Impatience

There is one theme that seems to be running through every asset class at present. Perhaps it is because we have been locked up for a year, and literally can’t wait until it is all over, but there is a distinct air of impatience in every circle of life. The pandemic has accelerated the decision-making process for everyone in every facet of our lives.

Mrs. Treacy and I have been discussing moving from Los Angeles for two years but there was never a push big enough to stir us into action. We looked at Las Vegas suburbs in 2019 and toured schools but my eldest daughter was accepted into one of the most prestigious high schools in Los Angeles, so we decided to linger.

The experience of living in Los Angeles during the lockdowns, from schooling to public safety, made us impatient for a change. Like many others we decided to move and have only been delayed by reapplying to schools for our daughters and finding a suitable home.

The housing markets in the USA, Canada, UK and Australia are on fire. The rising cost of building materials, lack of available craftspeople and sheer demand are all conspiring to increase the cost of construction. Not only are buyers being forced to bid well over asking to secure contracts, but sellers are intimidated because they fear they will not be able to buy where they wish to move to. A substantial proportion of people have decided, en masse, to move and that trend that could persist for as long as companies are willing to tolerate remote work.

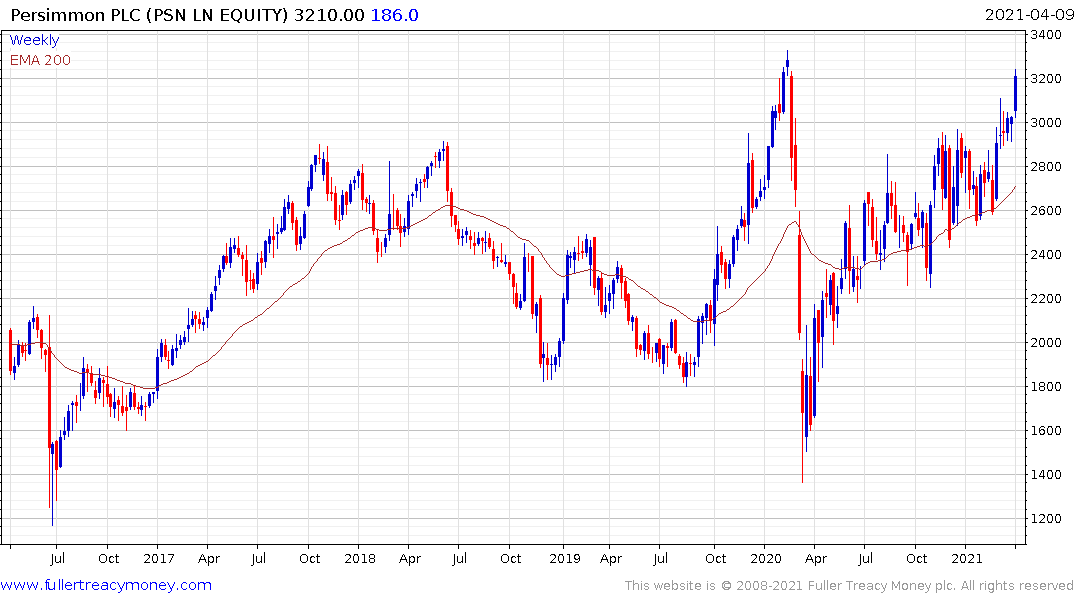

The UK’s Persimmon is on the cusp of taking out its old high.

The USA’s Lennar Corp and DR Horton share similar patterns and continue to extend breakouts.

Australia’s Goodman Group continues to rebound from the region of the trend mean.

