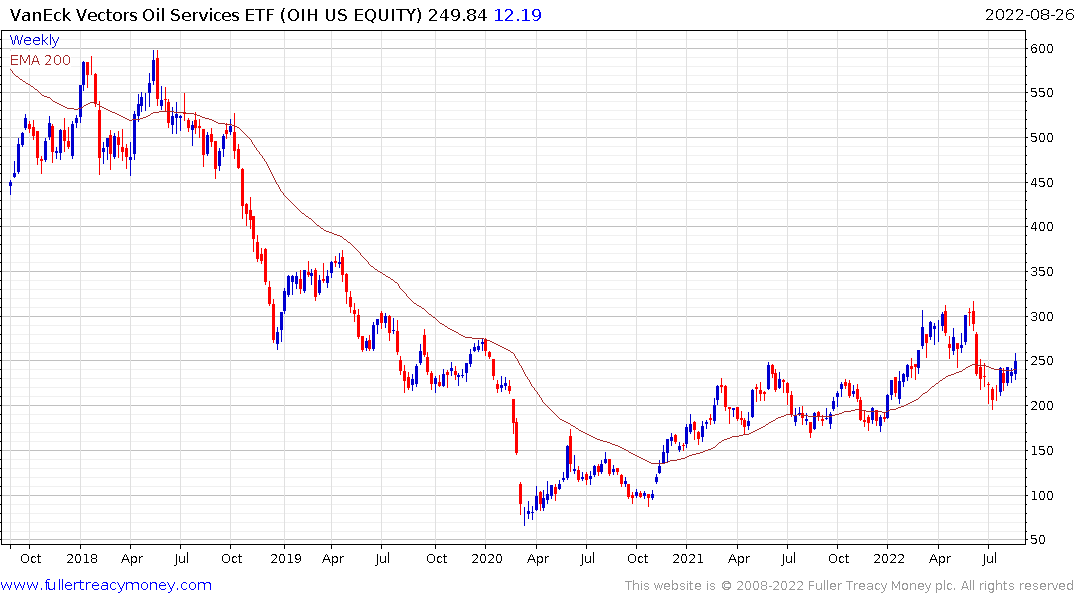

Less than enthusiastic support for offshore and other oil field development continues to be reflected in the subpar performance of the oil services ETF. It is back testing the region of the of the 1000-day MA and has held an upward bias since the July low.

Less than enthusiastic support for offshore and other oil field development continues to be reflected in the subpar performance of the oil services ETF. It is back testing the region of the of the 1000-day MA and has held an upward bias since the July low.

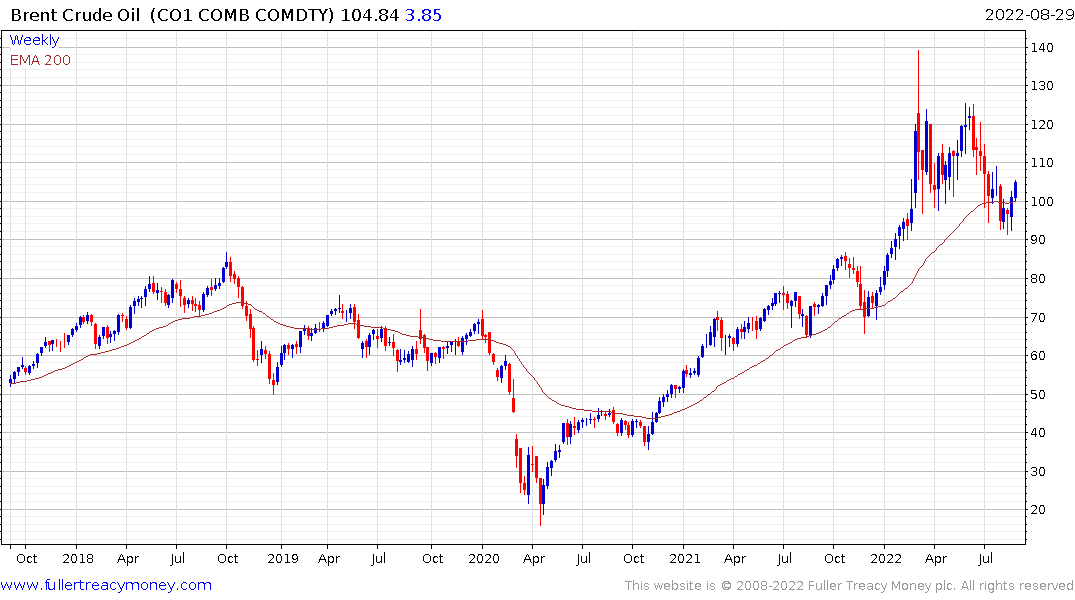

The delay to Iranian supply returning to the market and less immediate available supply from other sources is supporting the oil price. Brent crude is pulling away from the $100 area as it pushes back up into the overhead range. This is looking increasingly like a failed downside break which supports the bullish near-term outlook.

The delay to Iranian supply returning to the market and less immediate available supply from other sources is supporting the oil price. Brent crude is pulling away from the $100 area as it pushes back up into the overhead range. This is looking increasingly like a failed downside break which supports the bullish near-term outlook.