EU Moves Toward Zero-Emissions Cars After German Deal on E-Fuels

This article from Bloomberg may be of interest to subscribers. Here is a section:

E-fuels, made using renewable energy and carbon dioxide captured from the air, aren’t seen as a viable solution for the vast majority of cars, given their high cost and current lack of availability. Instead, the bulk of carmakers in the region are expected to remain focused on battery-powered vehicles.

“We see e-fuels as a useful addition to the existing fleet of combustion engines and for special applications such as emergency vehicles or limited series, the Porsche 911 for example,” Volkswagen said in a statement. Europe’s biggest carmaker said that it remained committed to the electrification

of its fleet.

The deal, announced on Saturday, was enough for Germany to drop its opposition to the proposal. A push by the country’s pro-business FDP party, the junior member of Chancellor Olaf Scholz’s governing alliance, for the commission to come forward with more assurances on e-fuel cars had delayed a vote earlier this month.

2035 is little more than a decade from now and that is a short period of time to completely remake the industrial infrastructure of the European heartland. High performance sports cars are a niche business and e-fuels are unlikely to gain significant market share without a major breakthrough in production costs or a significant rise in energy prices more generally which would also improve competitiveness.

The clear upshot of this agreement is to further disincentivize investments in oil and gas production or processing. The contrast between French strikes, which have curtailed refinery production for the last month and Saudi Aramco’s largest foreign investment, spending $3.6 billion on a Chinese refiner is particularly poignant. The message is clear Europe is only likely to become more hostile to fossil fuels.

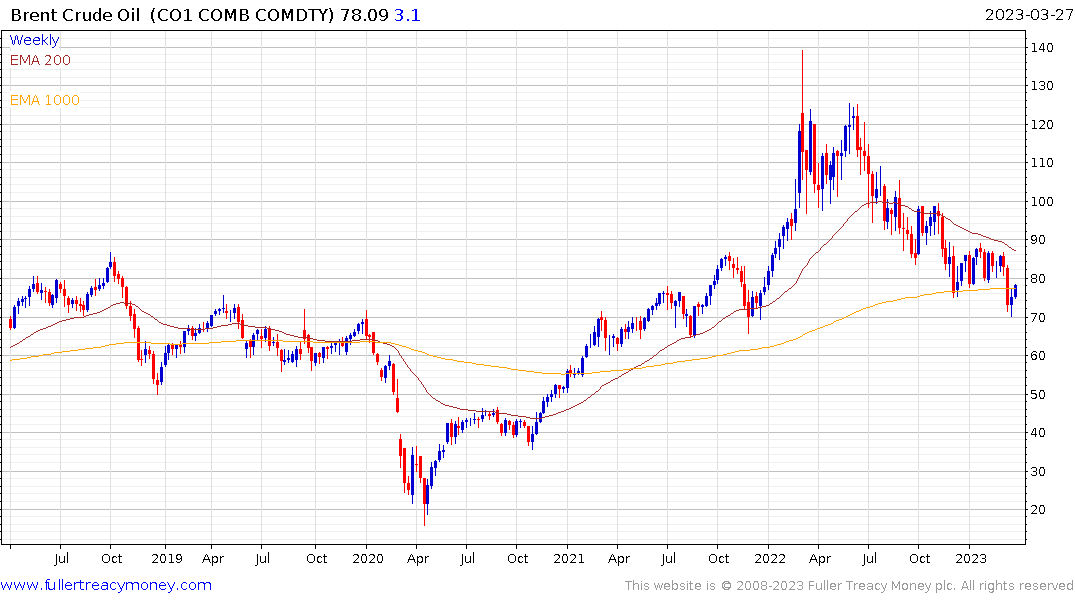

Crude oil extended the rebound that began on Friday afternoon with Brent approaching the psychological $80 level.

Crude oil extended the rebound that began on Friday afternoon with Brent approaching the psychological $80 level.

The electrical grid will need to be both expanded, upgraded and backed up with reserve power as a minimum requirement to approximate the carbon emission reduction goal. Terna - Rete Elettrica Nazionale SpA has the most consistent uptrend of the European grid operators.

The electrical grid will need to be both expanded, upgraded and backed up with reserve power as a minimum requirement to approximate the carbon emission reduction goal. Terna - Rete Elettrica Nazionale SpA has the most consistent uptrend of the European grid operators.

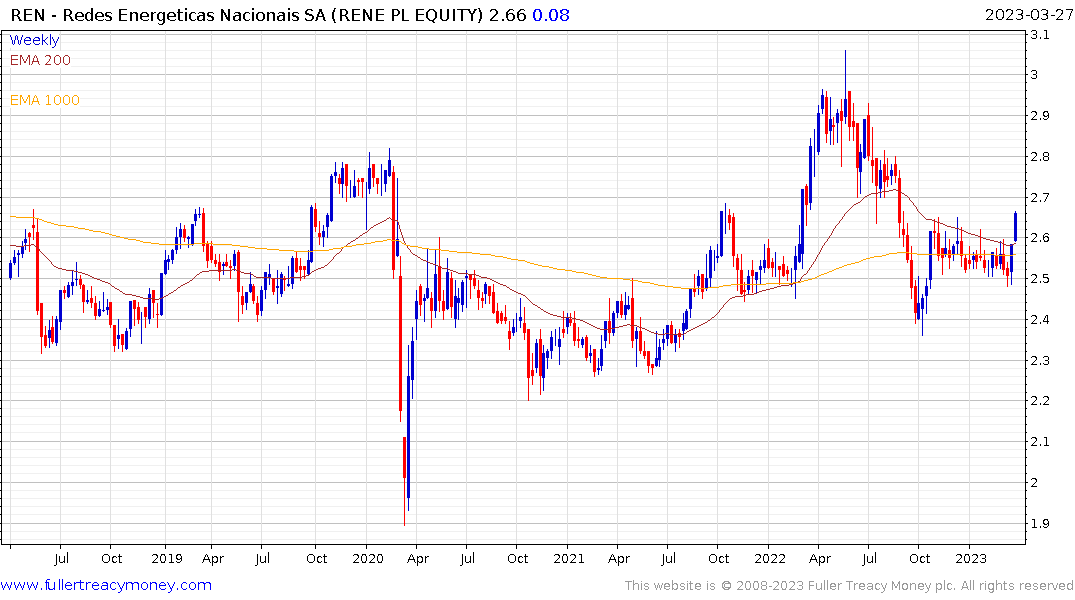

Portugal’s Redes Energeticas Nacionais SGPS SA firmed today within a long-term range.

Portugal’s Redes Energeticas Nacionais SGPS SA firmed today within a long-term range.

Sasol has historically been the largest producer of synthetic fuels, with coal as the primary feedstock. The share remains in a medium-term downtrend.

Sasol has historically been the largest producer of synthetic fuels, with coal as the primary feedstock. The share remains in a medium-term downtrend.

LyondellBasell Industries has been ranging since 2014 and is currently firming from the midpoint of this congestion area.

LyondellBasell Industries has been ranging since 2014 and is currently firming from the midpoint of this congestion area.