Email of the day on caution at potential areas of resistance

“You have been calling for some ‘consolidation’ for equity markets for a number of weeks now (which I expected too), but this just hasn’t come to pass. Instead we have seen a relentless charge higher in virtually every market. You’ve stated that it’s liquidity driven which until recently at least, little participation from the professional money managers. Short term yields no longer can be relied upon as a risk indicator with the Fed deliberately compressing yields at the front end. To what extent, if any, has this recent episode viewed the way you look at markets through a charting lense. A despondent sceptic of this rally here, it seems the only winning strategy is just to ride the liquidity train, and rotate one’s positions towards riskier assets (travel, emerging etc) as the new safe havens (tech) reach maturity.

I used the significant setback in March to buy precious metals but I also pointed out the wide discounts many investment trusts were trading at, the extraordinarily high yields energy companies were trading at and the much-improved valuations on dividend aristocrats.

![]()

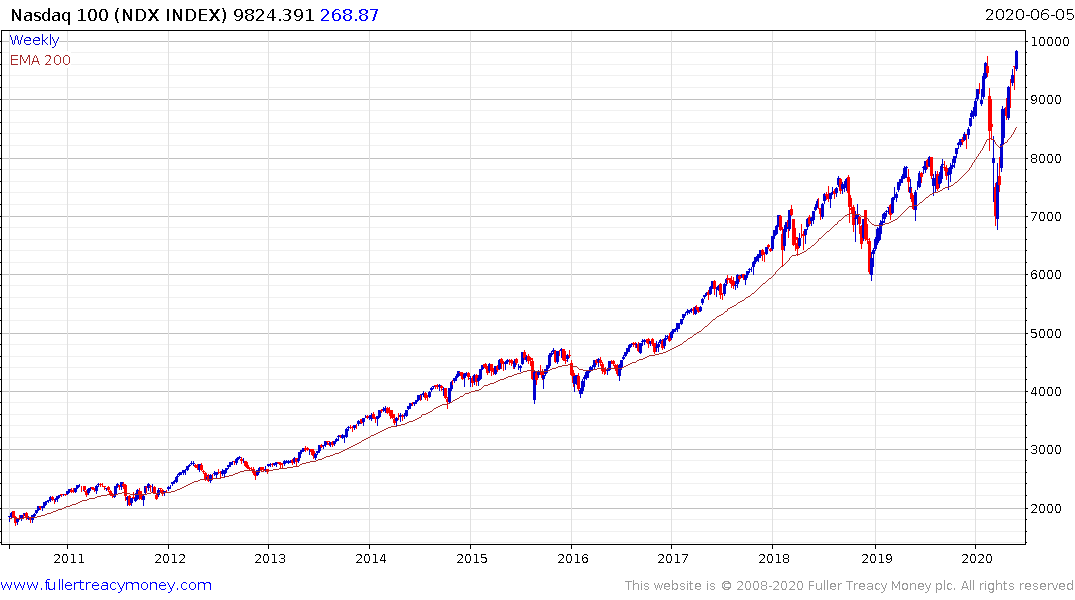

That was the best time to buy. We have not seen a significant setback on the Nasdaq-100, FAANGs or semiconductors and they are all now at new all-time highs. Therefore, the big question is whether we have jumped from bear to bull in short order and is the medium-term uptrend about to be reasserted?

