Early Morning Reid

Thanks to a subscriber for this report by Jim Reid for Deutsche Bank which may be of interest. Here is a section:

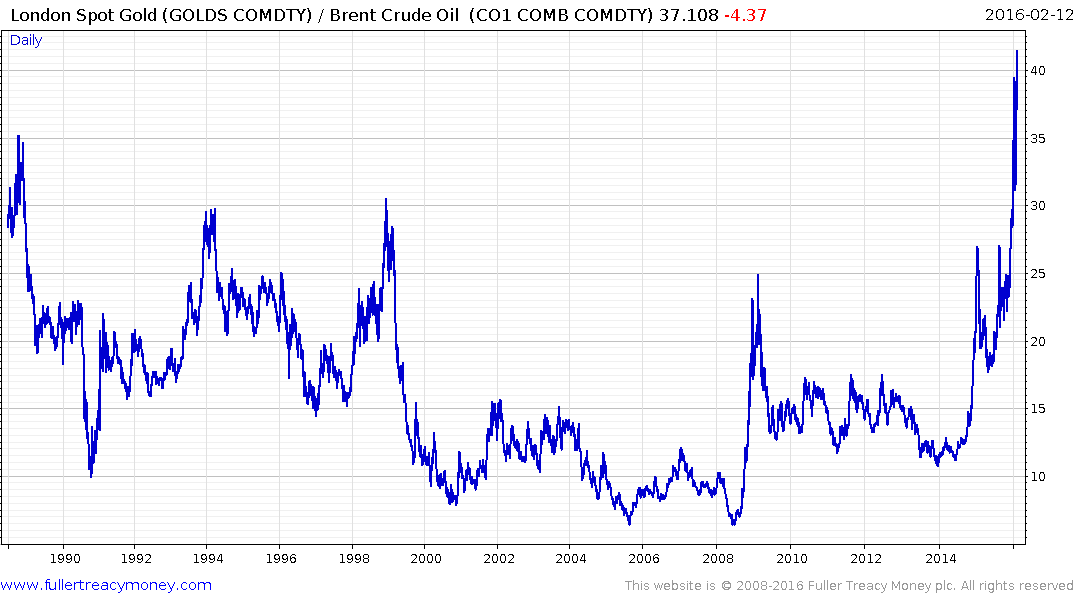

Talking of Oil and Gold, last week we showed a long-term graph of Oil in real adjusted terms, showing that the average real price since 1861 was $47. Following on from that, one ratio we occasionally look at is the ratio of various assets to the price of Gold. So today in the off we update the Oil/Gold ratio back to 1865 and find that the Gold price has just hit an all-time high at around 44 times the price of Oil. The previous high of 41 in 1892 has just been exceeded. For perspective, the ratio was at 6.6 in June 2008 and only 12 in May 2014. The long-term average is 15.5. While this says nothing about where the ratio is going in the short-term surely this looks a good trade to exploit over the longer-term for those who care about such things.

A big reason behind the rally in Gold this year has been a flight to quality and the fading expectations of further Fed tightening in the next twelve months. Yesterday Yellen stuck largely to the script in acknowledging market concerns emanating from tightening financial conditions, while at the same time refusing to fully close any doors still open to the Fed later this year. That said the overall tone was certainly of a dovish leaning. Much was made of the passage suggesting that ‘financial conditions in the US have recently become less supportive of growth, with declines in broad based measures of equity prices, higher borrowing rates for riskier borrowers, and a further appreciation of the dollar’. Yellen said that should these developments prove to be persistent then they ‘could weigh on the outlook for economic activity and the labour market’.

Here is a link to the full report.

When gold was used to buy oil the ratio between the two would have been a powerful indicator of sentiment towards the economy and relative value of savings over investment. That may no longer be the case in an era of fiat currencies but when the ratio hits new highs it tends to turn heads.

Precious metals have been among the only commodities rebounding while oil has led declines resulting in the ratio hitting over 40 times last week. That’s overextended by any measure and suggests gold is likely to underperform for a while.

.png)

Gold pulled back sharply today to unwind at least part of its surge and a process of mean reversion is looking increasingly likely.

Brent crude may now be in the process of forming its first higher reaction low in months; suggesting a low of at least near-term and potentially medium-term significance has been found.