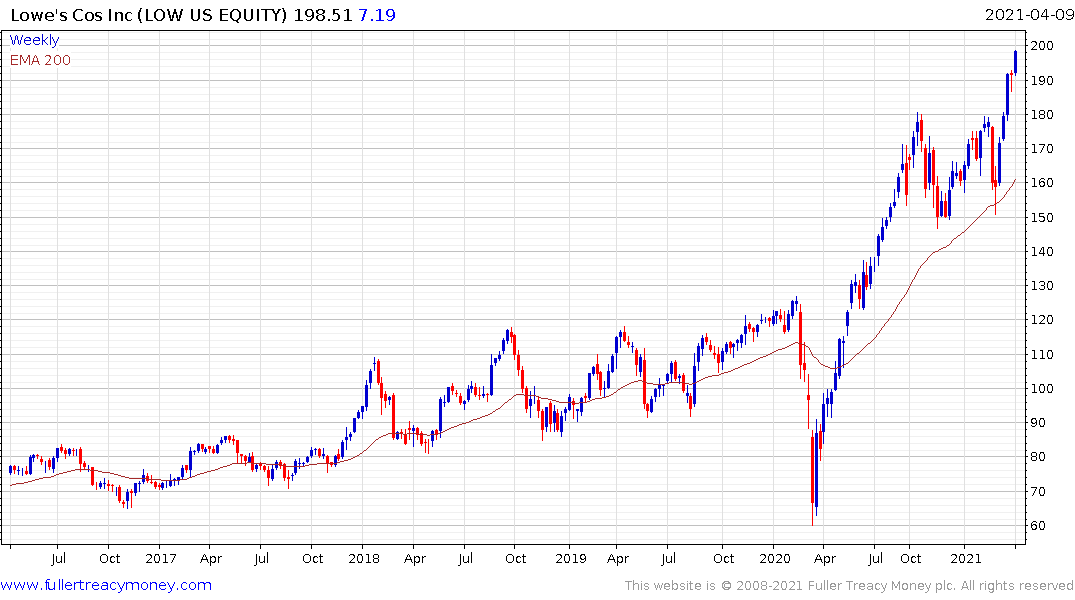

Both Home Depot and Lowe’s both broke out to new all-time highs in the last couple of weeks.

Lumber is also accelerating higher.

![]()

Every manufacturer of electronic devices from cars to kitchen applicances is impatient for the semiconductor supply chain to be fixed.

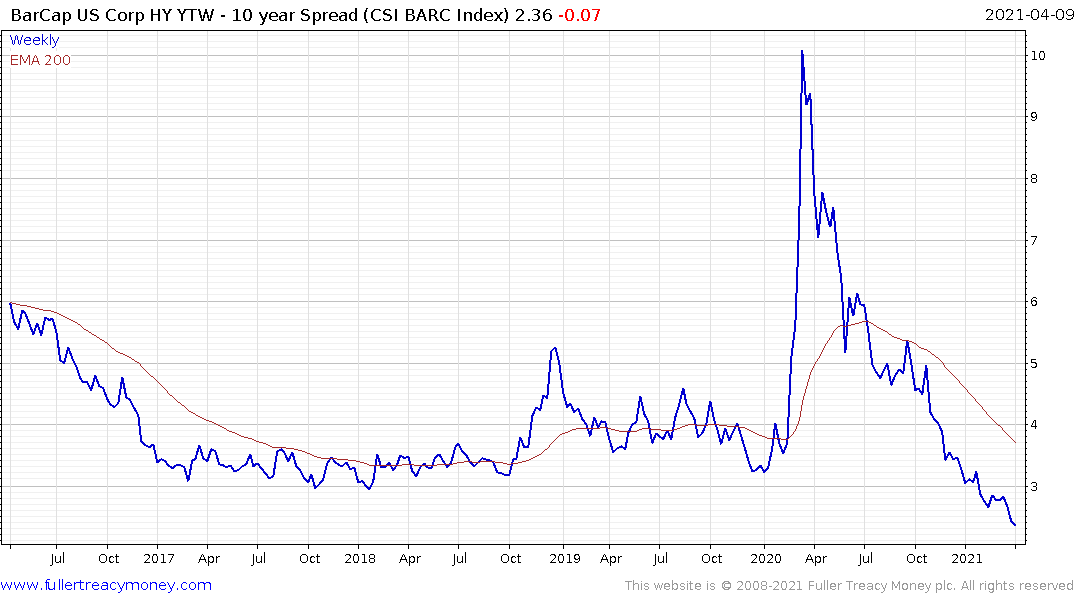

Bond investors are not just impatient but desperate to capture a positive yield. High yield spreads are close to the narrowest levels ever and the number of pool available

China’s Communist Party is coming up on its 100-year anniversary. The one big unachieved goal is to bring Taiwan back into the fold. Every day this year there have been incursions into Taiwanese air space and now China’s aircraft carrier is patrolling along the Taiwanese coast. This is not friendly action. It is a sign of impatience at the lack of progress on China’s most significant foreign policy goal. Most strategists believe China will not be ready to commit to military force for at least another four years. Instead, a blitzkrieg type action could occur at any time.

