How are traditional Safe Haven assets performing?

Following yesterday’s disappointing start to the year and against a background of heightened geopolitical tension, weakening performance in emerging markets and fears about a paucity of earnings growth I thought it would be an interesting time to look at the performance of what have traditionally been viewed as safe haven assets.

The Yen tends to strengthen during times of stress as carry trades are unwound. The Dollar lost momentum against the Yen from late 2014 and is now trading below the 200-day MA. The weakness of the Yen was predicated on BoJ intervention but it has recently been reluctant to continue to accelerate its intervention. With the Dollar now testing the lower side of its range a clear upward dynamic will be required to signal support in this area.

While the Yen is currently firm, the Dollar is coming in a close second in terms of its predominance against other currencies. The Dollar Index is rallying back towards the upper side of a yearlong consolidation having found support in the region of the 200-day MA from mid-December. This is a bullish looking chart and a sustained move below the trend mean would be required to question medium-term Dollar dominance.

German Bund yields hit an important low in April before staging an impressive rally but have since been ranging with a downward bias. A sustained move above 0.70% will be required to question potential for continued lower to lateral ranging.

Gold has been on the side lines for what feels like a long time but is no longer deteriorating in response to the strength of the Dollar and has in fact been performing admirably when redenominated into other currencies. The US Dollar price has been ranging mostly above $1050 since early December, in what has so far been a relatively gradual process of mean reversion. It will need to sustain a move above the trend mean to signal a return to demand dominance beyond short-term scope for a reversionary rally. Nevertheless, a point we have made on numerous occasions over the years is that gold does best when it is appreciating against most currencies and this is certainly the case at present.

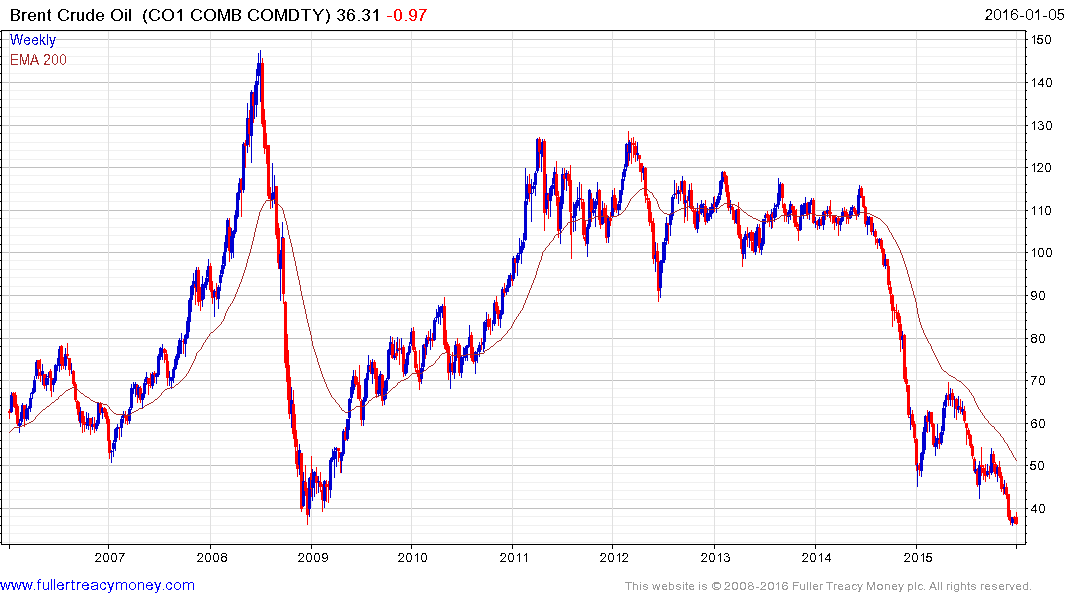

Brent Crude Oil continues to hold the $35 area which corresponds with the 2008 nadir. The continued weakness in energy pricing is reflective of North American supply gains achieved over the last decade but also geopolitical considerations where Saudi Arabia is seeking to capture market share ahead of the lifting of sanctions on Iranian supply. Low prices will encourage demand growth eventually but a change in the supply dynamics currently present will be required to signal a medium-term low. Therefore while oil is not considered a safe haven asset at present it has the potential to act as a barometer of geopolitical stress if relations between Saudi Arabia and Iran continue to deteriorate.

Taken on aggregate the above charts help to emphasise how at least some market participants are unwinding carry trades and generally taking money off the table. Against that background some evidence that recent strength in safe haven assets is being reversed would be beneficial for those looking for a source of liquidity to generate demand for risk assets amid developing short-term oversold conditions.

Back to top