Email of the day on Royal Dutch Shell

Hi Eoin, I love my daily read of your great service.

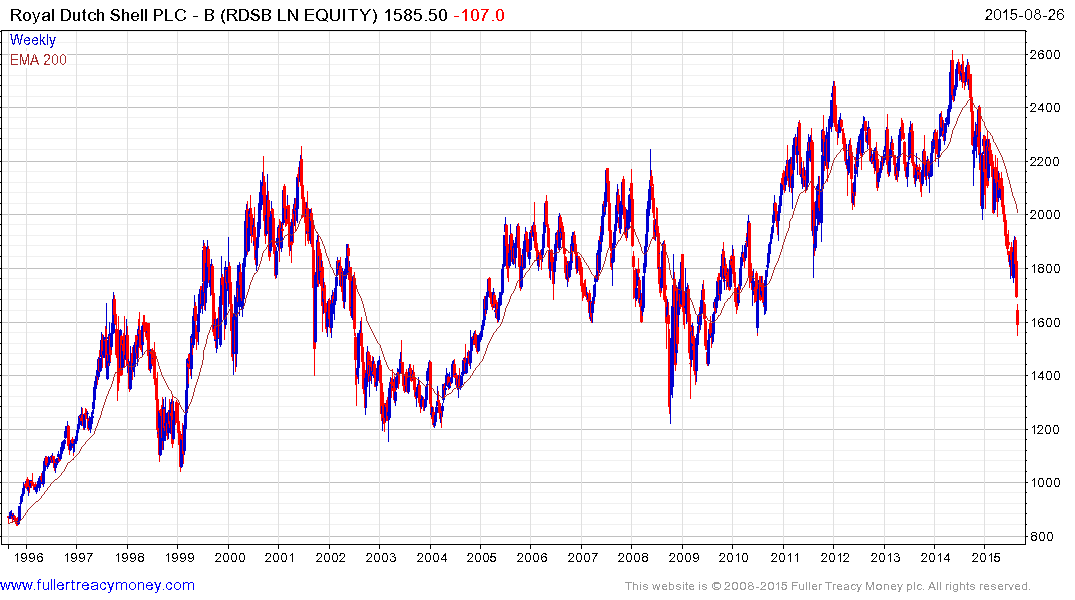

What is your opinion on Royal Dutch Shell, I am under water by about 30% not counting dividends.

Thank you for this question which is sure to be of interest to other subscribers and I’m delighted you’re enjoying the service. The steep decline in a large number of sectors, particularly energy has left a lot of people in a similar dilemma. My first thought is that with a share yielding 7.71% today it would be rash to ignore the dividend even if the yield was lower when you purchased it.

.png)

In fact concern about the ability of major energy companies to sustain their dividends in a low energy price environment has been one of the contributing factors in the decline. A great deal of supply is uneconomic below $40 so even in a highly bearish short-term environment it is debatable how long prices can stay at such depressed levels. The share is currently 26% overextended relative to the trend mean so potential for a reversionary move is looking increasingly likely but it probably requires a catalyst in the form of a firmer tone in oil prices to reverse the short-term downward bias.

Over the medium-term it is worth considering that RDS produces more gas than oil and the acquisition of British Gas represents a further emphasis on the global LNG business. Natural gas is a cheap, energy efficient, reasonably clean fuel and demand is still on a secular upward trajectory. The established energy sector is not going to be sexy for the foreseeable future so yield really will be a more relevant consideration than it was over the last decade. Over the last 20 years deteriorations similar to what the share has experienced since September has resulted in significant rallies once selling pressure has been exhausted. The company’s ability to sustain its dividend will be pivotal in the share’s ability to rally significantly from current levels.