Gold Gains as Investors Weigh Growth Concerns; Palladium Jumps

This article from Bloomberg may be of interest to subscribers. Here is a section:

“We are finally starting to see some weakness in the US dollar index, as gold bounces off an oversold level, recovering above $1,700 for now,” said John Feeney, business development manager at Sydney-based bullion dealer Guardian Gold Australia. “We now expect this initial flight to the US dollar to start rotating back into gold as investors search for a true and reliable hedge against inflation.”

The Federal Reserve’s willingness to increase rates has been the standout event this year. Their attempts to regain investor confidence following the failure to anticipate sticky inflation has resulted in a rare confluence of weak bond, stock and commodity markets at the same time. That has played havoc with returns for institutional investors.

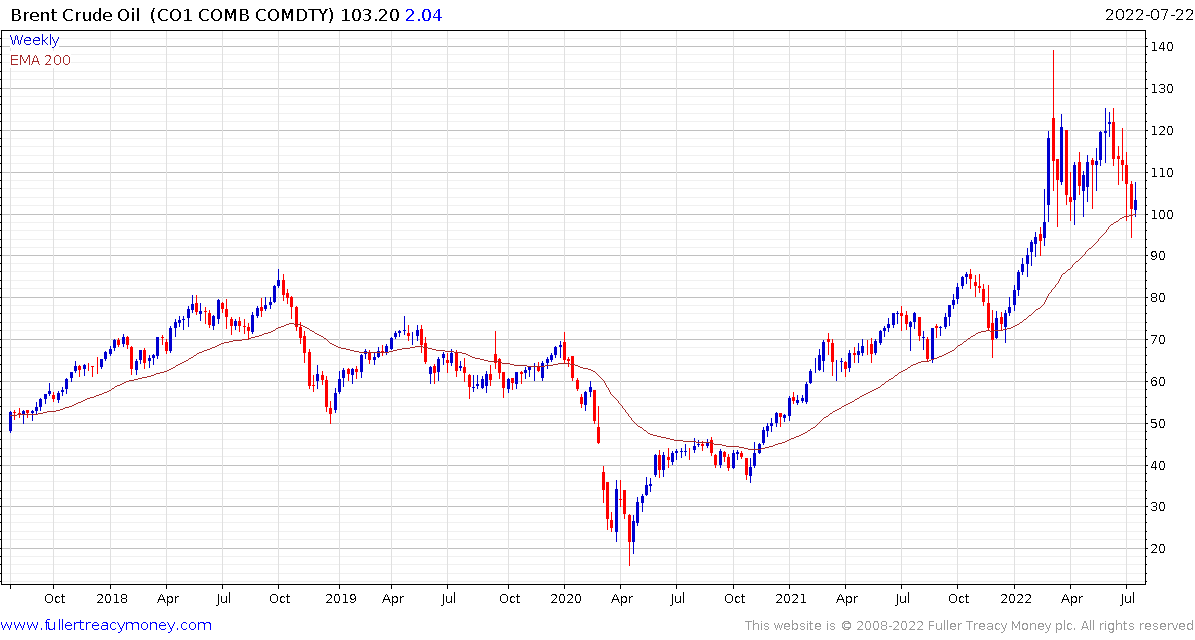

The Dollar and crude oil have been two of the strongest assets this year. The Dollar because of the widening interest rate differential and most particularly because tightening global liquidity creates a serious issue for any foreign country or company with dollar debt. The oil price has surged because of the difficulty in replacing Russia’s barrels when the ESG movement has successfully made investments in the sector a nonstarter.

.png)

Gold initially held out reasonably well but the strength of the Dollar and weakness in portfolios weighed. It eventually gave way and the price declined back to test the lower side of the range and the 1000-day MA near $1700.

The Dollar’s advance has paused against the Euro because the ECB is finally beginning to play catch up by raising rates and US corporate activity is turning decidedly mixed. Gold rebounded with an upside key day reversal on Thursday and improved on that performance on Friday. That suggests a low of at least near-term significance.

Back to top