DoubleLine Round Table Prime 1-6-20 - Segment 3: Best Ideas

This third part of the round table may be of interest to subscribers.

The biggest risks and tradable opportunities discussed by the panel members focus on the fixed income markets but it did get me to thinking where I see the biggest risks and where are the biggest opportunities right now.

The biggest risks are seldom what we think they might be. I have long espoused by suspicion that the regional banking sector in China represents a significant risk which is not easily monitorable. However, the number of articles discussing it suggest it is a reasonably well understood risk.

The next risk that is making headlines is the coronavirus and its capacity to evolve. There was news today that some of the patients who died from it did not exhibit a high temperature. That’s problematic in containing the spread since thermometer readings are the primary diagnostic tool right now. Right now, it is not currently deadly enough to truly affect markets but this is a situation worth monitoring.

The one risk I would suggest is a clear and present danger is Boeing. The company announced today it will restart product of the Max before it has formal certification to sell them. The question is whether that is a sign of confidence from the board that they are going to be able to fix the issues outstanding, or is it in response to the dire straits many suppliers are in. If suppliers go bankrupt it may be difficult to replace them which would delay the eventual relaunch of the product even further.

The opportunities reside in the stock and commodity markets. The continued supply of liquidity is contributing to accelerations in the technology sector in particular. Gold has completed a six-year base formation as demand for a hedge against the loss of purchasing power increases.

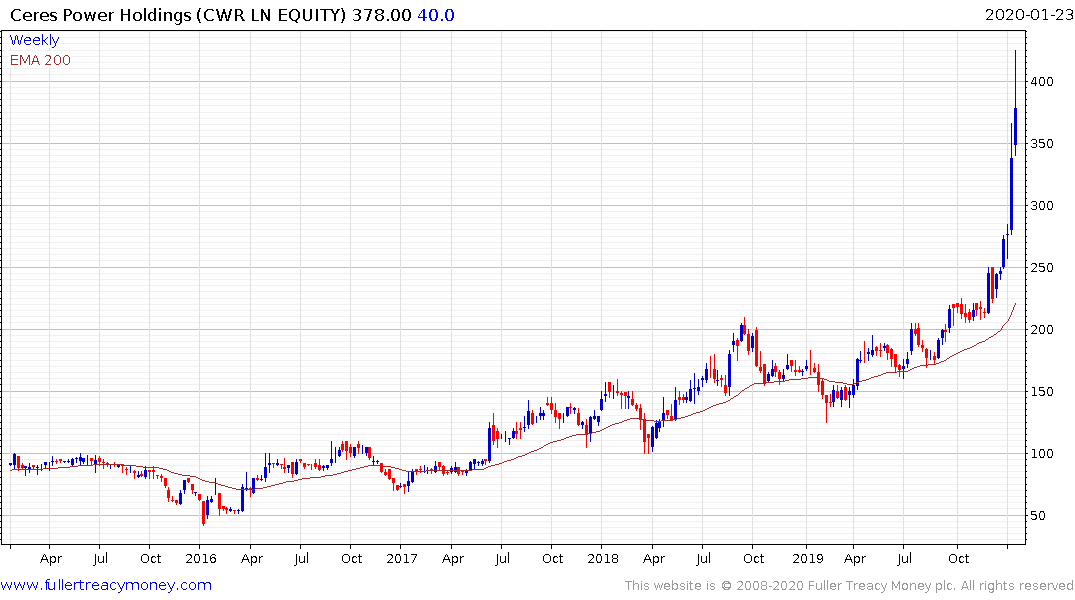

Meanwhile, there is clear evidence that alternative energy is enjoying a recovery because virtue signalling among politicians is in fact turning into policy. The revival of interest in lithium miners and the dawn of interest in hydrogen are both symptomatic of that trend.