Harvey Recharges Offshore as Crippled Houston Counts the Cost

This article by Joe Carroll and Thomas Black for Bloomberg may be of interest to subscribers. Here is a section:

Gasoline futures in New York extended gains a sixth session Tuesday as more than a million barrels of fuel-making capacity was knocked offline; and natural-gas fields and offshore-drilling rigs shut down. The motor fuel advanced 0.4 percent to $1.7183 a gallon at 5:09 a.m. New York time.

Ports along a 250-mile stretch of Texas coast were closed to tankers. Twenty-two vessels laden with a combined 15.3 million barrels of crude from as far afield as Brazil and Colombia were drifting off the coastline, waiting for the all clear.

Ten of the state’s 25 refineries are shut down, accounting for about half the 6 million barrels per day of capacity, said Christi Craddick, chairman of the three-member Texas Railroad Commission, which regulates the industry. Companies will have to wait for floods to recede before they can evaluate damage, she said.

“Hopefully within the next week to two weeks, we’ll see refineries back online,” Craddick said.

Hurricane Katrina resulted in a surge in natural gas prices because so much supply depended on Gulf of Mexico platforms. The rise of onshore shale supplies has reduced reliance on offshore gas so hurricane Harvey has had little impact on gas prices. On the other hand, gasoline refining is heavily concentrated on the Gulf coast and not least around Houston. Therefore, it is the commodity most likely to be affected by hurricane induced damage.

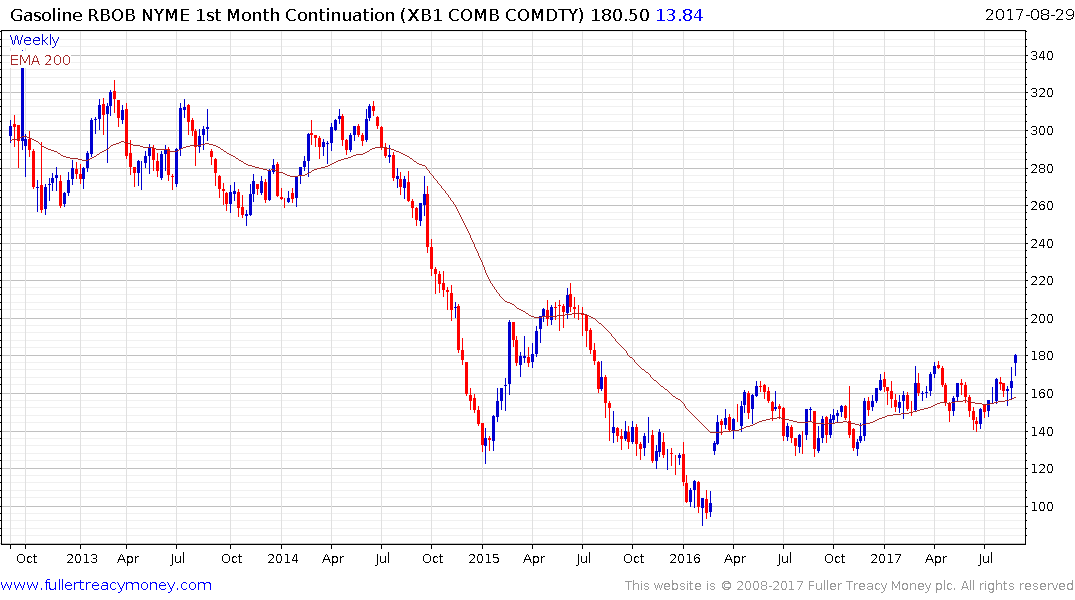

Gasoline has been ranging mostly below $175 since late 2015 and is now testing that level once more. The flow between contango and backwardation in gasoline is highly cyclical but the current situation has resulted in a wide backwardation between the September and October contracts.

A sustained break above $175 would confirm a return to demand dominance beyond the current range.

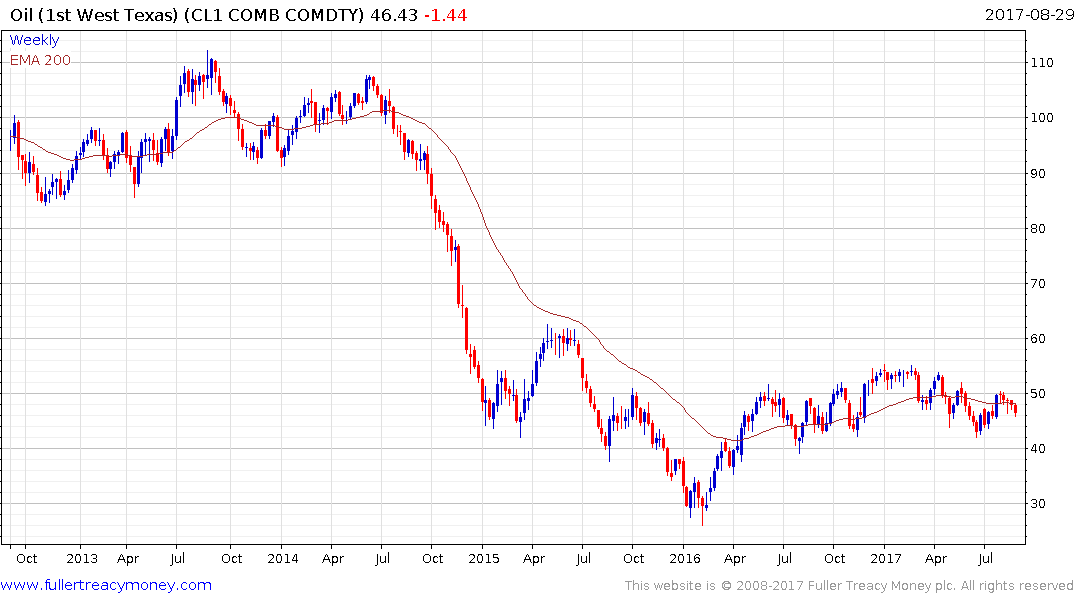

Meanwhile West Texas Intermediate Crude Oil has dropped back from the $50 area to continue to hold this year’s progression of lower rally highs. A sustained move above that level would be required to question the continued lower to lateral bias to trading.