Eoin's personal portfolio: profit taken in commodity contract and a long opened in another

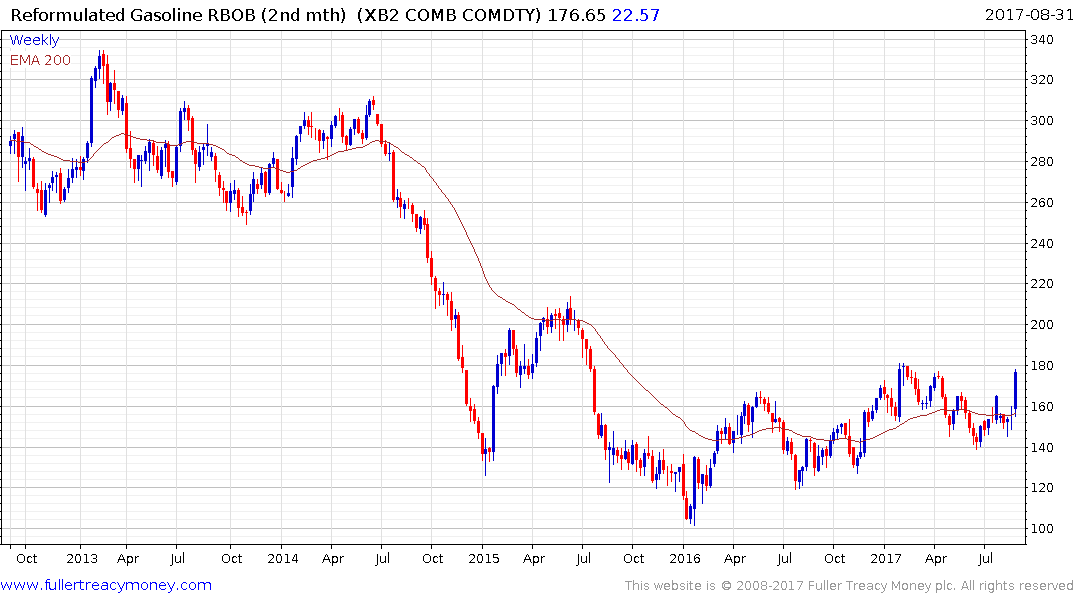

I decided to take the profit on my October gasoline position today at $172.60 against the rolled forward entry point on Tuesday at $160.20. For the reasons explained in the above piece I think the odds are now skewed towards some consolidation of recent powerful gains. The risk of course is that the price continues to move higher on the back of it taking longer to get refineries back on line.

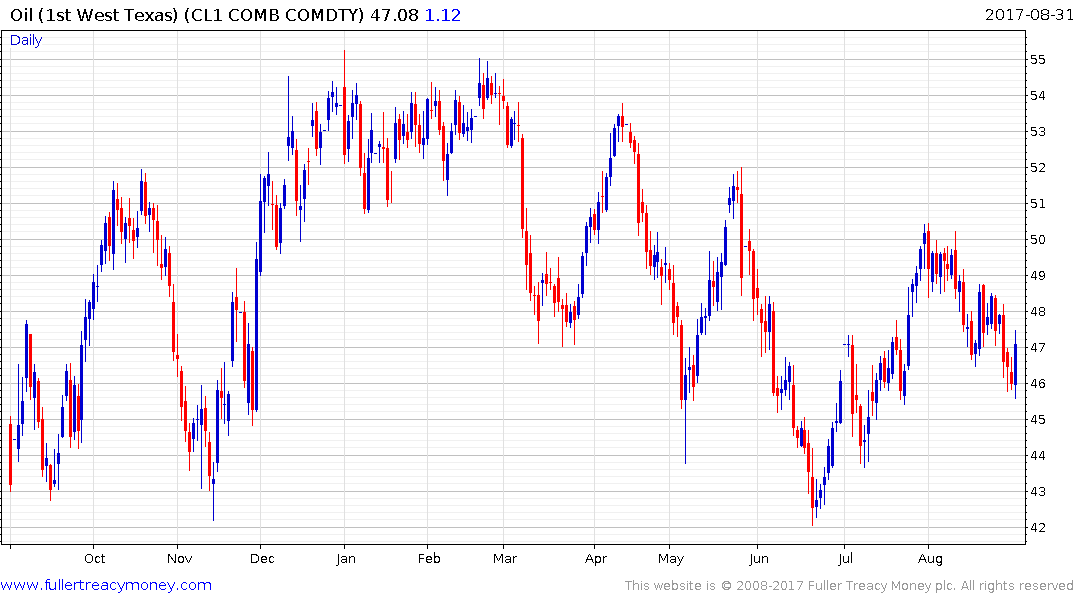

West Texas Intermediate posted an upside key day reversal today and it now has a $5 gap with Brent Crude. I suspect there is a scope for that gap to close so I bought an October contract at $47.355 including spread-bet dealing costs.

Oil prices have been subject to successive bouts of volatility this year but have held a downward bias with a progression of lower rally highs evident. The most recent high is close to $50 on West Texas Intermediate and a sustained move above that level would be required to signal a change of trend.