EU Gas, Power Tumble After Russian Signals to Add More Fuel

This article from Bloomberg may be of interest to subscribers. Here is a section:

It’s the latest intervention in the market from Putin to talk down gas prices, even as some European officials suspect he’s been holding back supply to pressure Europe into approving Nord Stream 2, the controversial new pipeline linking Russia to Germany. Russia is also concerned that excessively high prices could destroy demand, and would like to see them fall by about 60%, according to people familiar with the situation.

Higher Norwegian gas flows and a drop in Chinese coal prices are also putting downward pressure on prices, Engie EnergyScan said in a note. Norway’s Equinor ASA promised Wednesday to boost exports. Maintenance at its giant Troll field in December will be shorter than previously planned, system operator Gassco said Thursday, also a bearish factor.

Tom Marzec-Manser, an analyst at pricing agency ICIS, said the timing of Putin’s comments on adding fuel to Gazprom’s storage sites in Germany and Austria could be connected to Germany’s Economy Ministry saying on Tuesday that certification of Nord Stream 2 wouldn’t pose any risks to security of supply.

UK natural gas futures extended their pullback on the above news. That further supports the view that a peak of medium-term significance has been reached. The bigger question is how much prices will fall as the bottlenecks ease? Generally speaking, it is unusual for commodity prices to trade back down into their base formations once breakouts occur. Significant sources of new supply would be required for that to happen.

US natural gas is also pulling back on this news since it is much more influenced by international events than it was before the advent of exports.

Norway’s Equinor rallied extremely impressively over the last year to test the 2018 peak. Today’s large downward dynamic marks a peak of potentially medium-term significance.

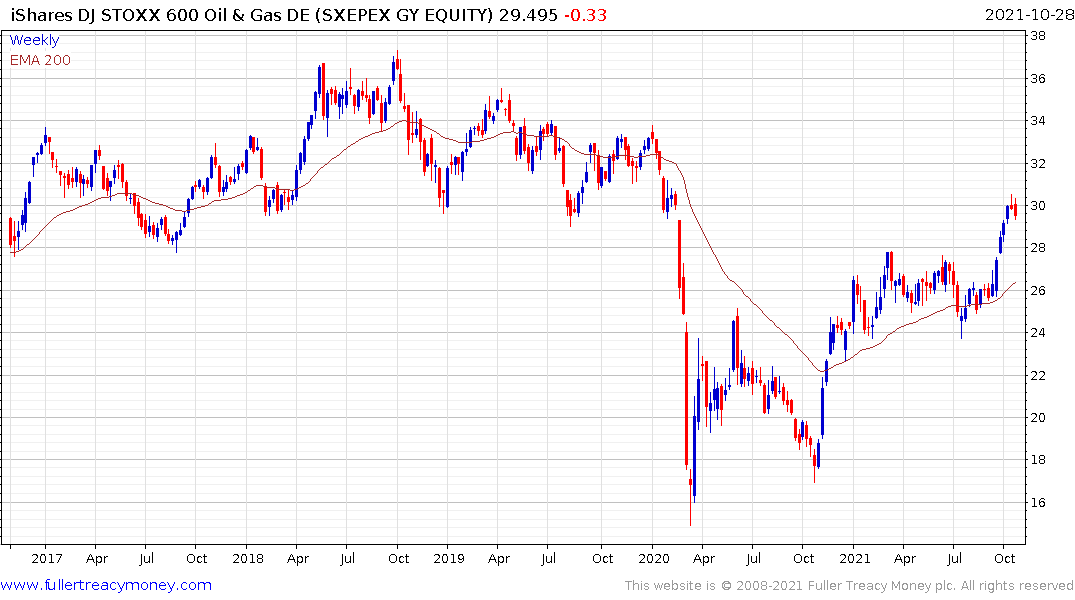

STOXX Europe 600 Oil & Gas is pausing in the region of the lower side of the overhead trading range and at least some consolidation of the short-term overbought condition appears likely.