Even in Canada, booming U.S. petroleum elbowing out Alberta producers

Thanks to a subscriber for this article by Jeff Lewis for Financial Post which may be of interest. Here is a section:

Even in Canada, booming U.S. petroleum elbowing out Alberta producers – Thanks to a subscriber for this article by Jeff Lewis for Financial Post which may be of interest. Here is a section:

So much low-cost gas is expected to flow from the Marcellus in the northeast part of the U.S. , for example, that Nova is in “serious” talks to develop a second pipeline into the region, Mr. Thomson said. Access to U.S. feedstock is “going to be key” in deciding whether to build a second production unit for making high-end polyethylene products at its Sarnia plant, he said.

In the Quebec town of Bécancour, IFFCO Canada Enterprise Ltd. aims to start construction on a $1.6-billion fertilizer plant by spring next year. But the company, majority owned by a unit of India’s largest fertilizer manufacturer and distributor, has warned the project’s future hinges on timely access to low-cost gas, including through the Dawn trading hub in southwestern Ontario, one of the entry points for U.S. gas into Canada.

“At the moment Dawn is the cheaper alternative than Western Canada. I don’t think this is a surprise,” said Simon Pillarella, vice-president, corporate affairs with IFFCO Canada.

?“It’s not only us who’s looking for this sort of option,” he added. “Most clients in Eastern Canada are looking for the cheapest way to supply their gas.”

The boom in the USA’s production of crude oil, natural gas and various by-products can’t but displace more distant suppliers. The evolution of North American unconventional extraction methods continues to represent a game changer for the energy sector which is having a significant effect on capital investment decisions across the chemical, fertiliser, industrial, refining, pipeline and transportation sectors which in no small part has contributed to the USA’s recovery. .

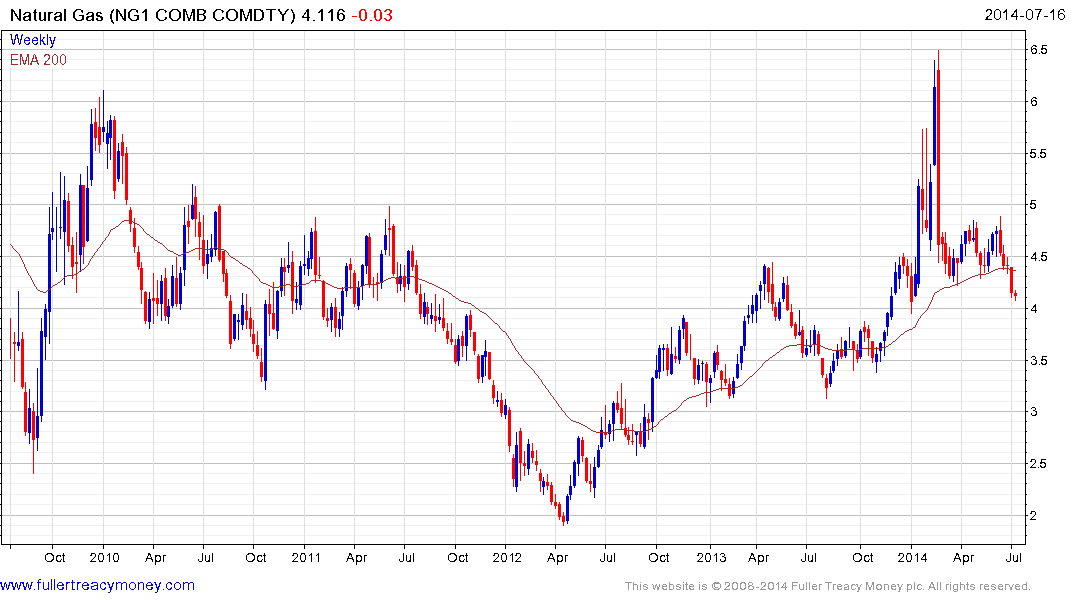

$4 is a psychological and economic Rubicon for natural gas prices not least because it represents the breakeven point for a considerable quantity of unconventional supply. Prices experienced downward pressure recently falling from just below $5 to test the $4 area and have stabilised this week. This represents a previous area of support and a clear upward dynamic would confirm the return of demand.

