Email of the day on paying up for commodities

Thanks again for your very calm analysis of these volatile times. I appreciate it a lot. I enjoyed very much your comments about the tendency of remembering the end of the events/experiences. There is a very good experiment on this done by Daniel Kahnemann. On a different note; you seem to be very bullish on copper, but it seems not enough to invest on that theme yet. Are you planning to invest? Otherwise, what would be a good instrument to invest for the medium/long term on that theme. Thanks in advance

Thank you for this email which may be of interest to subscribers. I have been conditioned through the decades to refuse to pay up for commodities. It’s a volatile sector that tends to have outsized moves in both directions. I am very bullish on industrial commodities overall and copper in particular.

Seeing outsized new sources of demand emerge for a commodity is a once in a couple of decades event. It will require a massive supply response to bring the market back into equilibrium. At present commodities are rallying because investors are pricing in an epic rebound in economic activity as fear about the pandemic subsides and people embrace fun and joie de vivre.

In tandem, the migration to more electric vehicles, with whatever battery chemistry, will require more copper, nickel, lithium and cobalt. These markets are where the secular bull market hypothesis is most credible. I expect to be buying significant dips in these commodities for years to come.

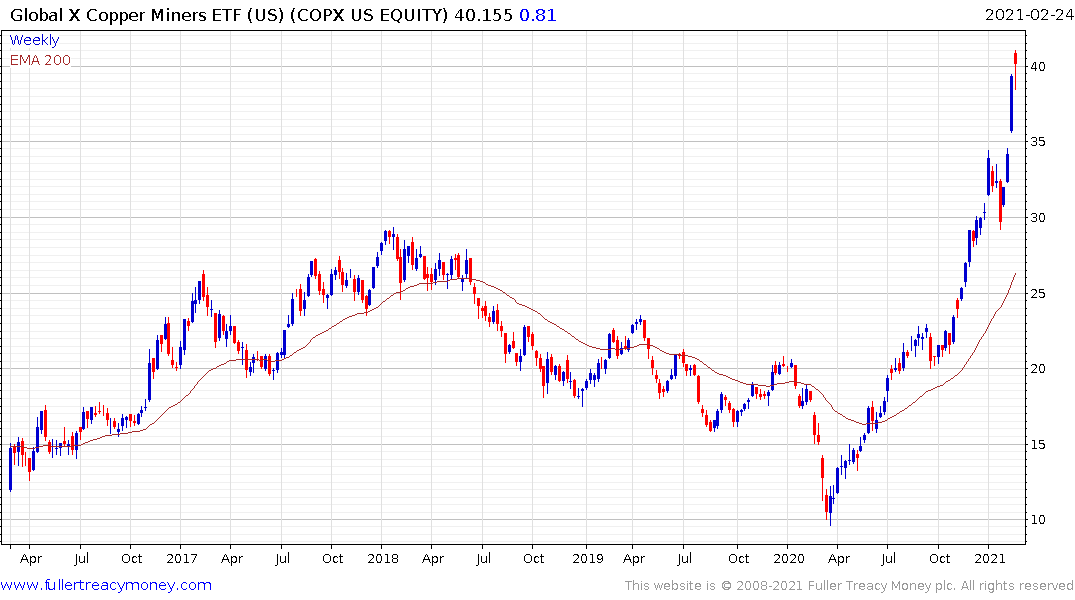

The easiest way to play it is via an ETF. The Copper Miners ETF (COPX) has completed a multi-year base formation but is overextended in the short term.

