Email of the day on investing for inflation:

Dear Eoin, Many thanks for your comment on inflation as a solution for the massive public debts. In these circumstances how would you structure your portfolio? In which sectors would you invest your funds?

Thank you for this question which may be of interest to subscribers. This is a very big question because the stocks that have done best over the last decade have benefitted enormously from the massive availability of liquidity and very low rates. Divesting from the best performers runs contrary to most people’s instinct to run their winners so monitoring the consistency of their price action is particularly relevant to all portfolios over the next decade.

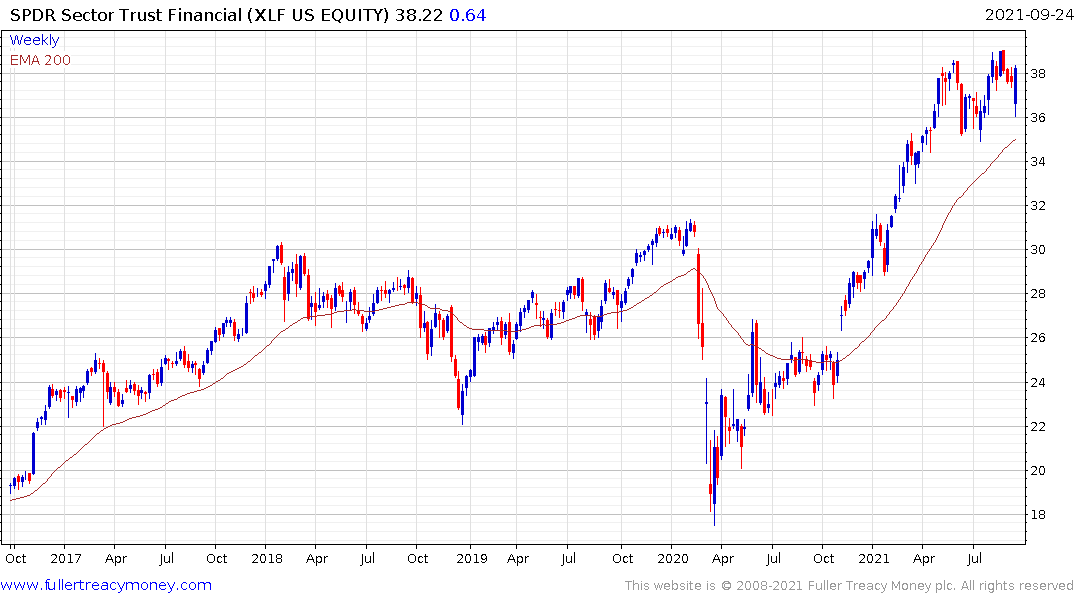

In an inflationary environment, financials and value tend to do best. At present financials are following that playbook. Value is lagging but perked up today with yields.

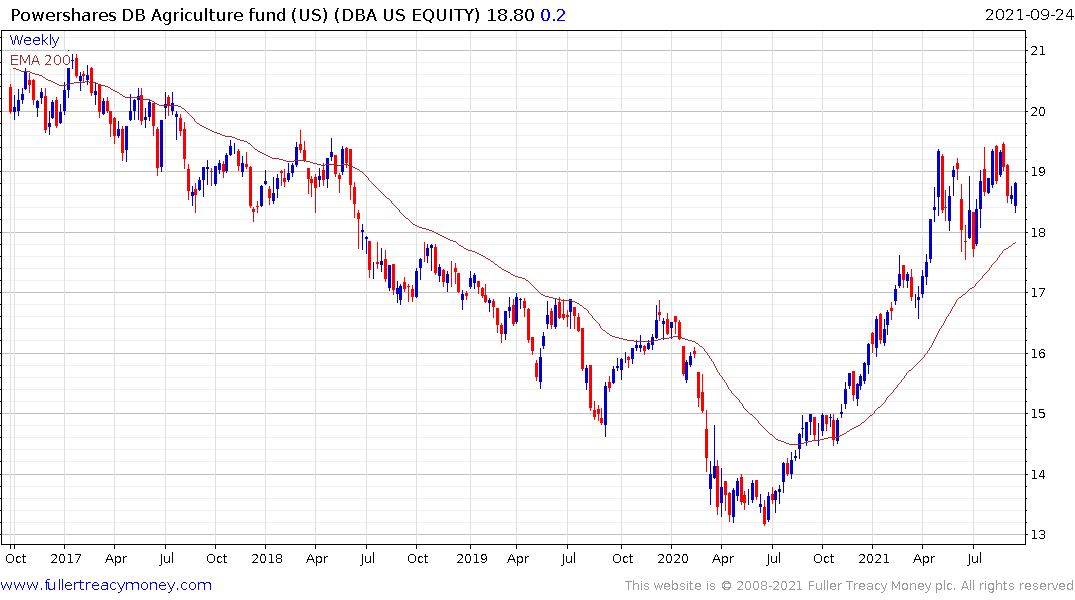

Commodities, as real assets, tend to rise at least in line with inflation and we have plenty of evidence of that at present even if gold is still lagging. Nevertheless, commodities remain volatile and are best bought following inevitable setbacks.

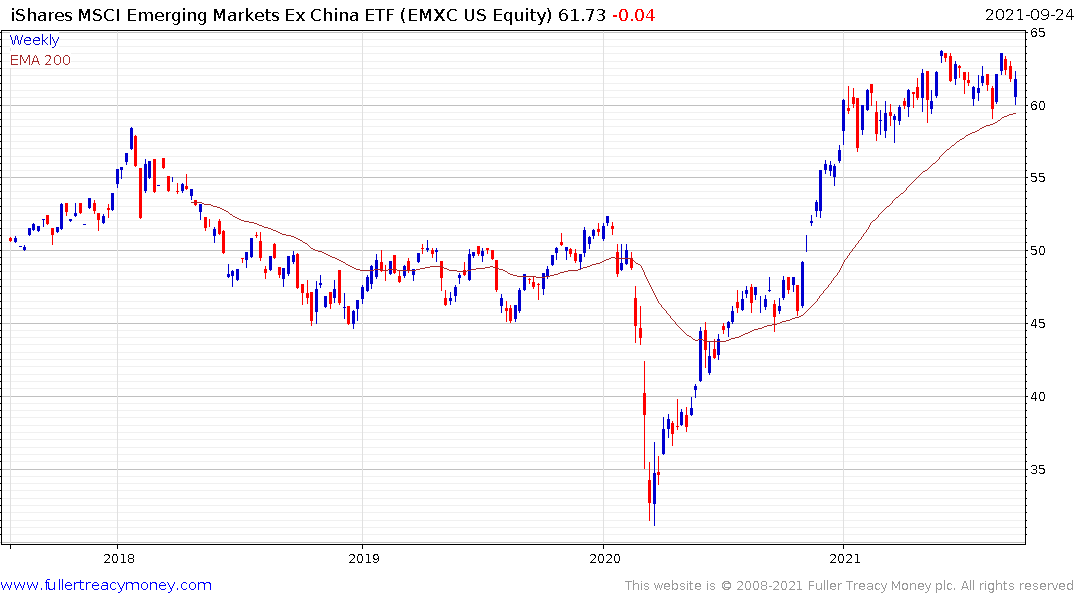

Emerging markets are much more accustomed to dealing with inflation than developed markets and should outperform based on higher growth rates.