Energy Trading Stressed by Margin Calls of $1.5 Trillion

This article from Bloomberg may be of interest to subscribers. Here is a section:

Aside from fanning inflation, the biggest energy crisis in decades is sucking up capital to guarantee trades amid wild price swings. That’s pushing European Union officials to intervene to prevent energy markets from stalling, while governments across the region are stepping in to backstop struggling utilities. Finland has warned of a “Lehman Brothers” moment, with power companies facing sudden cash shortages.

“Liquidity support is going to be needed,” Helge Haugane, Equinor’s senior vice president for gas and power, said in an interview. The issue is focused on derivatives trading, while the physical market is functioning, he said, adding that the energy company’s estimate for $1.5 trillion to prop up so-called paper trading is “conservative.”

Many companies are finding it increasingly difficult to manage margin calls, an exchange requirement for extra collateral to guarantee trading positions when prices rise. That’s forcing utilities to secure multi-billion euro credit lines, while rising interest rates add to costs.

“This is just capital that is dead and tied up in margin calls,” Haugane said in an interview at the Gastech conference in Milan. “If the companies need to put up that much money, that means liquidity in the market dries up and this is not good for this part of the gas markets.”

The ECB is looking primed to begin hiking rates while at the same time it will also be prevailed upon to provide significant additional liquidity. This is akin to taking with one hand and giving with the other. Even that’s a stretch.

Saudi Arabia’s oil minister clearly spoke about the disconnect between the physical and paper markets for oil at the last OPEC meeting. European premia are rising because the future is currently so uncertain, and the region is particularly susceptible to a harsh winter.

EUR 2-year swap spreads are at 130 basis points. That is similar to the levels posted in 2008 and 2012. Those comparative levels should highlight just how much stress European liquidity metrics are experiencing.

EUR 2-year swap spreads are at 130 basis points. That is similar to the levels posted in 2008 and 2012. Those comparative levels should highlight just how much stress European liquidity metrics are experiencing.

Brent Crude continues to pause in the region of the lower side of its range. There is clear scope for industrial demand to come under heavy pressure in Europe so that is keeping a lid on oil prices in the near term.

Brent Crude continues to pause in the region of the lower side of its range. There is clear scope for industrial demand to come under heavy pressure in Europe so that is keeping a lid on oil prices in the near term.

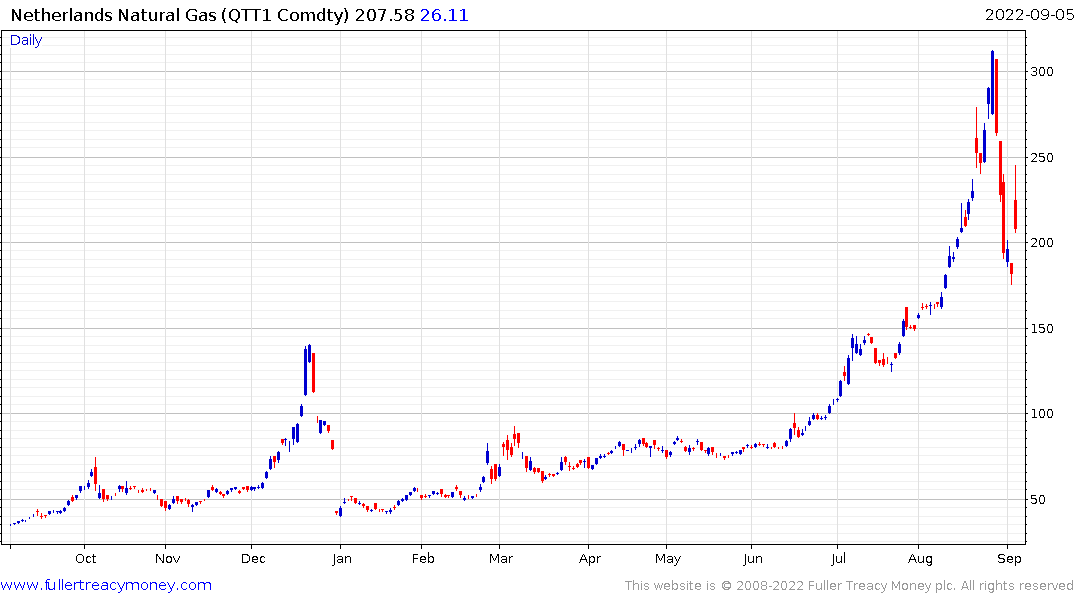

Dutch TTF gas has been yoyoing around since the encouraging news of accelerated reserve accumulation. That was thrown into doubt over the weekend when Russia confirmed supply will not be increased until the sanctions are removed. This represents at least a short-term low for the price.

Dutch TTF gas has been yoyoing around since the encouraging news of accelerated reserve accumulation. That was thrown into doubt over the weekend when Russia confirmed supply will not be increased until the sanctions are removed. This represents at least a short-term low for the price.