Copper Mine Flashes Warning of 'Huge Crisis' for World Supply

This article from Bloomberg may be of interest to subscribers. Here is a section:

Take not just Chile, with its revisions to fiscal policies for miners, but Peru, a country long considered crucial to the next wave of copper production, where the mining sector has been battered during lengthy social unrest. Rio in late March agreed to sell a controlling stake in its Peruvian mine La Granja to First Quantum.

“What the market never predicted was how difficult South America would become,” said Radclyffe. “The uncertainty out of both Chile and now ongoing in Peru, that’s just added an extra level of complexity that the market never expected, and that hasn’t really been resolved.”

The classic basis for a big bull market in commodities is supply inelasticity meets rising demand.

The promise of a big bull market in copper is heavy on the supply inelasticity argument. I think everyone understands, there is limited supply and sufficient increases to meet the expected demand from renewables is not feasible.

That claim glosses over the fact that existing miners are investing in new supply. I totalled up the increases assumed in the above graphic and the net increase is 937,000 tonnes by 2027. That’s an increase of around 1% a year between now and 2027. It probably ample in a low growth global economic environment but is nowhere near enough to meet a buildout of renewable energy infrastructure.

The rising demand argument is where the big questions reside. A price war is underway in the EV market. Ford’s results offered some intelligence on where the market is right now. They sold 91,000 vehicles and posted a greater than -100% margin. That implies the revenue from sales did not cover any of the spending on production. Tesla is obviously betting they can survive longer in the EV space than their competitors.

The simple fact is EVs are too expensive for mass consumption. There is no way Ford’s policy of subsidising EV production by cannibalising pickup truck sales is anything but a niche business model.

As electricity costs rise to incorporate the cost of expanding and upgrading grid infrastructure, the cost of recharging is also rising. There is no doubt the trajectory of government policy is towards greater support for EVs and CATLs battery innovations are very impressive, but that does not solve the cost question.

The challenge with looking at the future is you are either right, too early or wrong. This graphic from the Financial Times from about a month ago highlights how copper inventories are quite low. If I had to point at one factor that is helping to support prices, this is it.

Even here the argument is not fool proof because it is impossible to know how much copper has been stockpiled in China during the pandemic, or how demand growth will be sustained in the absence of a significant Chinese stimulus program?

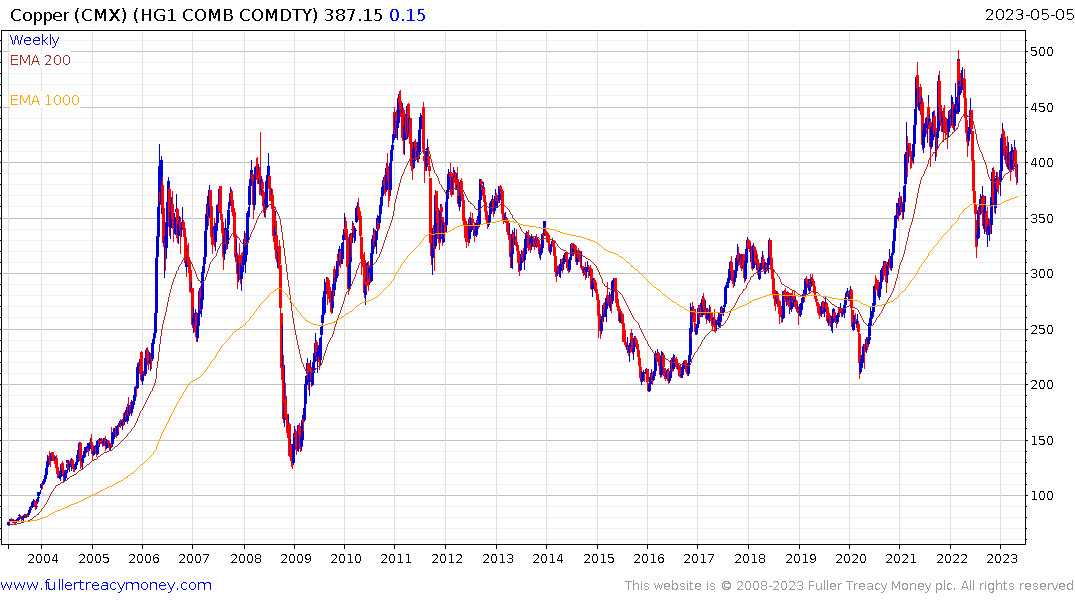

The price failed to sustain the break above $5 in 2022 and experienced a massive reaction against the prevailing trend. It has rebounded over the last year but is still trading below the overhead top formation. Copper steadied over the last few days from the lower side of the short-term range, but it has a lot of work to do to confirm a return to medium-term demand dominance.

This article from thechinaproject.com also highlights an uncomfortable truth. Here is a section:

China still accounts for more than 90% of all announced battery 98% and 93% of the world’s announced manufacturing expansion plans. The United States will remain dependent on China’s expertise, technology, and manufacturing capabilities: There is no political rhetoric that can alter that reality.

If the utopian ideal of electrifying transportation depends on allowing China to takeover the global auto industry, how likely is that to be supported by voters?

Back to top