Drilling deeper into trouble

Thanks to a subscriber for this report from FondsFinans focusing on the North Sea drilling sector which may be of interest. Here is a section:

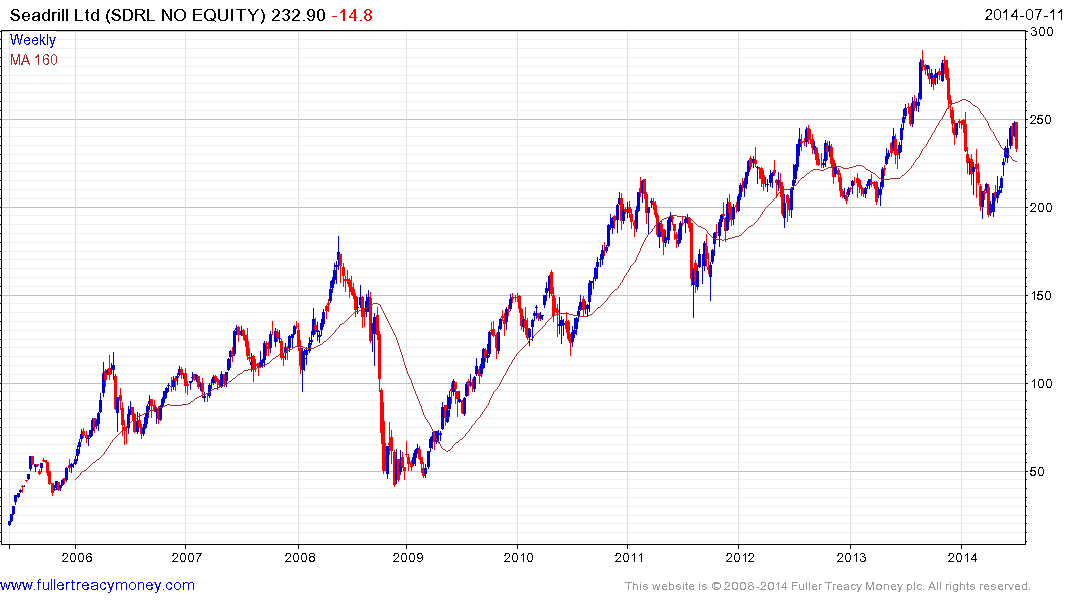

Sector completely out of favor due to increasing oversupply - Solid rebound lately to yield stocks with near term cash flow visibility (SDRL, AWDR)

Seadrill’s rebound explained by several positive company specific events (Rosneft deal, Pemex deal, Jupiter contract etc.)

Underperformance in general driven by sentiment, while also company specific events explain Songa’s (balance risk), FOE’s (SPS cost overruns) and Sevan Drilling’s (rig #4) underperformance

Here is a link to the full report.

The oversupply in the drilling sector referred to in this report has resulted in the majority of related companies trending lower. Just as a similar situation contributed to the underperformance of the US drilling sector in 2010 and 2011, the eventual outcome will be that orders for new rigs will be cancelled and others will be idled which will eventually resolve the oversupply situation.

Seadrill has already rationalised at least part of its operations and has more international exposure than some of the other Norwegian drillers. The share encountered resistance this week in the region of the 200-day MA suggesting at least some consolidation of recent gains.