Email of the day on crude oil prices:

Please check on my enquiry below (sent to Eoin on 16.4.2019): [On 12/4/2019, you wrote "Nevertheless, a great deal of additional supply, internationally, becomes economic above $80 so that level represents a significant Rubicon for prices." I presume the $80 refers to the Brent crude oil price. What is the equivalent Rubicon price for the WTI? Thanks in advance.] I have not seen a reply to my query above. Can you please check what happened?

Thank you for this email which I am only seeing now because of previously undiscovered issue with the contact us form on the site. If anyone sent an email which has not been replied to in the last couple of weeks please resend it.

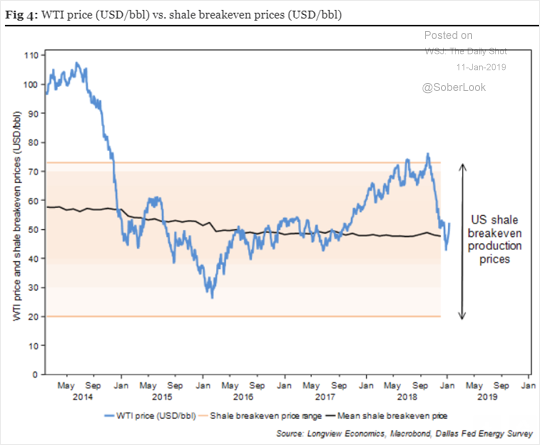

$55 is the breakeven point for a substantial portion of the USA’s shale oil. However, in order to justify the expense of unconventional drilling companies need to have a significant margin of error before they source capital. What we have seen previously, is drilling pick up when the forward price of oil is squarely above $65 to $75. By the time the price gets tot $80 supply is already coming market.

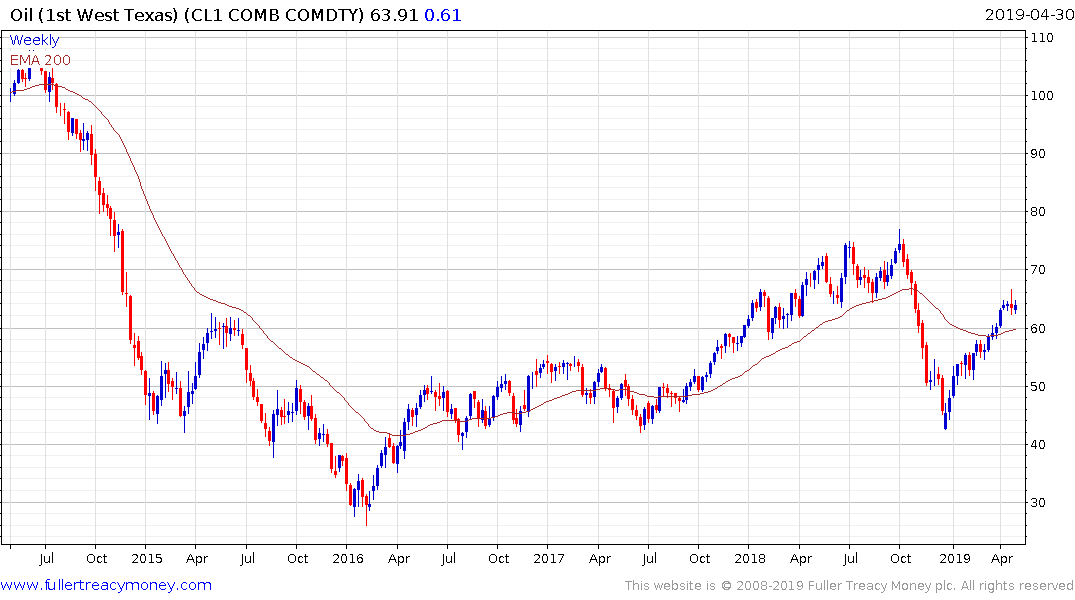

Right now, oil is trading in a significant backwardation so drillers no incentive to sell futures, borrow money and boost drilling. That is limiting the quantity of oil available to flood the market.

As long as the price holds the recent low near $62.50 this reaction can be considered to be a “normal” step within an otherwise consistent uptrend.

Back to top