Germany Tightens Control Over Industry With Russian Oil Grab

This article from Bloomberg may be of interest to subscribers. Here is a section:

Germany seized the local unit of Russian oil major Rosneft PJSC as Berlin moves to take sweeping control of its energy industry, secure supplies and sever decades of deep dependence on Moscow for fuel.

Alongside its move for the Rosneft unit, Chancellor Olaf Scholz’s administration is in advanced talks to take over Uniper SE and two other major gas importers, Bloomberg reported on Thursday. Germany is pressing ahead with an historic overhaul of its economy just two and half years after the Covid-19 pandemic, grabbing control over a huge chunk of its industrial base to prevent shortages and blackouts this winter.

A decision on the next moves could come within days. The need for action is urgent with Uniper losing 100 million euros ($99.7 million) a day as it tries to replace Russian gas to maintain deliveries to local utilities and manufacturers.

Germany took over all of the landesbanks during the Eurozone’s sovereign wealth crisis. Shorting individual stocks is frowned upon, with several bans being introduced over the last decade. The state has also waded into the market for failing companies, like Wirecard, and banned naked shorting. Therefore, it is not such a logical leap to think Germany will have fully nationalised the domestic gas industry within the year.

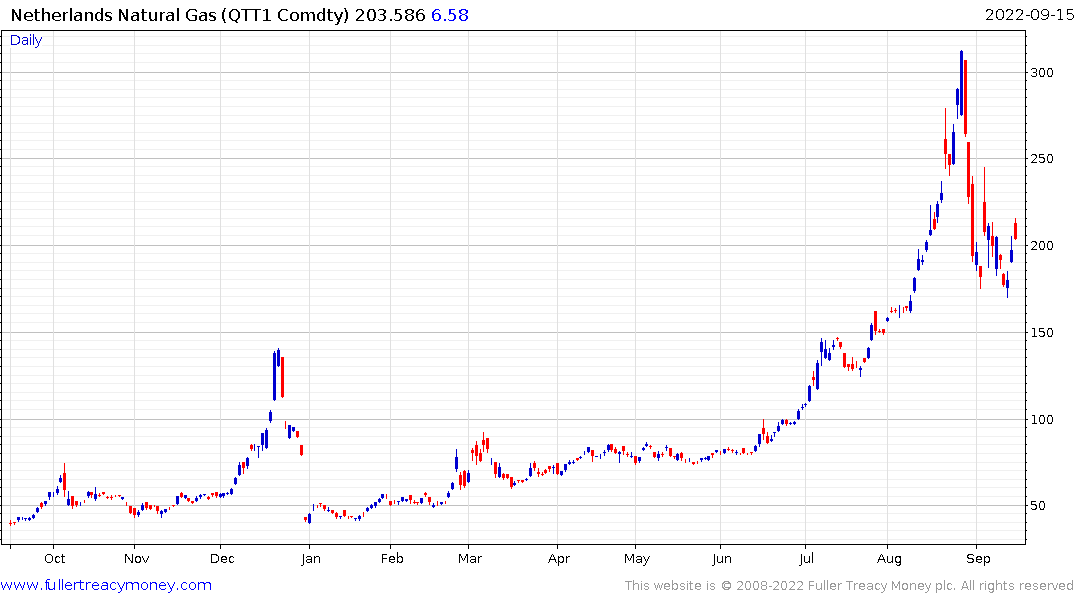

Volkswagen sold its 2.6 terrawatt-hour natural gas hedge recently. That fills a hole in demand and is quite possibly the reason Dutch benchmark prices have rolled over since the August peak. The internal trading desk should be very proud of themselves.

The fact Volkswagen has delayed plans to use the gas in manufacturing and will instead stick with coal raises an important issue for European planners. The price of carbon found support this week at the lower side of the range. By eschewed reliance on natural gas, companies are volunteering to manage costs by choosing the lesser evil of paying for carbon credits.

Meanwhile E.ON is partnering with Nikola to develop a hydrogen fuel network for Germany. E.ON continues to distribute at the lower side of its range.

Nikola has been plagued with controversy following inaccurate claims about the prowess of its electric pickup. The share continues to trend lower. The performance of both these shares suggests trend is not attracting the interest of investors worried about the near-term availability of energy.

Nikola has been plagued with controversy following inaccurate claims about the prowess of its electric pickup. The share continues to trend lower. The performance of both these shares suggests trend is not attracting the interest of investors worried about the near-term availability of energy.