Fintech reloaded Traditional banks as digital ecosystems

Thanks to a subscriber for this report from Deutsche Bank which may be of interest to subscribers. Here is a section:

Isolated solutions are often only implemented in a fragmented fashion from division to division. Innovation processes are still being driven forward laboriously using an outdated silo approach. Furthermore, many banks' command of the global “language of the internet” is still deficient. The banks will not achieve resounding success using such methods. Digital change requires far-reaching structural reforms that extend beyond all internal and external bank processes and systems.

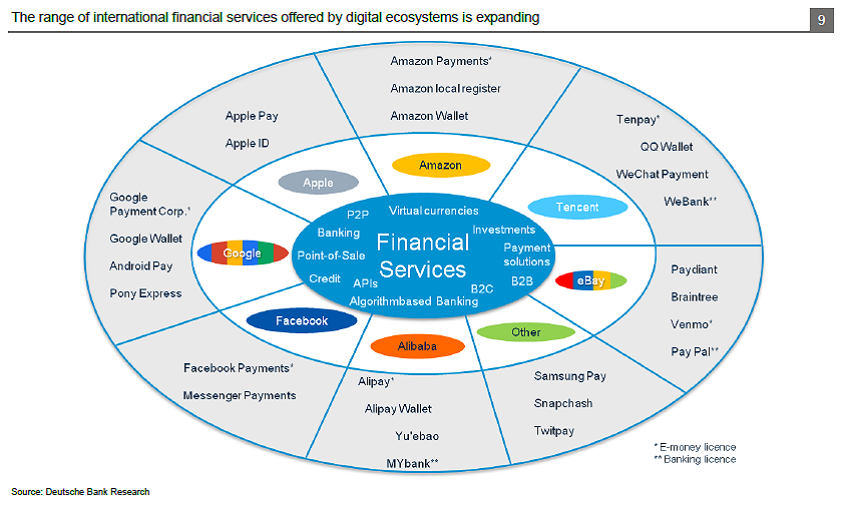

The new market players from the non-bank sector, by contrast, have an almost perfect understanding of the language of the internet. First and foremost it is the scarcely regulated digital ecosystems, but there are also many fintechs that are using their platforms and ingenious “walled garden” strategies to dominate markets across a range of sectors. Their recipe for success is based on the harmonious interplay between implemented hardware and software. Via the optimum interlinking and utilisation of compatible and interoperable standards/technologies we – the platform-spoiled consumers – are courted with attractive products and services conveniently, globally and from a single source.

?Traditional banks could do this, too, however. This now provides the opportunity to swiftly learn and adopt the strengths and particularly the monetarisation strategies (walled gardens) of the successful digital ecosystems.

There are many benefits to be gained by banks that transform themselves into platform-based, digital banking ecosystems. Apart from easy access to numerous personalised products and services, including those of external providers, as well as a more secure IT environment, the customer can also make interactive contributions on the financial platform in a variety of useful networks. Furthermore, the banking ecosystem offers a flexible corporate architecture that will in future enable as-yet-unimagined technologies to be docked onto one's own infrastructure in a timely fashion and at an acceptable cost.

Here is a link to the full report.

Fintech (finance technology) is rapidly advancing as the evolution of the block chain, demand for enhanced online services and the economies of scale represented by services delivered online coalesce to drive the sector’s growth.

From the perspective of what are classically considered technology companies, the buildout of financial arms represents an additional anchor to keep someone within their specific ecosystem. An Apple customer often continues to buy Apple products because of the cost of replacing all of the different apps and transferring photos, music etc. make it too much trouble to switch. The logical conclusion is that companies wish to ensure their customers remain within their sphere of influence and therefore offer more products with increased profit potential.

Just about all the companies in the above graphic pulled back today and will need to find support in the region of their respective trend means if the benefit of the doubt is to be given to the medium-term upside.