China is also moving much quicker than other central banks to establish a digital currency that will run in parallel with the Renminbi. The eventual aim is to make all domestic financial transactions fully transparent. The additional aim is to create a fully autonomous system from the US controlled SWIFT system, so China will have no issue with circumventing potential financial sanctions in future. During the last year just about every one of China’s long-term plans has been accelerated. The Party is no longer content to bide its time, they are not impatient for progress on their long-term aim of global dominance. Even as the world has its eye on what China is doing Russia may yet surprise with a full-scale attempt to take over Ukraine.

Bitcoin’s investors are also impatient for progress on their goals of creating an alternative financial system that is free from corruption by the governments. The fact that the new head of the SEC in the USA used to lecture on cryptocurrencies at MIT suggests there will at least be someone at the head of the USA’s regulatory body that understands the premise for the sector. Quite whether that leads to an ETF being permissioned is still open to question despite the impatience of investors. https://www.barrons.com/articles/a-bitcoin-etf-is-still-in-the-works-here-are-your-options-in-the-meantime-51618014033

The price is now less consistent that it has been in a year. Nevertheless, if it can sustain a breakout above $60,000, there is potential for an additional leg higher.

In the UK, the Scottish and Welsh independence movements are also impatient to achieve their long- stated goals of breaking up the UK. At the other extreme, loyalists in Northern Ireland are protesting at the fact Boris Johnson weakened the Union; by putting the border between the UK and EU in the middle of the Irish Sea instead along the border with the Republic of Ireland. With the political arena in a state of flux there is clear potential that the impatience and frustration many people feel will spill over into rash decisions.

At least Boris Johnson does not have the face the public in an election any time soon. Germany’s election is later this year and there is considerable room for an upset. Meanwhile 9 countries in Latin America are going to the polls in 2021.

The green movement has been growing in influence for years but the pandemic saw the urgency to achieve a carbon free global economy move into high gear. There seems to be a new found urgency to achieve climate goals. I’ve seen a large number of reports recently that assume the transition away from oil and coal is inevitable.

Governments appear to be on board with supporting that view and carbon prices continues to trend higher as a result. The wind, solar and hydrogen sectors are benefitting from this impatience.

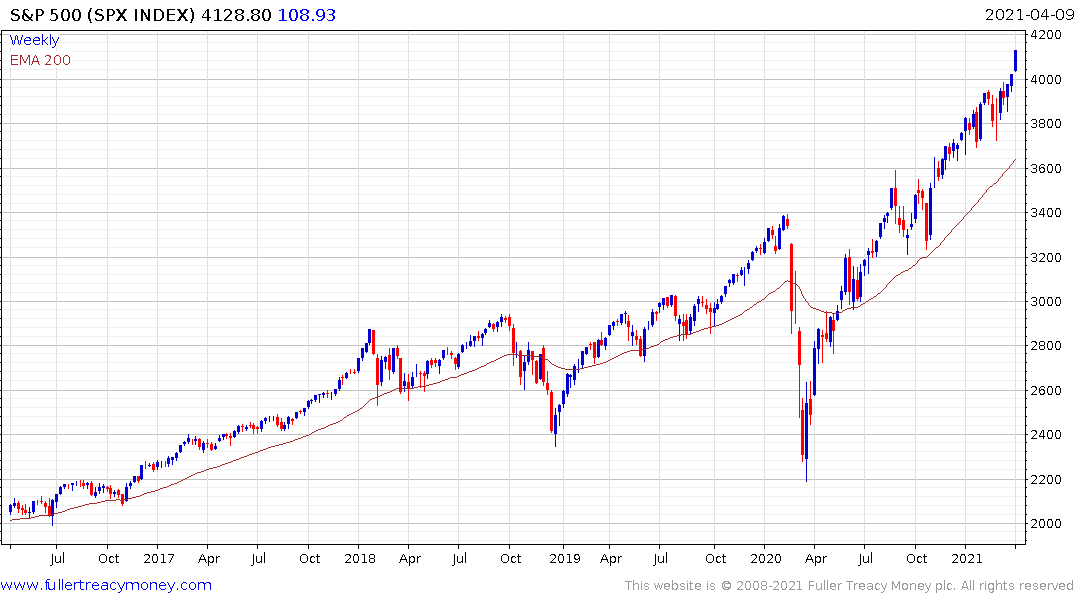

Stock market investors are also in a hurry to price in a full economic recovery on an accelerated timetable. No credence is being given to the threat from variants because the vaccines provide at least some protection.