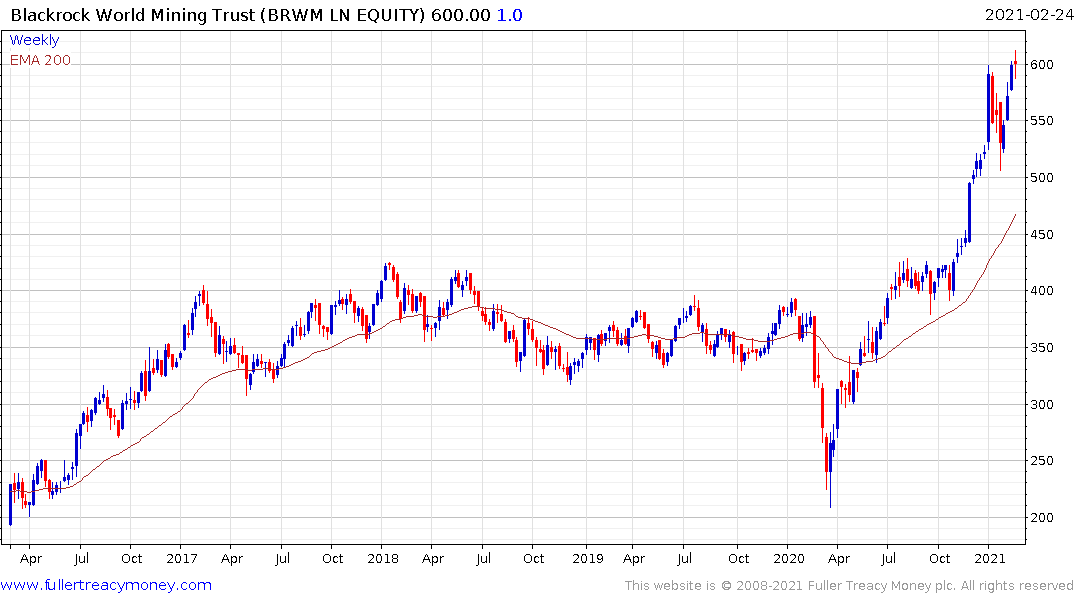

The Blackrock World Mining Trust is a more diversified play on the industrial metals sector and it has also completed a lengthy base formation.

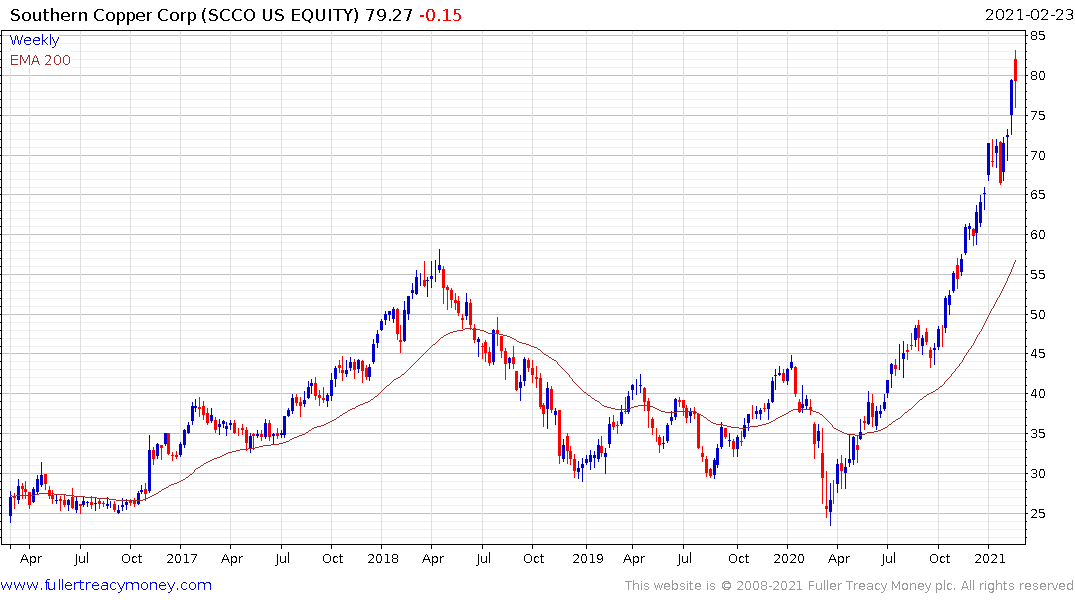

Southern Copper has been among the best performing shares as it completed its base formation. It’s overbought in the short term but the management team is competent so it might be worth also keeping an eye on for an opportunity to buy on weakness.

I’ve been slow to make additional investments recently because I am probably going to be buying a home in the next month or so. It’s an interesting topic and I’ll give a full report of our experiences when the process is eventually complete.

Back to top