Dirty Energy Is the Lone Junk Winner in Credit's Brutal Year

This article from Bloomberg may be of interest to subscribers. Here is a section:

Junk-bond investors had almost no way to avoid losses this year, and shunning dirty energy only made the pain deeper. The best return -- one of very few gains -- was in coal, highlighting challenges for investors who need to perform but also want to be sustainable.

Junk’s 11% loss this year -- the worst since the global financial crisis -- was led by communications and consumer non-cyclical bonds, down 15% and 13%, respectively. Energy performed best in the US high-yield index, down about 5% overall.

Coal -- albeit a very small chunk of the corporate bond market -- is up 3.2%, while oil and gas services debt gained 1.7%. That compares with a global credit market that’s down double digits in most market segments this year, with particularly steep losses for longer-dated debt.

Credit markets are forecast to see a broad-based rebound next year and with many sectors trading cheap to history, junk energy probably won’t be the best again in 2023. But so long as oil prices stay supported by conflict and reopening, it should at least be a buttress for bond portfolios likely to take another beating from inflation next year.

The energy sector has been the best performer in S&P500 for two consecutive years. The fact it is also leading performance in the junk bond market is a testament to the strength of commodity prices in a geopolitically tense environment.

China bought a record quantity of LNG and imports of both oil and coal are also surging. That suggests one of the primary factors holding down prices is reversing.

Brent crude oil has now posted a higher reaction low, as it unwinds the short-term oversold condition. The price is bouncing from the region of the 1000-day MA and the upper side of the underlying range so this may represent a medium-term low.

Brent crude oil has now posted a higher reaction low, as it unwinds the short-term oversold condition. The price is bouncing from the region of the 1000-day MA and the upper side of the underlying range so this may represent a medium-term low.

With the USA now buying for its strategic reserve, the dynamics of the energy sector have changed. As a net exporter, the USA no longer has a vested interest in low prices. That suggests a higher floor over the medium-term. Ultimately, that will encourage additional investment in new supply and improves the viability of more expensive sources of supply.

Canada’s Suncor Energy is currently firming from the region of the 200-day MA.

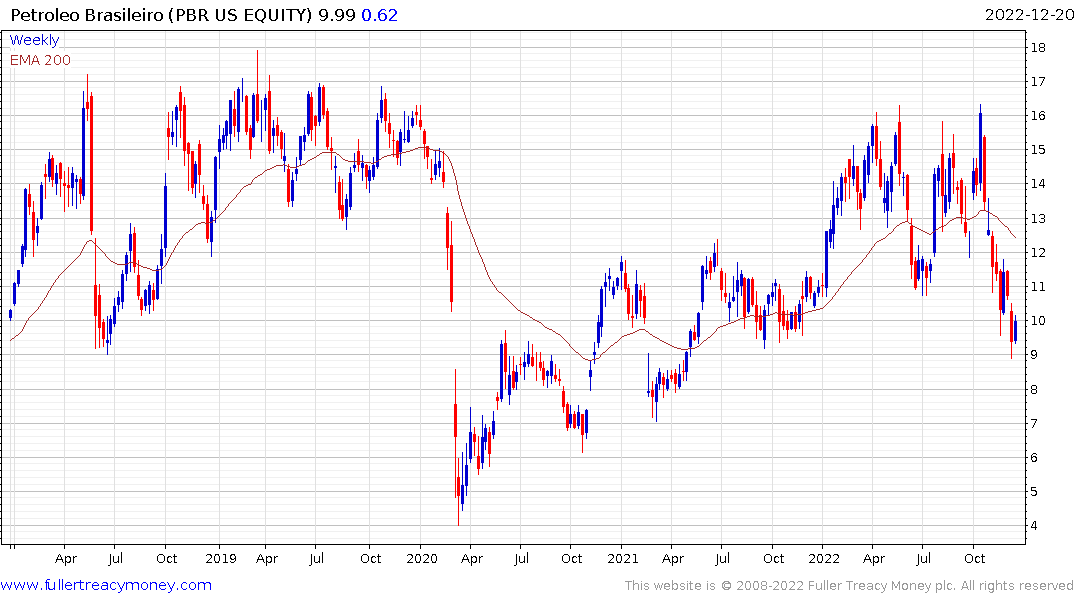

Petrobras pulled back violently following the Brazilian election amid fear the outsized dividend is no longer secure. The share is currently firming from a deep short-term oversold condition.

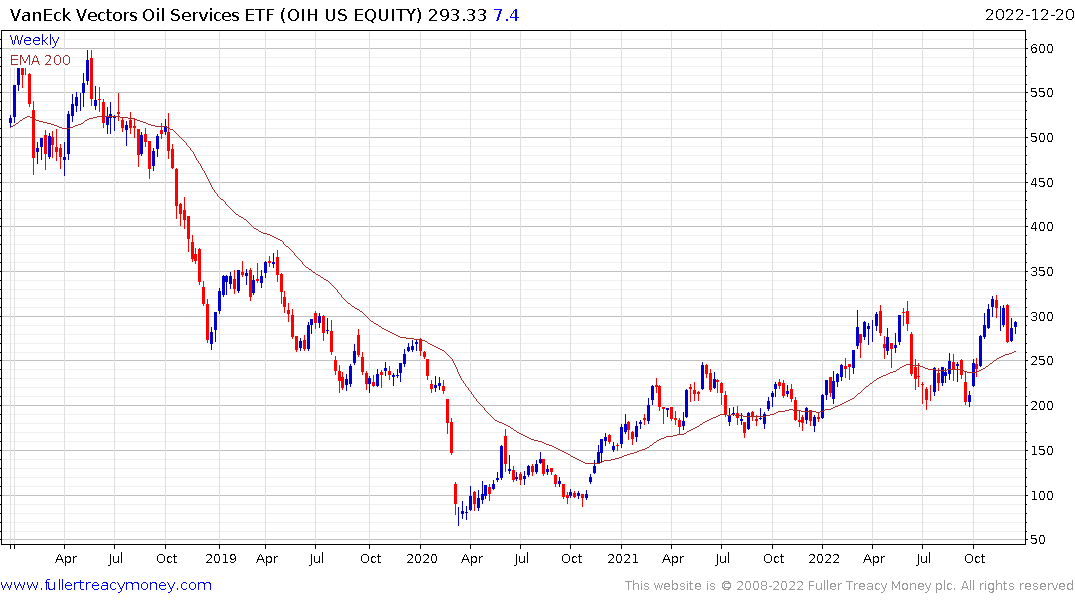

The VanEck Oil Services ETF is firming in the region of the upper side of its first step above the base.

The VanEck Oil Services ETF is firming in the region of the upper side of its first step above the base.