Wall Street continues to lead with repeated moves to new highs.

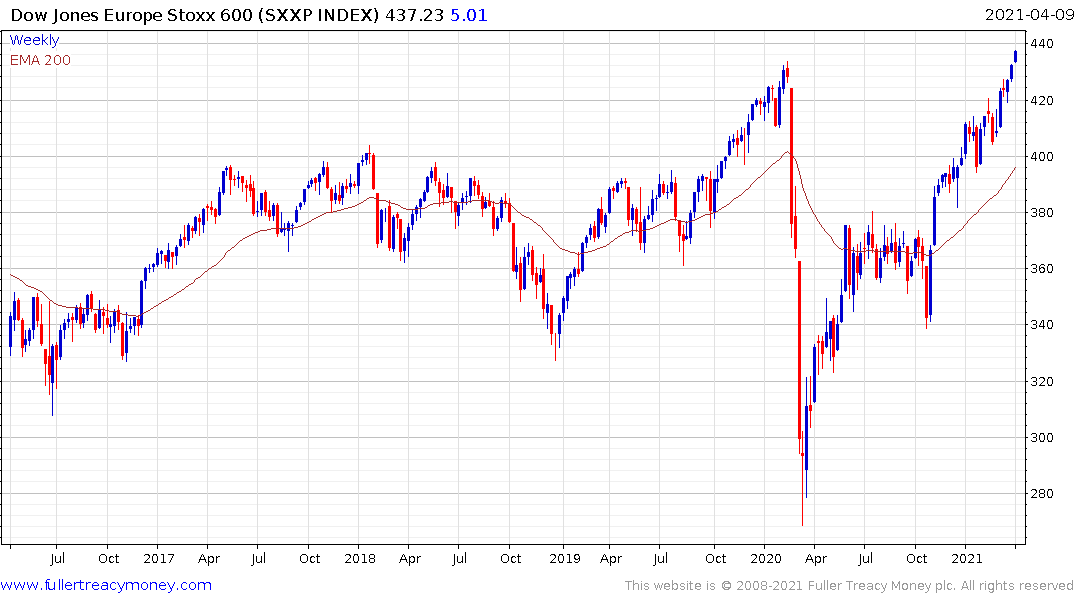

European markets are increasingly completing 21-year base formations.