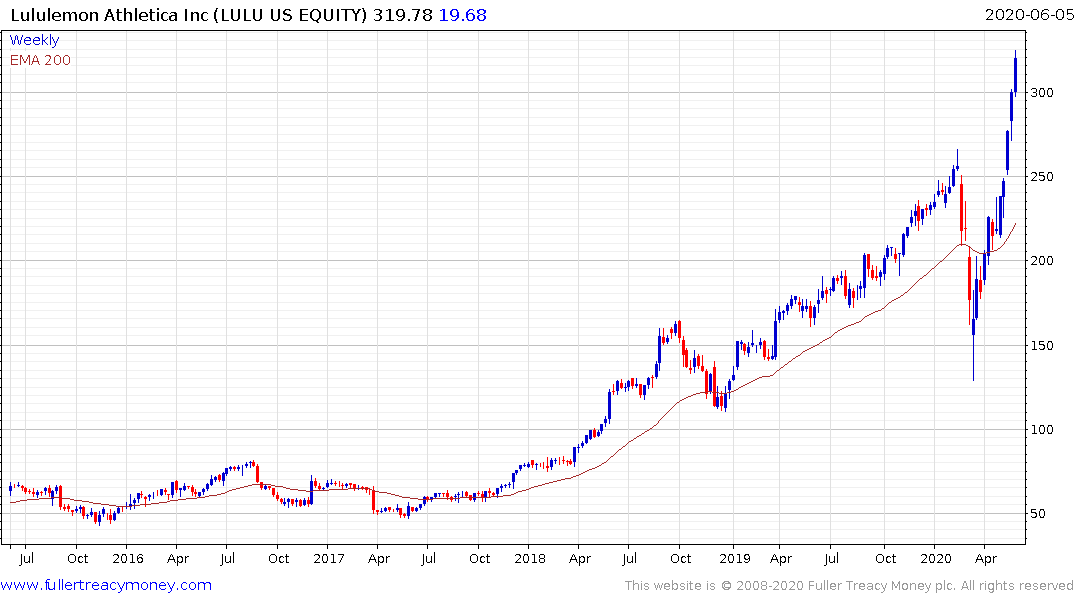

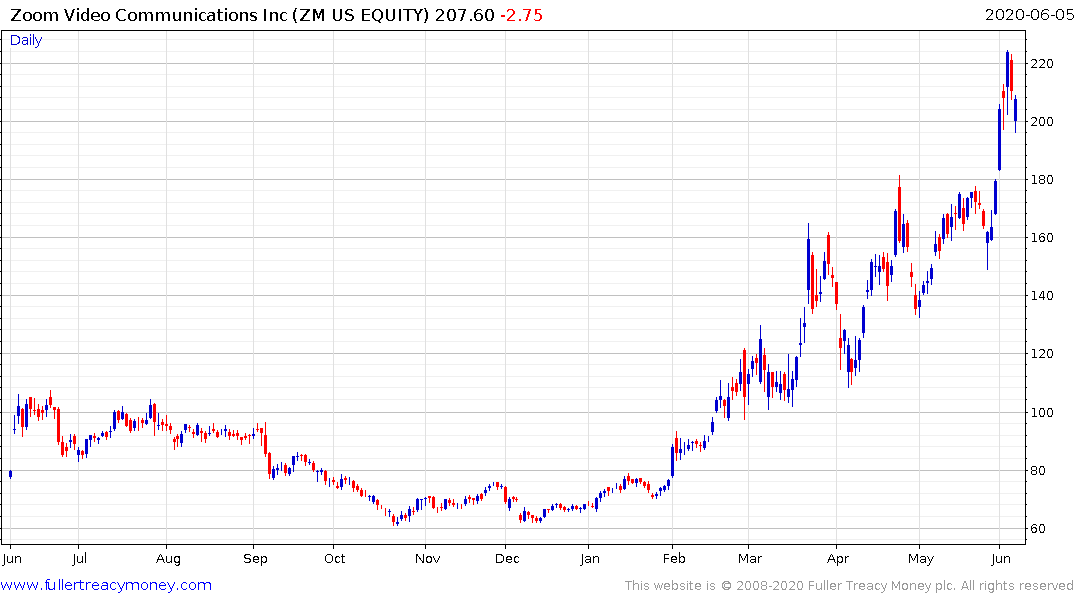

I continue to think that the 10,000 level represents an awfully big psychological level for the Nasdaq so I personally will not chase the Index at this level. I am also very suspicious that exaggerated moves in stocks like Lululemon and Zoom Media will not be sustained.

At the same time some of the most beaten down of shares are also now breaking out to new recovery highs. Boeing, for example, has doubled since late March but none of the issues that assailed the company from below the coronavirus panic has been addressed.

The reality is the global economy has been swamped in liquidity. $10 trillion in monetary and fiscal stimulus is enough to buy a rally in just about everything. The big outstanding question is how sustainable that rally will be in the face of improving economies where there is less need for emergency assistance? A consolidation is still needed to prove investors are in this for more than momentum.

The comforting point about the best performers off the low is they have plenty of room in which to consolidate.

The biggest thing investors should consider today is the consensus over the last three months is momentum is king because the discount rate is no longer relevant. That only works if bond yields are falling. Today, they are rising and brings relative valuation back into focus. For the moment equities are still in the ascendency but this is a topic to monitor. In order to arrest the uptick in yields the Fed is going to have to ramp up its bond purchases. In fact, that is what the run-up in equities is pricing in.