Equinor Says EU Price Cap Unlikely to Limit Natural Gas Exports

This article from Bloomberg may be of interest to subscribers. Here is a section:

Equinor ASA, Norway’s biggest energy company, said a European Union proposal to cap natural gas prices is unlikely to dampen exports of the fuel to the region.

“The intention behind the proposed mechanism is to avoid episodes of excessively high gas prices and not to implement a permanent intervention in market mechanisms,” Equinor spokesperson Magnus Frantzen Eidsvold said in an email Wednesday. “Our immediate assessment is that this will not have substantial consequences for our exports.”

Norway is Europe’s biggest supplier of natural gas, after Russian flows were slashed following the invasion of Ukraine. Norwegian Oil and Energy Minister Terje Aasland said in October that the country expects to sell about 8% more gas this year than it did in 2021, much of it to continental Europe.

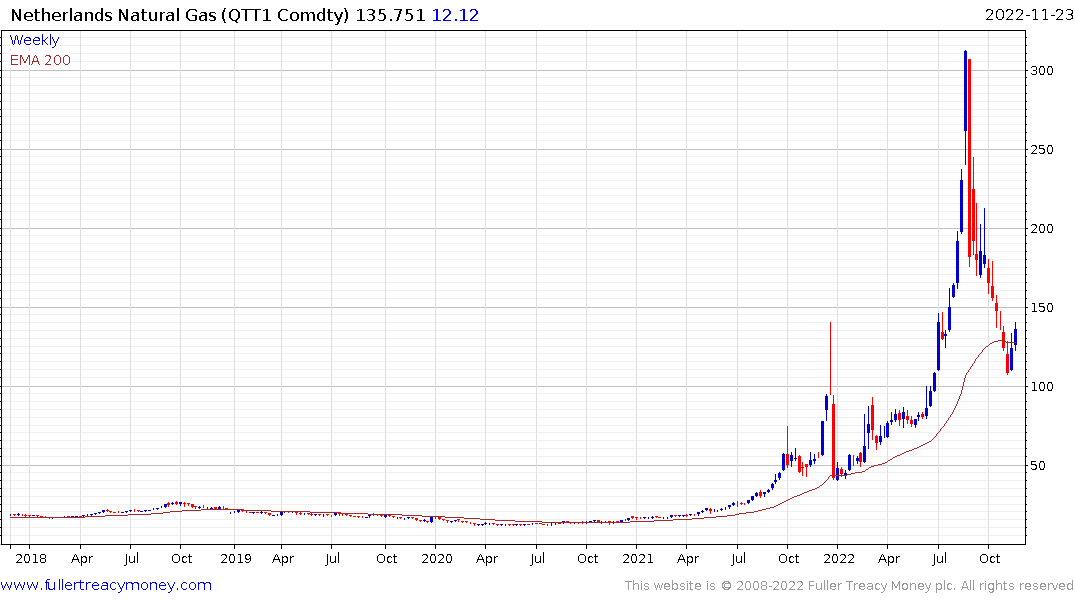

After months discussing how to prevent gas from skyrocketing again, the European Commission on Tuesday proposed an emergency brake on prices. However, the cap is only triggered when benchmark Dutch futures exceed €275 per megawatt-hour for two weeks and the gap between TTF and liquefied natural gas prices is greater than €58 for 10 trading days.

Dutch futures are currently trading at €130 which is a fraction of the peak values over €300 in August. The big question going forward is whether the price cap will be enforceable in the event of a fresh energy crisis. Additionally, the reliable suppliers like Norway would also be penalized through no fault of their own.

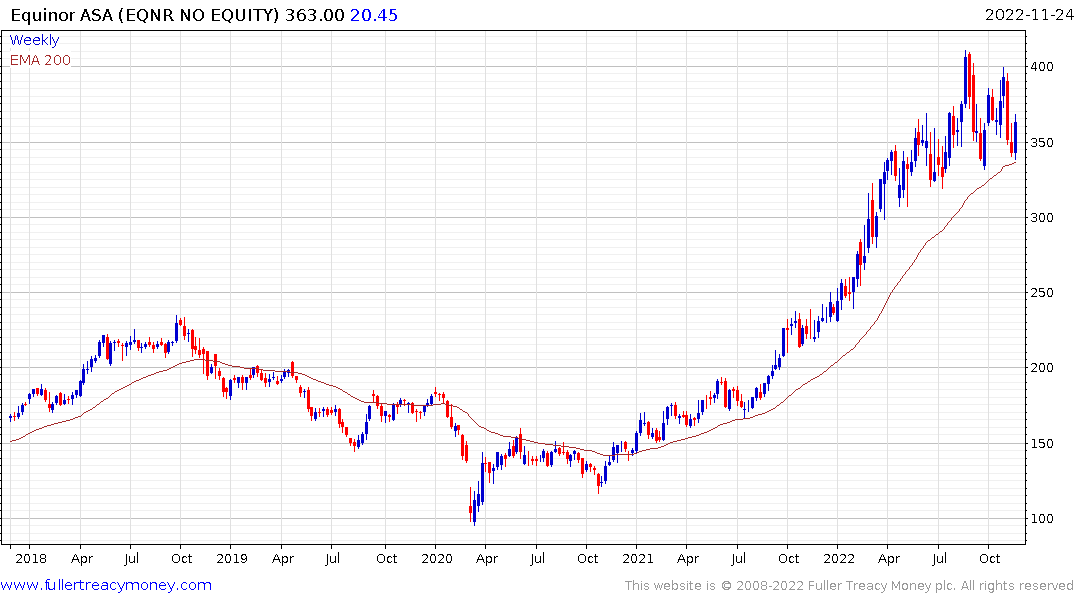

Equinor continues to hold its medium-term sequence of higher reaction lows as it bounces from the region of the trend mean.

Back to top