House Sales Collapse as UK Lenders Withdraw Mortgage Offers

This article from Bloomberg may be of interest to subscribers. Here is a section:

Deals for house purchases are collapsing after lenders pulled mortgage offers in response to soaring interest rates.

Smaller lenders such as Kensington, Accord Mortgages and Hodge were among those to say they were withdrawing products Tuesday. That follows the decision by Lloyds Banking Group Plc -- the UK’s biggest mortgage provider -- on Monday to halt some offers, while Virgin Money UK Plc temporarily stopped offering home loans to new customers.

Major firms weighed in later Tuesday. HSBC Holdings Plc told brokers it was removing new mortgage products for the rest of the day while Nationwide Building Society announced that it was increasing rates across product ranges starting Wednesday. Banco Santander SA said it was removing some products and increasing rates on many others.

Jessica Anderson, a 33-year-old who works in publishing, was set to buy a house in Walthamstow, east London, with her husband until the seller pulled out last week.

“We’re in an uncertain position where we’re not sure whether it still stands,” she said, regarding the couple’s mortgage offer. “Since the approval there have been two interest rate increases.”

The UK housing market is at a significant point of peril because of interest rate uncertainty. Fixed rate loans typically trade at a 100-basis point premium over the 5-year government yield. At present that implies a mortgage rate of 5.7%.

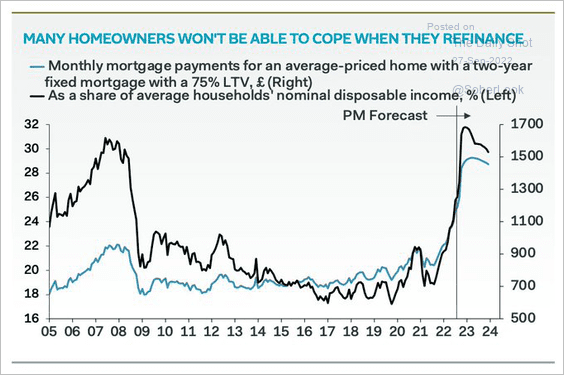

This calculation from Pantheon Macroeconomics may be of interest:

This calculation from Pantheon Macroeconomics may be of interest:

If mortgage rates rise to 6%-as implied by markets’ current expectations for Bank Rate-the average household refinancing a 2yr fixed rate mortgage in the first half of 2023 will see monthly repayments jump to £1,490, from £863. Many simply won’t be able to afford this …

The government is in a very difficult position. The UK economy does not have significant buffers against external shock. The City is a dominant force in the economy so financial issues can quickly cause problems. The UK is an energy importer with no significant storage facilities for natural gas. As an island nation interest rates tend to be higher to begin with.

Jacob Rees Mogg is talking about drilling every drop. That’s laudable in the short term but the UK needs a long-term solution to reliance on imports. That’s nuclear. Plans to build small modular reactors will need to be greatly accelerated. Wind turbine, geothermal and the coal will all play a part.

Shell remains steady in the region of the trend mean.

Shell remains steady in the region of the trend mean.

The Pound has often been a pressure release valve for the UK economy and that is still the case. The rebound from the historic low yesterday saw no follow through on the upside today.

The Pound has often been a pressure release valve for the UK economy and that is still the case. The rebound from the historic low yesterday saw no follow through on the upside today.

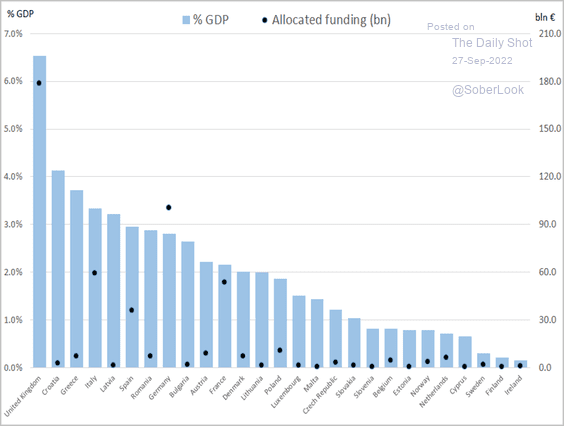

The Bank of England cannot correct the inflation issue on its own. The measures announced by the government to date are equivalent to 6.5% of GDP. Price controls are the only viable options because stimulating the economy when inflation is already running riot is more likely to make matters worse. When compared with the Labour party’s plan to nationalize energy companies price controls don’t look so bad.

The Bank of England cannot correct the inflation issue on its own. The measures announced by the government to date are equivalent to 6.5% of GDP. Price controls are the only viable options because stimulating the economy when inflation is already running riot is more likely to make matters worse. When compared with the Labour party’s plan to nationalize energy companies price controls don’t look so bad.