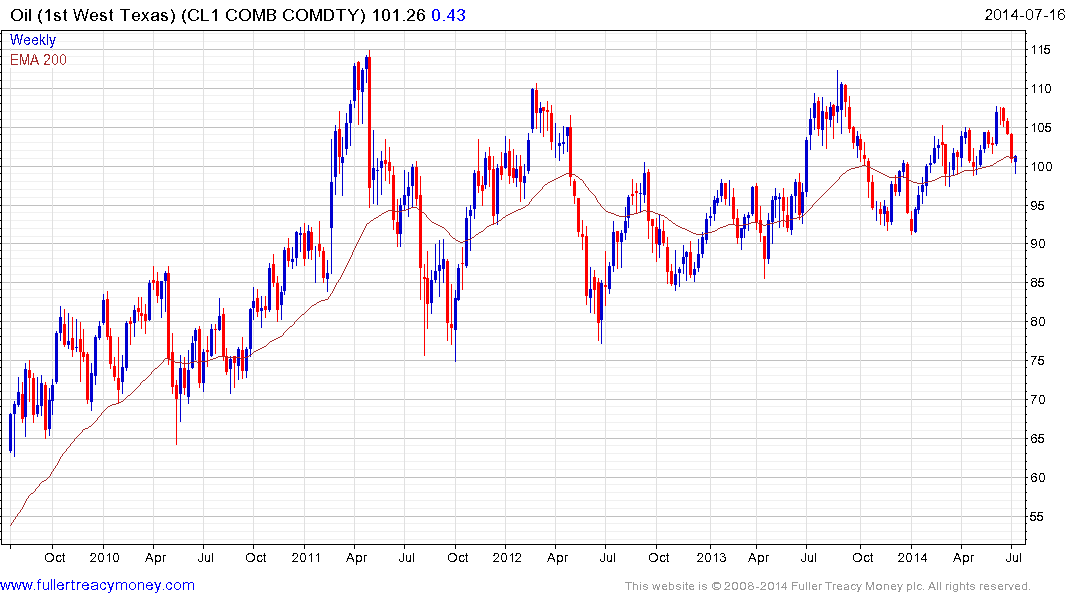

West Texas Intermediate Crude Oil paused yesterday in the region of $100 and potential for an unwind of the short-term oversold condition has increased. It will need to continue to hold the $99 area if this year’s progression of higher reaction lows is to remain intact.

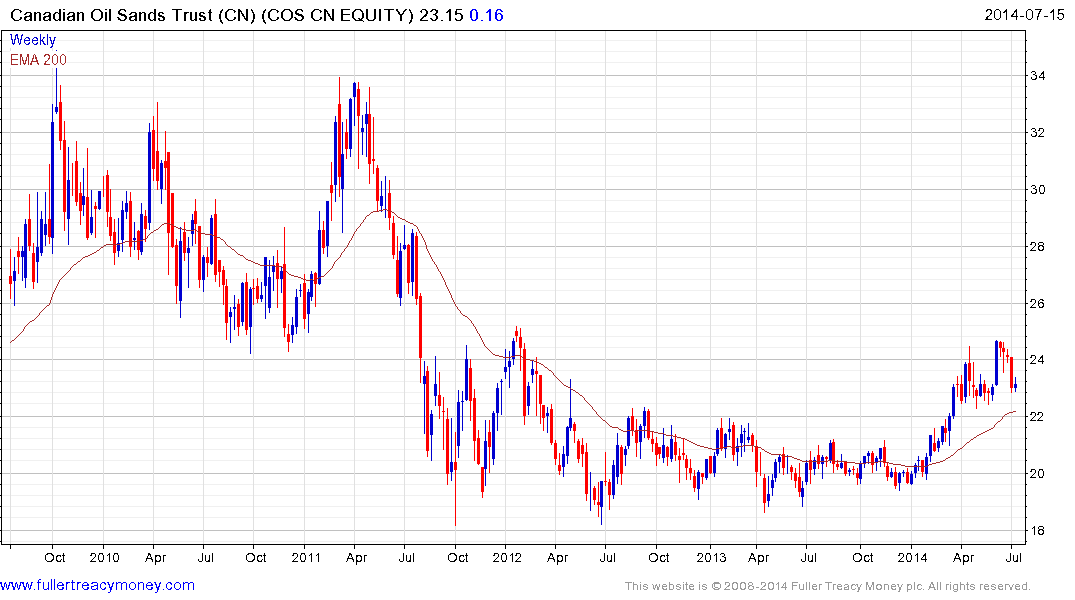

Canadian Oil Sands Trust completed a two-year base in March and continues to form a first step above it. It has returned to test the region of the 200-day MA and a sustained move below C$22 would be required to question medium-term recovery potential.

Back to top