ECB's Lane Urges 'Steady Pace' of Rate Hikes to Minimize Risks

This article from Bloomberg may be of interest to subscribers. Here is a section:

Officials attending the Federal Reserve’s Jackson Hole gathering signaled the ECB is prepared to at least repeat the 50 basis-point hike enacted in July, with some not excluding an even larger increase. Executive Board member Isabel Schnabel urged “strong determination to bring inflation back to target quickly.”

While Lane didn’t spell out whether he’d oppose a 75 basis-point step, his comments suggest officials would need to see the need for a higher “terminal rate,” or high point of the current hiking cycle, for him to support such a move.

The Irish official said a “multi-step adjustment path towards the terminal rate also makes it easier to undertake mid-course corrections if circumstances change.” If new data called for a lower terminal rate, “this would be easier to handle under a step-by-step approach,” he said.

Among the more cautious voices on the Governing Council is Executive Board member Fabio Panetta, who said last week that policy maker must tread carefully as a significant economic slowdown would ease inflationary pressure.

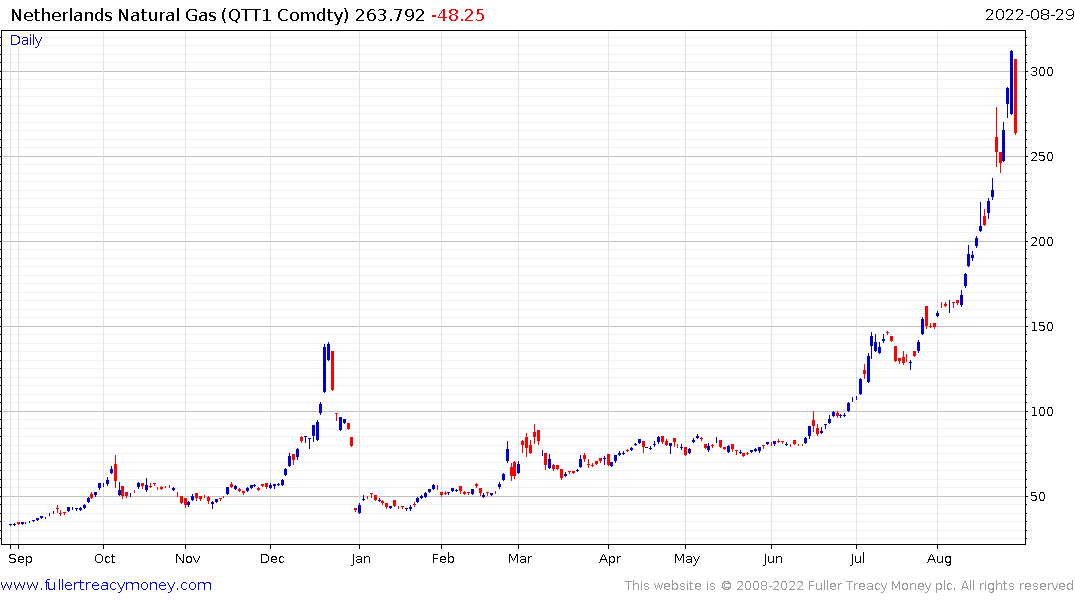

The ECB has one of the most out of control inflation problems in the world. The pressure being exerted on the region from Russia’s energy war is not about to disappear. However, the successful filling of gas storage facilities ahead of schedule will moderate the risk of shortages this winter.

Rebalancing demand with available supply implies a significant economic contraction. Raising interest rates aggressively into that environment will only accelerate the recalibration and could result in the contraction overshooting.

Rebalancing demand with available supply implies a significant economic contraction. Raising interest rates aggressively into that environment will only accelerate the recalibration and could result in the contraction overshooting.

The Euro steadied today to test parity with the Dollar. While there is some scope for additional steadier action a sustained move above $1.04 would be required to question the consistency of the medium-term downtrend.

The Euro steadied today to test parity with the Dollar. While there is some scope for additional steadier action a sustained move above $1.04 would be required to question the consistency of the medium-term downtrend.