Energy Stat: Is "Fake News" Driving Down Oil Prices?...

Thanks to a subscriber for this report from Raymond James which takes a bullish opinion on oil prices. Here is a section:

Myth #2: U.S. shale production growth is going to flood the market at $35/bbl.

The fear of massive U.S. oil supply growth at oil “breakeven” prices of $35-40 per bbl is the other panic button that most investors (and many sell-siders) have been happy to push over the past few months. Yes, there are many U.S. horizontal (especially Permian) operators that can make solid incremental well returns at $35-40 per barrel if and only if they do not include any costs other than the drilling and completion costs of that next well. The problem with this type of analysis is twofold: 1) It is definitely not capturing the fullcycle returns where companies must include lifting, overhead, interest expenses, and other sunk costs. On a full cycle basis, very few U.S. E&P companies are actually generating positive returns at oil prices below $50/bbl, and 2) There is simply not enough cash being generated by U.S. E&P companies at oil prices below $50 to justify current drilling and completion activity and some of the U.S. supply growth forecasts that are now starting to appear. In fact, at current oil prices (of around $45/bbl) we estimate that the U.S. E&P industry as a whole will outspend cash flow generated by a whopping 50% this year! That amount of outspend is simply unsustainable and means the unfettered U.S. oil supply growth assumptions in a sub-$50 oil world are highly, highly unlikely.

We would also point out two other important points on this emerging U.S. supply growth panic. First, we have historically had one of the most aggressive (and accurate) U.S. oil supply growth models on the Street. Despite this, our global oil supply demand equation still suggests a meaningfully undersupplied oil market for the remainder of this year. In fact, if we go back to the beginning of this year (six months ago), our 2018 U.S. oil supply growth estimate of 1.3 million bpd was high on the Street and at least 500,000 bpd above consensus estimates at the time. Note that our current U.S. supply estimate is actually down about 500,000 bpd from our estimate a year and a half ago (early 2016) because of downward revisions in U.S. industry cash flows and emerging oil service equipment bottlenecks. In our opinion, forecasts of 2018 U.S. supply growth of 2.5 million bpd at oil prices below $50/bbl are simply not doing the math. Secondly, the longer-term fear of too much U.S. supply growth at $50/bbl ignores the fact that there is another~30 million bpd of OPEC and ~50 million bpd of non-OPEC supply (across a variety of geographies, both short-cycle and long-lead-time) that will likely be declining in a few years. Solely considering U.S. supply growth would be a “one hand clapping” approach: that is to say, it gives an exaggerated impression of how much global supply is actually growing. In 2017, for example, at least three significant nonOPEC producers – China, Mexico, Colombia – are posting sizable declines. Several others – Russia, Norway, Argentina – are flattish. Longer term, 2018 is shaping up to be the cyclical trough year for global long-lead-time project startups (down close to 50% versus 2016 levels) meaning non-U.S. oil supply growth will likely come under significant pressure in 2019 and beyond.

Here is a link to the full report.

How do you make waves on the international geopolitical stage when you have a non- interventionist foreign policy? The easy answer is to have a quasi-vassal state do it for you. North Korea would not exist if it was not for China or to put it another way, North Korea only exists because of China’s desire to have a ring to buffer states around its border.

I think it’s fair to say that a lot of unconventional supply becomes uneconomic around $45 but starts making money anywhere above $55 so the big question is the extent to which producers hedged their exposure when prices were north of $55 at the beginning of the year. That is likely to be key variable in whether they are making money in the current environment.

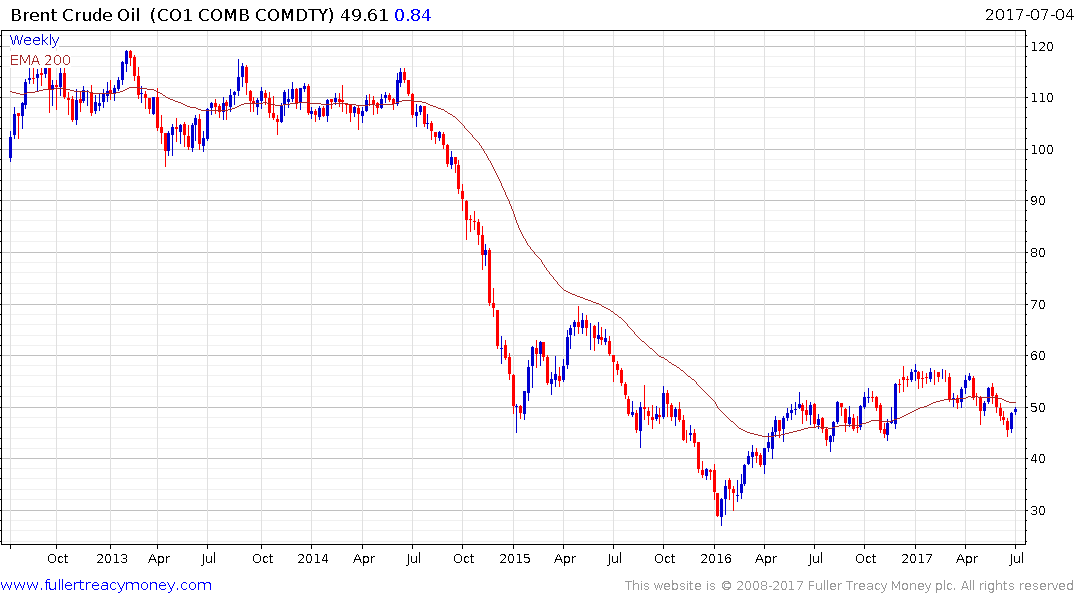

Over the last year crude oil prices have been very choppy not least because the marginal cost of production in unconventional wells has come down, and the same can be said for a number of deepwater locations, OPEC has shaved significant supply from the market while Venezuela is in the throes of civil unrest but Libya is beginning to come back on stream.

In the meantime last week’s rally broke the five consecutive weeks of declines and initiated a short covering rally which has persisted so far this week. Increasing optimism about global economic growth is one of the more bullish arguments for crude oil right not, but if the medium-term prognosis for volatile ranging is to be questioned it will need to sustained move above $55 to break the progression of lower rally highs that has prevailed so far this year.