Email of the day on hydrogen versus electric vehicles

I hope you are well. I was wondering what you thought of this article (Japan gambles on Toyota’s hydrogen powered car) about Toyota’s lack of faith in electric vehicles because 'a battery breakthrough is not in prospect'

Thank you for this email raising an important issue regarding energy density. Here is a section from the article:

Fuel cell vehicles, by contrast, need all the manufacturing skills of a car company. “From the industrial strategy point of view, fuel cell technology is extremely difficult, it’s in the world of chemistry not machinery,” says Hiroshi Katayama at the advanced energy systems and structure division of the ministry of economy, trade and industry (METI). If auto technology goes down the hydrogen path, Japan will be well placed. But if it doesn’t, Tokyo will have made a major miscalculation.

Toyota’s faith in hydrogen is best understood by looking at a car it never made: a pure electric vehicle. For the 20 years since it invented the Prius hybrid, Toyota has been the carmaker best-placed to launch a fully electric vehicle. It had the batteries, the motors and the power electronics but chose not to deploy them because of concerns about range limits, refuelling time and the risk of batteries degrading as they age.

It has announced plans for its own electric vehicle to exploit the demand from the premium segment opened up by Tesla and to meet emissions standards in the US and China. Yet Toyota’s fundamental doubts about battery-powered vehicles have not gone away.

The long dreamt-of Sakichi battery would store energy at the same density as the chemical bonds in petrol: roughly 10,000 watt-hours per litre — enough to power a family car for hundreds of kilometres on a single tank. The low energy density of the best batteries, about one-twentieth that of petrol, is why today’s electric cars have limited range.

Here is a link to the full text of the article.

Cost, power to weight ratios and energy density are all important characteristics in assessing the future of battery technology. Developing new chemistries has been integral to achieving better results in the latter two. By building its gigafactory Tesla is going for scale which aims to control costs but energy density is a thornier issue.

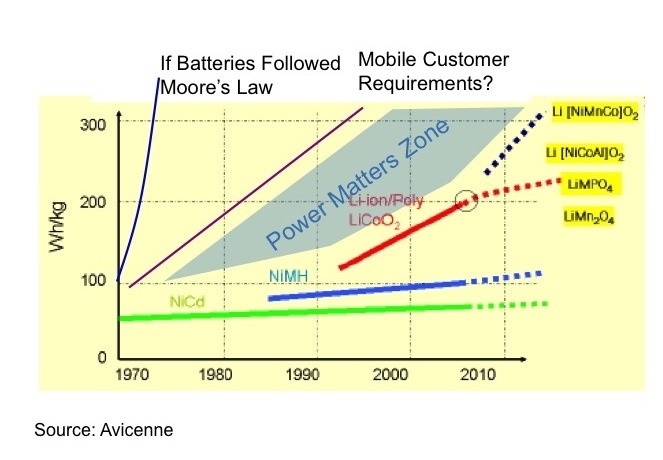

This chart posted in an educative Quora discussion highlights how dependent improvements in battery energy density are on new chemistries. It’s also worth considering that much of the data available on the internet is from about six years ago and that a great deal more investment is being poured into solving these complex problems now that a viable demand story for success in the field is evident. This article from phys.org from last October is a good example.

Fuel cell vehicles are essentially a play on cheap natural gas. Therefore it is somewhat specious to claim they are the best eco solution on the road today. When the nuclear fusion question is eventually solved then the hydrogen economy could really take off but in the meantime the most cost effective way of producing the gas is through natural gas reforming. Electrolysis is dependent on abundant cheap electricity.

It strikes me that one possible offshoot of President Trump’s relaxing of environmental standards could be improved economics for producing hydrogen from coal. However this is a double edged sword since part of the increased demand story for hydrogen has been tied to tighter environmental standards. https://energy.gov/fe/science-innovation/clean-coal-research/hydrogen-coal

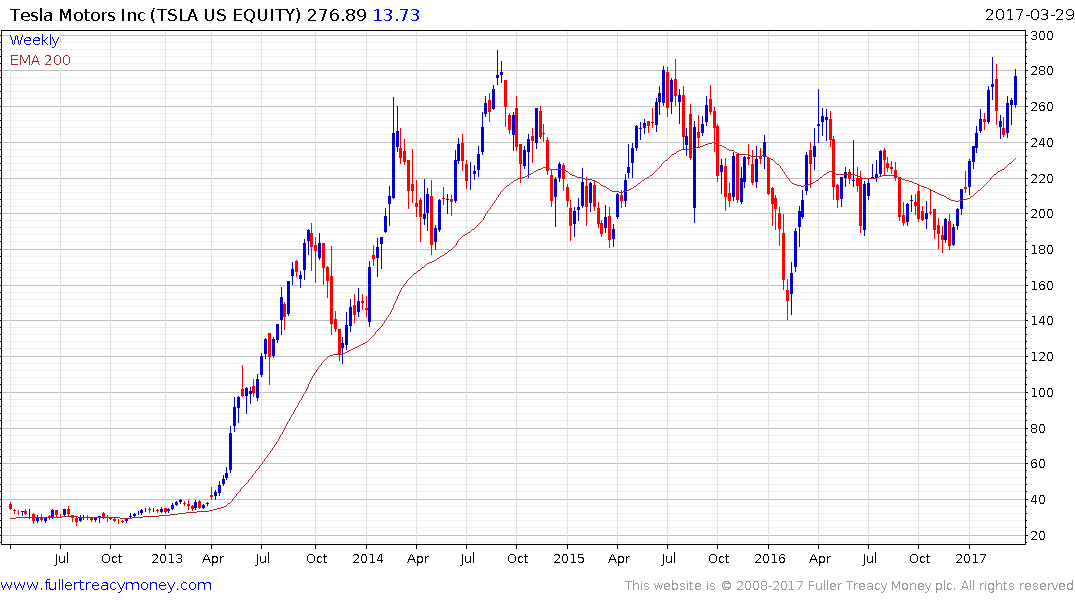

Tesla bounced last week from the region of the trend mean and is now challenging the upper side of a three-year range once more. A sustained move below $250 would be required to question potential for a successful upward break.

Toyota has been subject to some quite acute volatility over the last couple of years and has posted what might be described as a spiky bounce from its 2016 lows. It is now pulling back to test the progression of higher reaction lows and will need to find support soon if potential for higher to lateral ranging is to be given the benefit of the doubt.

On the highly speculative side Hazer Group has a market cap of AU$46 million and was spun out from the University of Western Australia to commercialise its gas cracking method for producing cheap hydrogen. The share was listed In Australia in December and needs to hold the A40¢ area to confirm demand is still dominant.