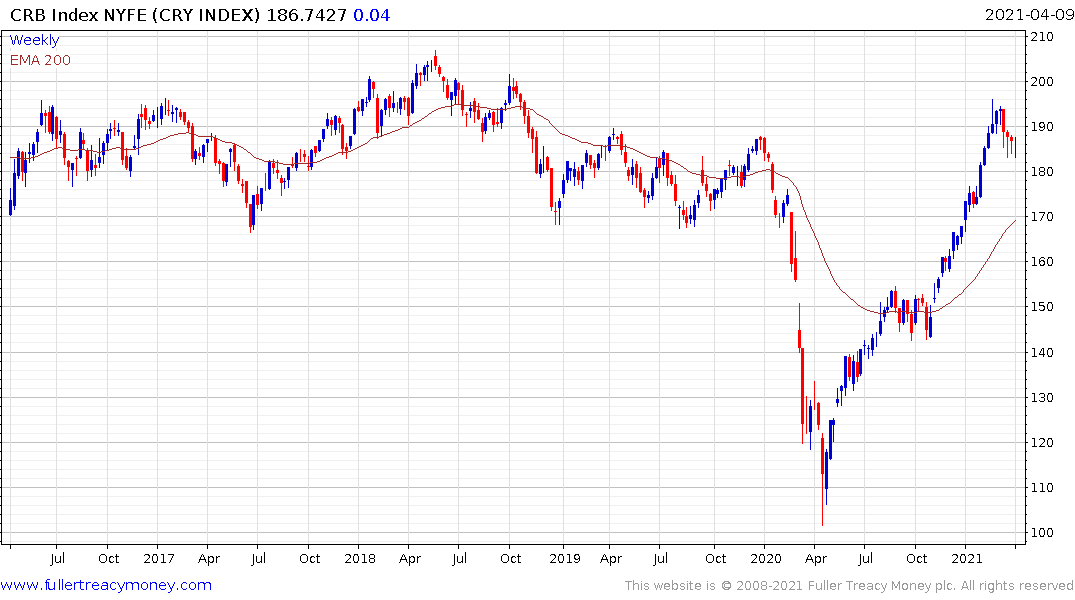

Commodity prices of all hues are also breaking on the upside.

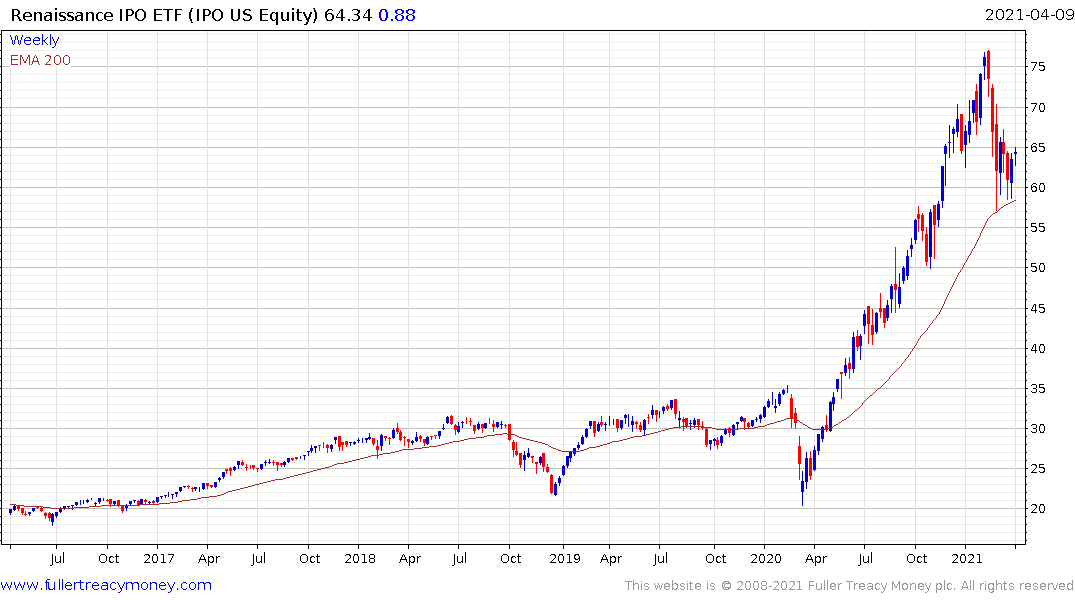

The most impatient group in the world today are the owners of privately held companies. They are seeking stock market listings at a pace not seen since the late 1990s. As David used to say the best time to sell your company is when you think you can get more for it than it is worth. It seems many companies have reached that conclusion recently. It’s particularly noteworthy because private companies eschewed the opportunity to go public following the credit crisis. They didn’t need the money. The pandemic shook up a lot of business models and now cash-in- hand probably feels more secure than further attempts to gain market share. The result is impatience to sell.

The one group that is not displaying impatience are central banks. They are in no hurry to stifle growth by raising rates. They want to foster inflation because it’s the only way to begin to erode the debt mountains. In so doing they are fuelling speculative activity in a large number of assets. With so much impatience everywhere else, sustained inflation is looking likely.

Impatience is a symptom of panicky behaviour. It is most easily observable in the markets as acceleration. That tells us risks are building and financial markets will form. That means prices are likely to surprise on the upside. Manias don’t peak because demand evaporates. They end because credit dries up and supply overwhelms demand. The time to be particularly worried about bubbles popping is when central banks finally become impatient. There are some short-term overbought conditions that appear likely to be unwound at present, but the conditions for medium-term peaks are not present.

Back to top