Dollar Won't Be Haven Currency of Choice for Long

This note from Bloomberg may be of interest to subscribers. Here is a section:

This in turn takes us to an interesting observation by George Saravelos, Deutsche Bank AG’s global head of currency research, who says that “we are perhaps now reaching the tipping point where further financial conditions tightening will start to place more severe headwinds to how much more we can reprice the Fed.” This will result in the dollar becoming less responsive to risk-off due to more dovish implications for the Fed path. And while it’s still early stages, Saravelos argues that “the market is starting to behave as if we may be approaching this tipping point.”

Now, even if inflation does peak this year, that won’t mean central banks will exit their tightening path, but will adjust it accordingly. Just look at the Bank of England’s latest forward guidance and the divide within the voting committee. At the same time, and if we talk stagflation or recession, we should consider that the yen may attract haven flows once again given its low inflationary readings, Japan’s current surplus and so forth.

Today’s month over month CPI figure was 0.3%. Analysts expected 0.2% but the prior reading was 1.2%. That’s still a moderation in near-term inflation, even if it is still rising. Year over year the rate is still 8.3% which is in the middle of what was expected and the last reading.

The ECB is talking about starting to raise rates next month or July. That will begin to narrow the interest rate differential relative to the Dollar even if the Fed keeps tightening. Meanwhile the Euro is back testing its lows over the last decade and is very oversold in the short term. The rate has been inert, but holding the $1.05 level, for 10 sessions.

The ECB is talking about starting to raise rates next month or July. That will begin to narrow the interest rate differential relative to the Dollar even if the Fed keeps tightening. Meanwhile the Euro is back testing its lows over the last decade and is very oversold in the short term. The rate has been inert, but holding the $1.05 level, for 10 sessions.

It is natural for traders to think about the potential for a rebound when previous areas of support are tested, but a clear upward dynamic will be required to pressure shorts and signal a return to demand dominance.

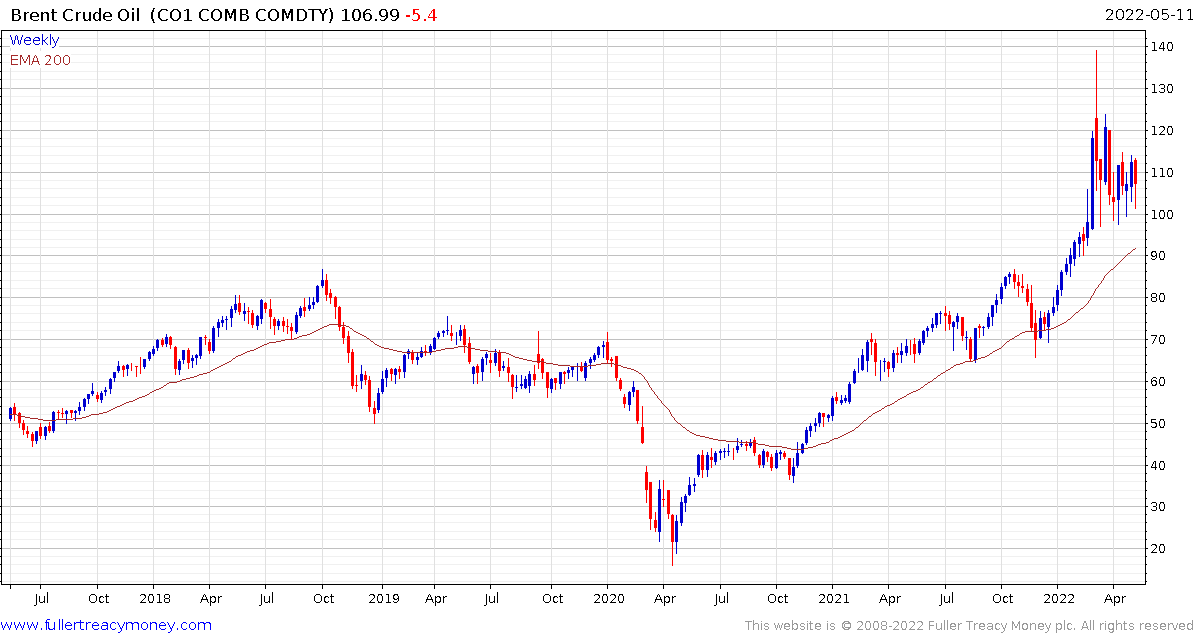

Commodities rebounded impressively today on speculation that the Dollar’s rapacious rally may be moderating or even peaking. Crude oil rebounded from the $100 level to post an upside key day reversal and hold the incremental sequence of higher reaction lows. This narrowing wedge pattern is likely to give way to an outsized move when it is completed and at present the upside is being favoured.

Gold and silver both steadied to confirm areas of at least near-term support.

Sticky inflation readings are not exactly news, but traders are looking for any sign that inflation is moderating to initiate long positions. We have been through more than a decade where buying the dip has always worked. That suggests there is a strong bias towards that strategy among the wider investment community. The counter argument is the economy is heading for much slower growth which is good for bonds and bad for stocks. The fact 10-year yields were negative again today and tech stocks led the decline suggests a change of emphasis is unfolding towards pricing in a recession.

.png)

Apple breaking downwards today, to play catch up with other mega-caps, is a particular challenge for the Nasdaq where it is the largest component at 13.29%.